White House Board of Economics and Finance chair Jared Bernstein said that signs of improvement, including higher Christmas spending, real wage rises, and consumer confidence, are encouraging for the start of 2024.

The Main Task of the President According to Jared Bernstein

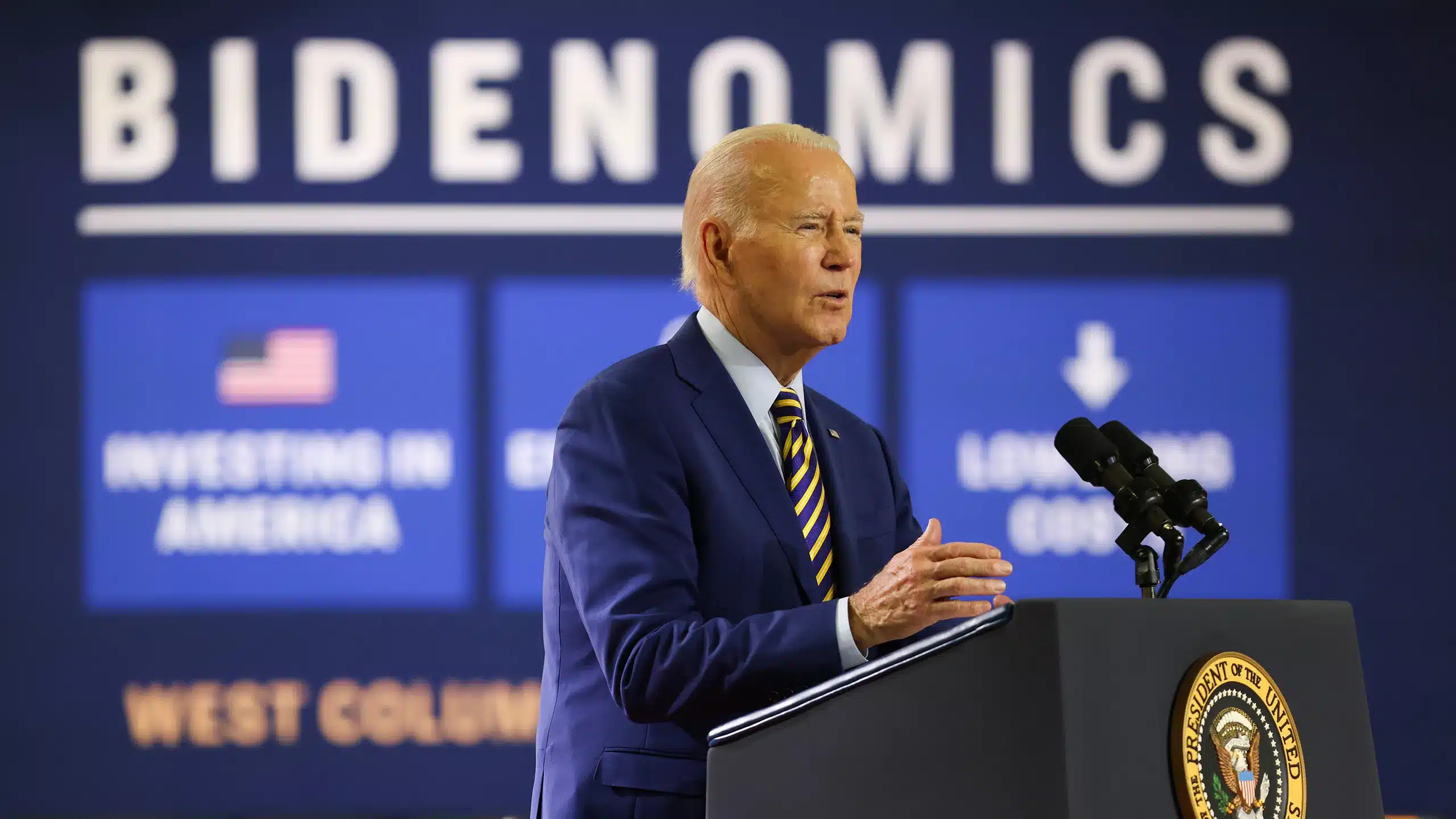

Bernstein stated that should President Joe Biden secure a second term in the November 2024 presidential election, his primary focus would remain on reducing expenses for the American people.

“When analyzing the current state of the economy, it becomes evident that there is a significant amount of momentum that is propelling us towards a positive start for the new year,” Bernstein stated.

The U.S. consumer confidence reached a five-month high in December, according to the Conference Board’s report on Dec. 20. This was in line with the significant increase of nearly 14% in the University of Michigan’s benchmark Consumer Sentiment Index, marking its largest surge in over three decades.

Throughout Biden’s term, the Michigan index has consistently indicated a prevailing sense of negativity among households regarding the economy. However, the latest data reveals a noticeable shift in Americans’ perception, as they are becoming more confident that inflation is gradually decreasing.

Joanne Hsu, the director of the Michigan survey, highlighted the positive trend in December, which completely reversed the declines observed in the previous four months. These trends are based on significant improvements in how consumers perceive the direction of inflation.

Dynamics of Main Indices in 2023

It is true that inflation has significantly decreased throughout 2023. The Labor Department’s Consumer Price Index started the year with annual price increases averaging 6.4%. In November, that had decreased to 3.1%. Bernstein observed that the price of gasoline was below $3 per gallon in over half of the states.

GasBuddy.com’s annual outlook predicts that the average retail gasoline price in the U.S. may decrease by 13 cents next year to $3.38 per gallon. This would mark the second consecutive year of declining fuel costs.

“The Christmas season has shown significant growth,” Bernstein stated. He mentioned that there was an 8% increase in spending at restaurants from Nov. 1 to Christmas Eve, along with a 6% rise in online sales. Overall, retail spending experienced a 3% increase.”

Despite the increasing positivity, the Biden administration emphasizes its vigilance towards geopolitical risks, such as Russia’s ongoing conflict in Ukraine. This conflict has the potential to disrupt grain markets and contribute to inflation once more.

What Else Should You Pay Close Attention To?

In the Middle East, Israel anticipates a prolonged conflict with Hamas militants, which raises concerns about potential escalation in the region. The Red Sea has been impacted by attacks from Iranian-backed Houthi militants in Yemen, causing disruptions to global trade. Maersk, a leading global cargo shipping company, announced on Sunday that it will temporarily suspend all sailing operations in the Red Sea for a period of 48 hours. This decision comes in response to an unfortunate incident involving a Houthi attack on one of its container vessels.

Bernstein also highlighted significant growth in the establishment of new businesses, particularly among individuals from diverse backgrounds. This trend indicates a greater sense of optimism and confidence in the state of the U.S. economy.

Bernstein mentioned that the Biden administration is closely monitoring the increase in credit card debt, perceiving it as a reversion to typical levels of delinquencies or debt levels. According to him, it would be beneficial to see significant growth in wealth among Americans of all income levels and people of color, which would help balance out the increases.