Argentine financial institutions, adopting a cautious approach in anticipation of the upcoming presidential election, are strategically acquiring highly liquid assets to safeguard against the possibility of a substantial increase in peso withdrawals.

At This Point, There’s No Reason to Panic

There is no indication or projection of a surge in deposit withdrawals following the electoral contest between Economy Minister Sergio Massa and libertarian Congressman Javier Milei. It is worth noting that a similar scenario did not materialize after the initial round of voting in October.

However, after being taken by surprise by an unexpected surge in demand preceding the ballot above, exacerbated by eleventh-hour governmental limitations that resulted in a substantial accumulation of monetary resources being immobilized at the nation’s primary airport, they are now inclined toward proactive measures to avoid a recurrence of such circumstances.

There is widespread speculation in Argentina that a currency devaluation is highly probable after the forthcoming vote. Consequently, individuals seeking to preserve their savings may tend to expeditiously withdraw their peso deposits to procure dollars through unofficial channels in anticipation of the impending alteration.

This assertion holds particular integrity if the victor is Milei, given his proposal to abolish the national currency and substitute it with the United States dollar to mitigate the rampant inflation currently surpassing 140%.

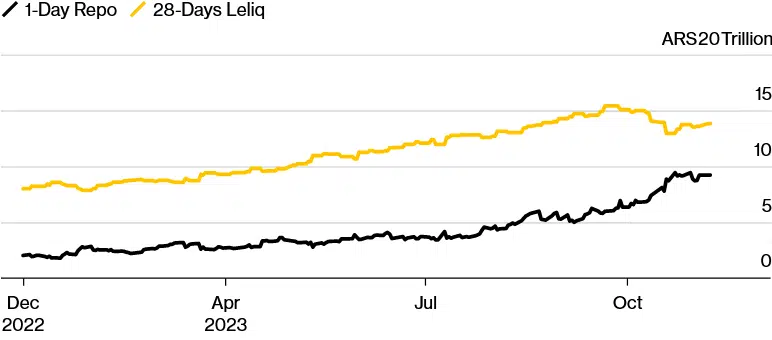

The amount of ownership of a 1-day term observed in pesos, commonly referred to as “passes,” by Argentine financial entities has experienced a notable increase of 47% over the previous month and a half. This surge has reached the highest level observed in nearly two years. Simultaneously, there has been a reduction of 10% in the allocation of 28-day period notes denominated in the local currency, specifically in pesos, commonly referred to as Leliq.

During September and October, financial institutions experienced the necessity to acquire additional reserves of the United States dollar in response to the withdrawal of funds by account holders who held balances denominated in said currency. The peso’s depreciation has resulted in a significant decline, reaching a rate of 1,000 units per dollar within the informal market used by Argentines to circumvent imposed regulations.

In the South American nation, individuals cany holdings denominated in the United States dollar. Many citizens adopt this practice to safeguard the adverse effects of inflation and substantial depreciation of the domestic currency, which has experienced a steep decline of approximately 90% within the preceding four-year period.

Based on the current state of affairs, lenders possess an adequate quantity of currency to address any potential increase in borrowing requirements effectively. Andres Borenstein, an economist affiliated with the Econviews consulting firm in Buenos Aires, shares this viewpoint.

In October, a notable 4.5% of Argentine citizens opted to withdraw their savings denominated in US dollars, while an additional 10% chose to start their savings denominated in pesos, as per the data provided by the central bank. However, most of the said withdrawals occurred during the initial phase of the month. Following the first-round vote on October 22nd, no significant movement was observed in the value of pesos and dollars held within the country’s financial system.

Massa and Milei have undergone a notable ideological shift towards more centrist stances in light of the impending runoff vote. This phenomenon may contribute to the enhancement of Argentines’ economic optimism.

Uncertainty in Politics Is Making Itself Felt

Diego Chameides, a senior analyst at Banco Galicia, Argentina’s biggest hidden bank in terms of assets, expressed uncertainty regarding the actions the winner may undertake. The presence of potential policy uncertainties associated with each of the presidential hopefuls renders it advisable to prioritize the acquisition of additional liquidity.