According to recent forecasts from the European Union, the euro area and its largest economies will avoid a recession. This positive outcome is expected to be facilitated by a resurgence in growth towards the end of the year, which will be further bolstered by decelerating inflation rates and a resilient labor market.

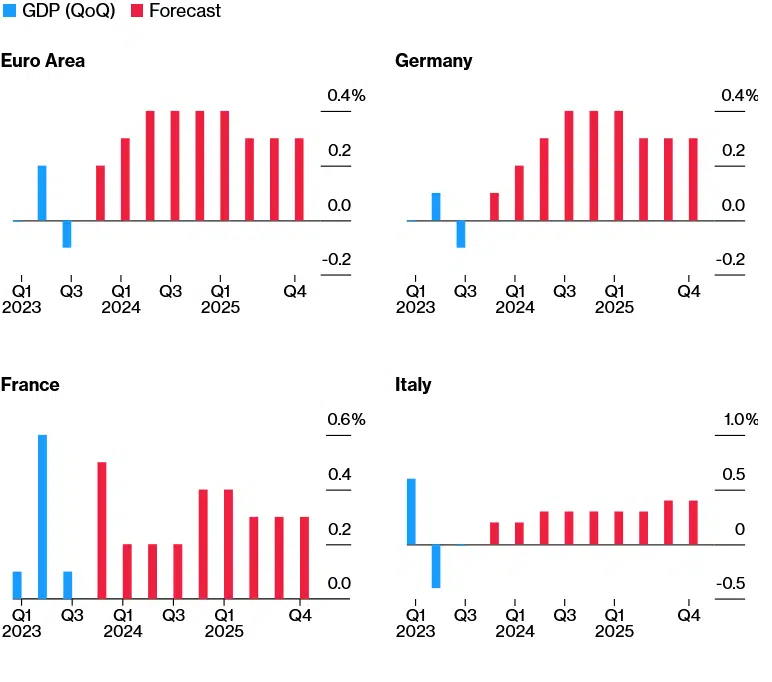

Based on a report that the European Commission released on Wednesday, the fourth quarter will see a modest 0.2% increase in output within the 20-nation bloc. This follows a contraction of 0.1% observed in the preceding three months, specifically from July to September. Despite experiencing a more challenging economic climate compared to its counterparts due to an extended period of decline in manufacturing, Germany is anticipated to avert a recession successfully.

Forecasts for Economic Expansion in the Euro Area’s Biggest Countries

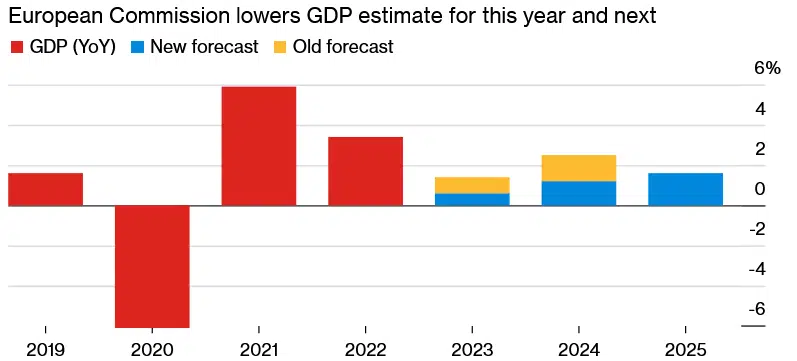

The European Union’s executive arm has revised its growth forecast for the entire year, projecting a decrease from 0.8%, estimated in September, to 0.6%. The projected growth rate is expected to reach 1.2% in 2024 and increase to 1.6% in 2025. This outlook is marginally more favorable compared to the assessment provided by the European Central Bank.According to a statement by EU Economy Commissioner Paolo Gentiloni, it is evident that households and businesses have been adversely affected by the combined impact of robust price pressures and the necessary implementation of monetary tightening measures to address them, alongside subdued global demand. The labor market will continue to be strong, and there will likely be a slight increase in economic expansion in 2024.

The projected trajectory of price growth indicates an anticipated average of 5.6% for the current year, followed by a gradual easing to 3.2% in 2024 and further deceleration to 2.2% in 2025. In contrast to the European Union’s forecast from September, the statement above resembles the European Central Bank’s (ECB) forecast, which has also included an upward revision for the upcoming year. The escalation in energy and food commodity costs has instigated this revision.

