If you want to invest like Warren Buffett, you don’t need to look further than his latest portfolio changes.

The most recent 13F report and results for the third fiscal quarter of Berkshire Hathaway made an unexpected observation. The well-known investor is selling more assets than purchasing new ones. This revelation carries significant weight, considering the investor’s remarkable history of success. Individual investors must pay close attention to this development.

The advice given is to exercise caution and remain vigilant in all situations… According to Lee Munson, the founder of Portfolio Wealth, potential challenges will arise in the upcoming year. In a recent interview, Munson expressed his concerns about the future.

Munson expressed his opinion, stating that he does not come across any exceptionally advantageous bargains that catch his attention. Finding companies that offer both quality and reasonable valuation can be quite challenging.

Warren Buffett Has Changed His Tactics

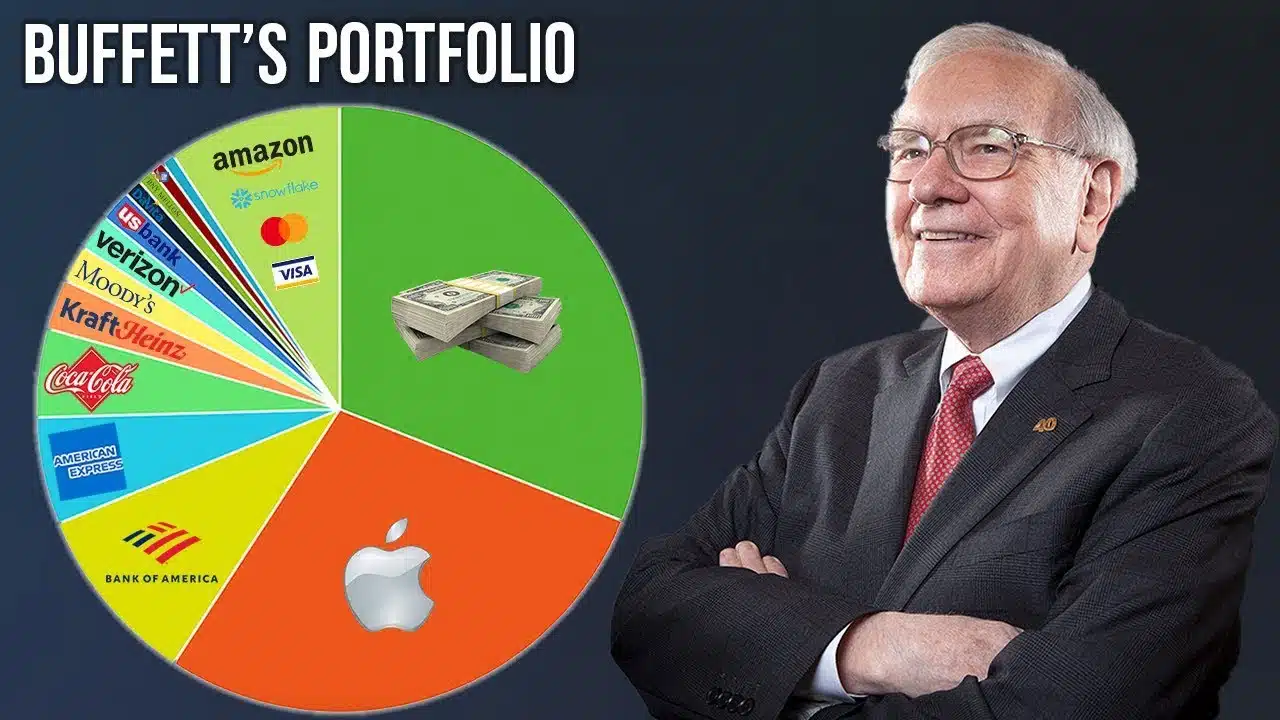

Starting January 1st, Warren Buffett has successfully disposed of around $23.6 billion of stocks, making him a net seller of supplies for the current year. His portfolio adjustments in 2022 were completely opposite to his previous actions, as he actively engaged in buying rather than selling.

In the third quarter, Berkshire Hathaway concluded with an impressive $157.2 billion in cash, a significant increase from the previous quarter’s $147.4 billion.

According to Greggory Warren, an analyst at Morningstar, Buffett’s recent choices demonstrate his unwavering commitment to “patience,” a quality that the Oracle of Omaha has repeatedly stressed as crucial for achieving investment success.

Discipline Has Always Been the Cornerstone of His Success

According to Warren, discipline is the critical factor that has prevented Berkshire from committing significant errors. Their current cash balance is at its current level because of their consistent track record of making wise decisions throughout their financial journey.

Warren explains that Berkshire’s decision to sell during the third quarter was primarily driven by the intention to eliminate remnants of the insurer’s legacy holdings.

During the third quarter of the year, Berkshire Hathaway sold its assets to several corporations, including General Motors and Johnson & Johnson. The conglomerate also decided to reduce its shares in HP and Amazon.

Berkshire Hathaway’s stake in its prominent position in Apple (AAPL), which currently represents 50% of the company’s stock portfolio, has remained unaltered. This was also true for all of Buffett’s other significant holdings besides Chevron.

According to an analyst, this investment strategy demonstrates absolute certainty in his top stocks. As Wedbush senior equity analyst Dan Ives reported, Warren Buffett has expressed concerns about General Motors and other companies. At the same time, he remains optimistic about Apple’s future, stating that the tech giant has a promising outlook. This marks the commencement of the subsequent chapter in Cupertino’s narrative of expansion, and Warren Buffett is well aware of the significance of this momentous occasion.

Parting ways with Apple in this scenario would resemble departing a Taylor Swift concert right after the initial melodic masterpiece has been performed. For all the devoted fans of Taylor Swift, no further explanation is necessary.

If you’re following Warren Buffett’s investment strategy, your performance this year has likely mirrored that of the broader S&P index. Since the beginning of the year, Berkshire Hathaway’s shares, including both Class A (BRK-A) and Class B (BRK-B), have experienced a rise of approximately 16%. This increase falls slightly short of the S&P 500’s impressive gain of 17.5% during the same period.