The resounding victory of Javier Milei, a far-right libertarian candidate, in Argentina’s presidential election, has elicited a positive response in the bond and equity markets. However, as investors observed on Monday, it has concurrently exerted a downward influence on the peso currency’s value.

We Can Expect Some Very Drastic Reforms

The candidate, known for his unconventional views and commitment to reducing public expenditure, expressed his intention to significantly reform the central bank and transition to a dollarized economy. Despite prevailing over Sergio Massa, the Peronist economy chief, in the recent election, the president-elect adopted a composed demeanor during his inaugural address.

The markets in the South American country were closed on Monday due to the observance of a local holiday. The overseas dollar bonds, currently trading at distressed levels, experienced a notable increase on Monday. Their value rose by 1.7-2 cents each, reaching a range of 29-34 cents on the dollar, as reported by LSEG Workspace data.

In the words of David Austerweil, the deputy portfolio manager at VanEck, it has been stated that Milei is mandated to execute “significant alterations in economic policy effectively.” The success of this endeavor will largely depend on the composition of his cabinet.

According to Austerweil, he must immediately reveal a skilled economic team and present a practical and reliable financial strategy. Failure to do so may result in a surge of the peso, which would progressively escalate the expenses required to mitigate its impact.

It Is Not Only Statements That Are Important but Also Concrete Actions

The potential for a rally in credit markets is contingent upon the strength and credibility of the forthcoming announcements. However, without prompt and substantive notifications, any initial gains will likely be reversed, resulting in losses.

In a communication addressed to its clientele, JPMorgan expressed its intention to maintain its current recommendation regarding Argentina’s international bonds, adhering to its prudent “market weight” position. This decision is contingent upon a clearer understanding of Milei’s proposed policy trajectory and the practical implementation of his outlined strategies.

The significant 40% increase in the U.S.-listed shares of the Argentine energy company YPF, which ultimately resulted in a closing price of $15.01, shows that stocks displayed a notable lack of restraint. Milei’s announcement of his intention to privatize the company was primarily responsible for this remarkable upturn.

Banks experienced notable gains ranging from 17.2% to 23.9%. Additionally, the Global X MSCI Argentina ETF <ARGT.K> demonstrated an increase of 11.6%, reaching a closing price of $46.98, marking its highest value since early September.

Milei, the incoming official who will assume office on December 10th, refrained from mentioning “dollarization” during his inaugural address, prompting inquiries regarding the potential practicality of his future endeavors to eliminate the peso.

The President Has a Huge List of Problems to Solve

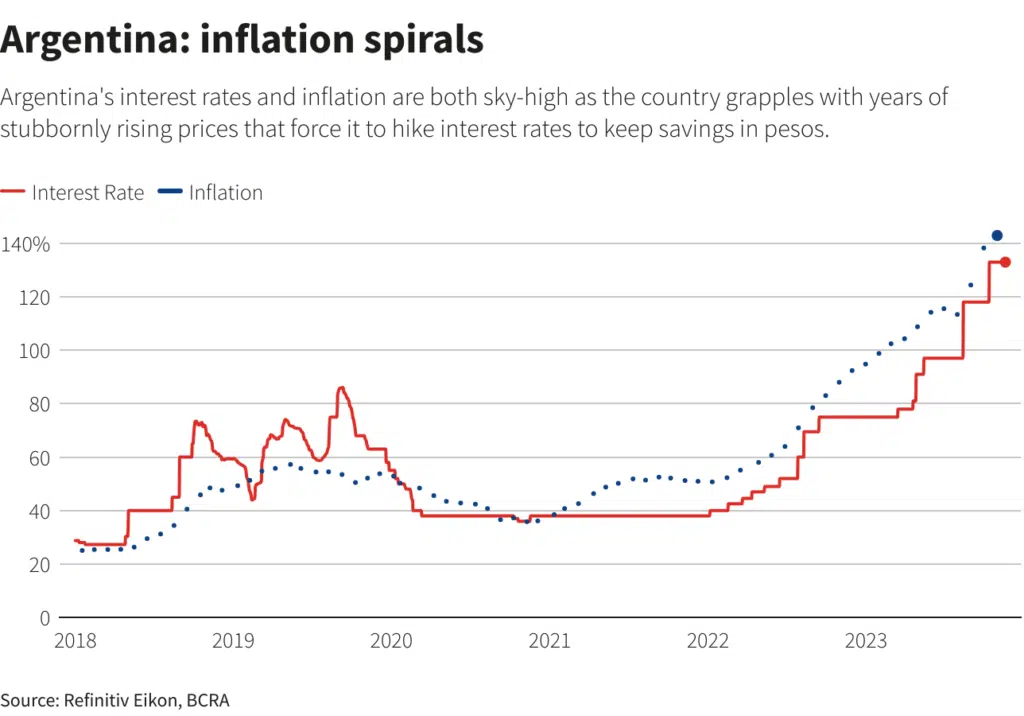

The individual expressed a commitment to expeditious implementation of comprehensive measures aimed at rectifying a deeply entrenched economic predicament. The current inflation rate stands at 143%, indicating a significant increase in the general price level. Additionally, the foreign currency reserves have surpassed a deficit of $10 billion, highlighting a substantial imbalance in the country’s international financial position.