Euro Area Growth Expected to Be Lower

According to the commission, price pressures associated with non-energy consumption categories are anticipated to dissipate, aligning with the previous forecast gradually. This is expected to occur amidst a backdrop of marginally more stringent financing conditions, a tempered rate of wage growth, and a return to typical profit shares.

The inflation rate experienced a decline to 2.9% during the previous month, marking a notable decrease from its last peak of over 10%. However, policymakers at the European Central Bank (ECB) have cautioned against adopting a complacent stance, as there remains a possibility of a resurgence in price growth in the upcoming months. The central bank maintained the prevailing interest rates during October, asserting that the existing level will facilitate attaining the 2% inflation target, provided it is upheld for a sufficient duration.

The European Commission noted that the substantial increase in living expenses and the extraordinary measures implemented by the European Central Bank in mid-2022 had a more significant impact than initially anticipated.

On Wednesday, in a recent interview with Bloomberg TV, Mario Centeno, a member of the ECB Governing Council, expressed concerns regarding the prevailing absence of momentum within the euro-area economy.

The numerical values have exhibited suboptimal performance, specifically registering as zero, 0.1, and -0.1 quarter-on-quarter for five consecutive quarters. This consistent trend has engendered a certain level of apprehension regarding the likelihood of a smooth and controlled deceleration in economic activity. The current state of economic stagnation within the euro area is undoubtedly a significant concern for all stakeholders.

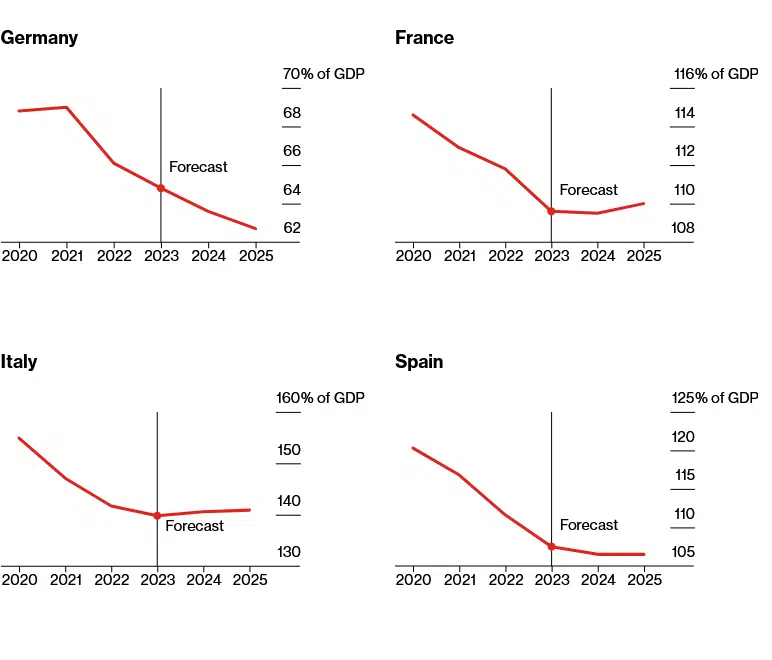

The European Union officials have expressed concerns regarding the potential stagnation of ongoing endeavors to reduce public debt levels in several prominent economies within the bloc. Italy is projected to experience a resurgence, surpassing 140% of its output within the next two years. Similarly, France is anticipated to witness a slight decline in the preceding year, followed by an upturn in 2025.

According to the commission’s analysis, lowering debt, which was initially made easier by inflation, will likely face bigger problems because price growth has slowed down, borrowing costs have gone up, and economic growth has stayed low.

Gross Debt of the Government

The sovereign debt within the euro area has emerged as a growing cause for concern, as governments have engaged in substantial borrowing during the pandemic and energy crisis while simultaneously experiencing a surge in borrowing costs to address inflationary pressures.

The labor market has exhibited resilience amidst economic challenges, as evidenced by the marginal increase in unemployment rates. While certain member states have observed subsequent growth, the commission anticipates that they are expected to maintain a stable trajectory, as stated in Ukraine, and the persistent conflicts in the Middle East have contributed to heightened uncertainty regarding the economic prospects. The photos of China’s financial performance and the transmission of monetary tightening within the euro area present inherent risks.

The report analyzed Ukraine after it attained EU candidate status, marking the first time the country was the primary focus of examination. According to the commission’s projections, a growth rate of 3.7% is anticipated for the upcoming year and 6.1% in 2025. These estimates come after a significant decline of 29%, expected in 2022.