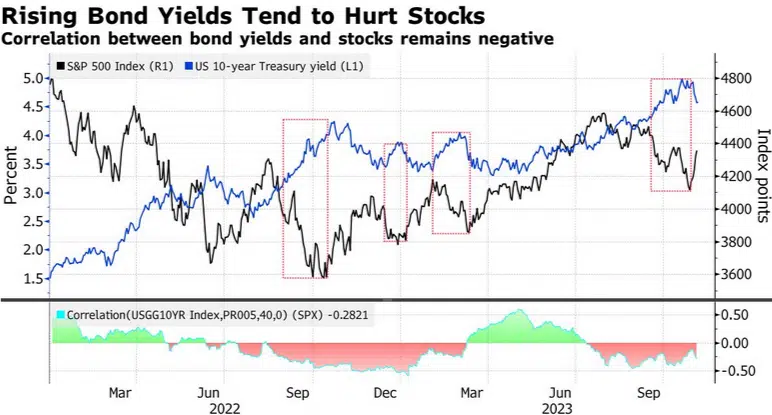

Stocks faced challenges in making significant progress as bond yields increased. Traders speculated that the Federal Reserve would counteract the recent relaxation in financial conditions by expressing its intention to maintain flexibility in policy decisions.

Following a week of notable performance in 2023 due to expectations of a more accommodative stance from the Federal Reserve, as well as oversold technical indicators and market positioning, the S&P 500 experienced a marginal upward movement on Monday.

A shift in the bond market dynamics impacted market sentiment, as 10-year yields increased by eight basis points to reach 4.65%. Treasury securities experienced a decline in value due to a substantial number of corporate debt offerings and in anticipation of upcoming auctions starting on Tuesday.

Wall Street additionally navigated the Senior Loan Officer Opinion Survey, commonly called SLOOS, which revealed ongoing tight standards and diminished demand at banks in the United States. A group of Federal Reserve officials, including Chair Jerome Powell, will deliver speeches in the coming days.

Swaps are incorporating a valuation that exceeds 100 basis points of interest rate reductions by the conclusion of 2024, originating from a projected pinnacle rate of 5.37%.

“There could potentially be a forthcoming assessment of the Federal Reserve,” stated David Donabedian, the chief investment officer at CIBC Private Wealth US. The anticipation is that the remaining portion of the year will exhibit a considerable level of instability, characterized by fluctuations resembling the behavior of a person experiencing manic-depressive episodes. The projected direction of interest rate movement will have a significant impact on these fluctuations.

“The Federal Reserve has completed its actions,” expressed Andrew Brenner, the leader of international fixed-income at NatAlliance Securities. June appears to be a finalized agreement for a reduction, as the markets are incorporating the anticipation of four rate reductions for the upcoming year. The Federal Reserve will likely resist this projection to maintain flexibility in its decision-making process. Powell will attempt to regain some of the relaxation of monetary conditions.

To the recipient at E*Trade from Morgan Stanley, the inquiry regarding the potential longevity of market momentum hinges upon the consistency of forthcoming economic data aligning with the jobs above report from last week, which indicated a deceleration in the labor market during October.

“If the continuation of this cooling trend occurs, individuals may consider the notion that the Federal Reserve will adopt a less hawkish stance,” Larkin observed. However, it is observed that the market often experiences a temporary retracement shortly following significant movements, such as the one witnessed last week.

Examination of the Specifics

The S&P 500 is now trading at 4,365.98, and chartists are keeping a close eye on the 4,355 level since it represents a 50% retracement of the peak-to-trough collapse that occurred from its highs in July to its lows in October. According to Keith Lerner, co-chief investment officer at Truist Advisory Services, the following number to watch is the 4,400 level if it maintains its position above that level. This is the level where the index lingered at its highs in the middle of October.

“To reverse this downtrend, the S&P 500 still needs to break above 4,400,” said Lerner, whose company is overweight in US equities. “But we’re getting closer.”