Moreover, indications of an impending recession suggest a contraction in economic activity. Additionally, the individual conveyed a sense of moderation and gratitude towards his supporters within the mainstream conservative sphere, namely Mauricio Macri and Patricia Bullrich.

The necessity of promptly transitioning away from the ineffective economic policies of previous times is beyond question. According to economist Sergio Armella of Goldman Sachs, it is imperative to promptly address the significant imbalances that have accumulated in the economy.

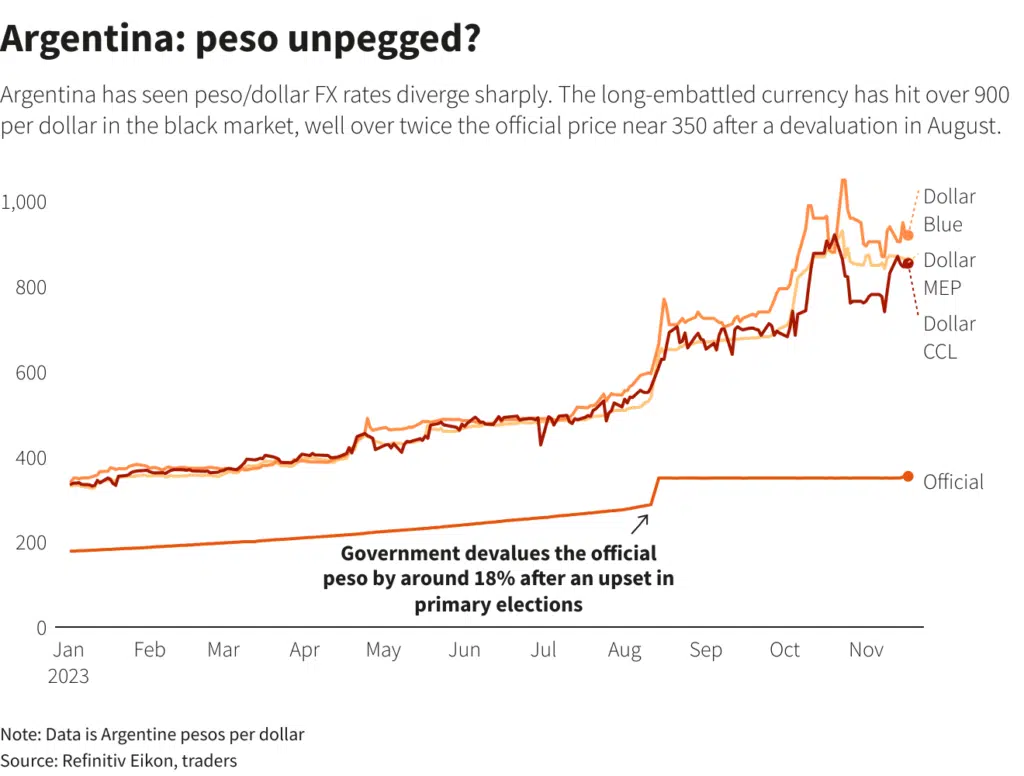

According to Bruno Gennari, an Argentina expert at KNG Securities, the current state of international reserves suggests a probable necessity for prompt devaluation. According to Morgan Stanley, an anticipated adjustment of at least 80% in Argentina’s official exchange rate will occur in December.

The disparity between the official exchange rate, which stands at approximately 354 pesos, and the parallel market rate of 920 pesos indicates a devaluation of about 60%.

As noted by Tara Hariharan, the managing director of global macro research at NWI Management, the feasibility of unifying exchange rates and enabling the new rate to fluctuate and reach an equilibrium level is hindered by the Treasury’s practice of running a substantial deficit financed through the printing of money.

Henceforth, Milei’s foremost objective is closing the fiscal gap, with subsequent emphasis on the unification of exchange rates.

Milei, a former television commentator who transitioned into a political role, emerged as a political candidate amidst heightened public discontent. His campaign platform centered around resolute commitments to curtail state expenditures and streamline the dimensions of the government apparatus.

The investors have expressed their expectation for adherence to the proposed spending reductions, emphasizing the need for prompt implementation to instill confidence in the markets. This sentiment persists, notwithstanding concerns regarding the potential impact of austerity measures on a significant portion of the population, approximately forty percent of whom currently reside in impoverished conditions.

According to Riccardo Grassi of Mangart Advisors, an entity that possesses Argentine bonds, it is no longer feasible for them to postpone crucial decisions.

It was further emphasized that Milei should promptly commence negotiations to reinstate the $44 billion International Monetary Fund loan program.

The International Monetary Fund (IMF) mustn’t experience any setbacks on this occasion.

Milei’s electoral performance has demonstrated a notable increase in support, as evidenced by his 56% vote share in the run-off election, surpassing initial expectations. This significant rise follows his previous achievement of securing 30% of the vote during the first round held last month. However, the incumbent continues to confront a fragmented Congress, where his Liberty Advances faction has a relatively modest portion of the available seats.

In the words of Jimena Blanco, the Head of Americas at Verisk Maplecroft, the resounding outcome witnessed yesterday has bestowed upon him a robust public mandate, which is particularly noteworthy considering his perceived lack of influence within Congress.