In the words of Michael Wilson of Morgan Stanley, the most fantastic week for the S&P 500 in the past 12 months was little more than a bear-market rally. “we find it difficult to get more excited about a year-end rally,” he continued, citing a bleak forecast for earnings, poorer economic data, and weakening analyst opinions. “We find it difficult to get more excited about a year-end rally.”

Marko Kolanovic, an analyst at JPMorgan Chase & Co., believes that the possibility of persistent high interest rates and weakening growth will soon bring back into focus that investors will find stocks unappealing again. The combination of declining bond rates and dovish comments made at central bank meetings was a “knee-jerk positive for equities,”

However, he predicted that the growth-policy tradeoff would continue to be difficult until the end of the year.

“We need to ask ourselves whether the October breakdown was a ‘bear trap,'” said JC O’Hara, chief market technician at ROTH MKM. “The question we need to ask ourselves is whether the October breakdown was a bear trap.” “If that’s the case, we should anticipate a sharp ascent.” In that case, we should investigate ways to reduce our exposure while maintaining the existing levels.”

According to Jean Boivin, who works in the research department of BlackRock Inc., any rise in stocks toward the end of the year might prove to be fleeting because equities do not entirely represent the view for rates continuing higher for longer.

Yields on 10-year Treasuries have experienced a significant decline following their peak of 5.02% on October 23rd. This shift in the bond market, valued at $26 trillion, has led traders to reassess their expectations regarding the conclusion of rate hikes.

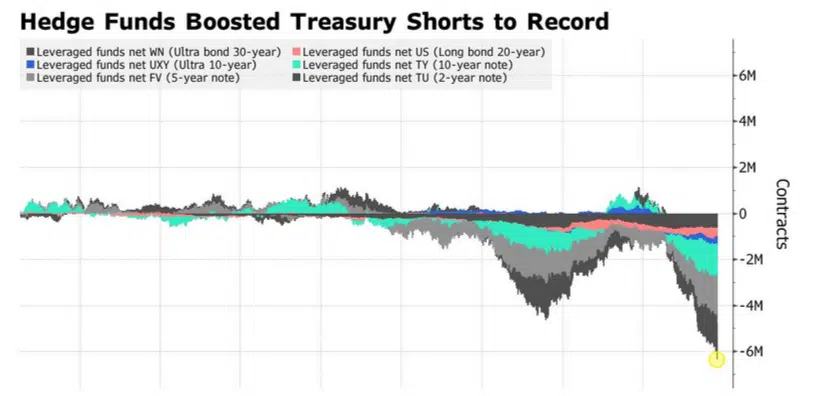

The convergence of increased benign US refunding requirements, unexpectedly weaker jobs data, and indications of the Federal Reserve adopting a less hawkish stance might have prompted a broad-scale closure of short positions.

Net short Treasury futures positions were significantly increased by leveraged funds, reaching the highest level recorded since 2006, based on an analysis of data from the Commodity Futures Trading Commission as of October 31st. The wagers continued even though the monetary securities had experienced a surge in value the previous week.

According to an analyst named Lori Calvasina at RBC Capital Markets, it has been observed that the primary concern among the equity investors her company engaged with last week revolved around the potential peak of 10-year Treasury yields.

“The perspective over the previous month or thereabouts has been that if the increase in yields were to cease promptly, American equities might be able to avoid incurring excessive further harm,” Calvasina supplemented.

From a seasonal standpoint, the S&P 500 has historically performed well during November. December is generally considered a favorable month; however, similar to October, there have been challenging periods in the past.

In another location, there was an increase in oil prices following the reaffirmation by Saudi Arabia and Russia that they will continue to implement restrictions on oil supply, amounting to over 1 million barrels per day, until the conclusion of this year. The price of gold experienced a decrease following a brief period of surpassing $2,000 per ounce on Friday.