In December, American employers added more workers to their workforce than anticipated while also increasing wages at a steady pace. This has raised questions about the financial market’s prediction that the Federal Reserve would begin reducing interest rates in March.

Nevertheless, the highly anticipated employment report from the Department of Labor on Friday did reveal a few weaknesses. The economy experienced a decrease of 71,000 jobs in October and November compared to the previous reports.

Although the unemployment rate remained steady at 3.7% in the previous month, this was primarily due to a significant number of individuals, totaling 676,000, exiting the labor force. This nearly negated all the progress made in terms of participation since February. There was a significant decline in household employment, while the average workweek was slightly shorter compared to November.

However, the report suggested that the economy managed to steer clear of a recession in the previous year and is expected to maintain its growth trajectory until 2024, thanks to the robustness of the labor market, which bolsters consumer expenditure.

“There continues to be a gradual slowdown in the labor market,” stated Scott Anderson, the senior U.S. analyst at BMO Capital Markets in San Francisco. “Nevertheless, the enduring fortitude of the labor market and the robustness of wage growth may cause the Federal Reserve to maintain its current position for a longer duration than what is presently anticipated by the markets.”

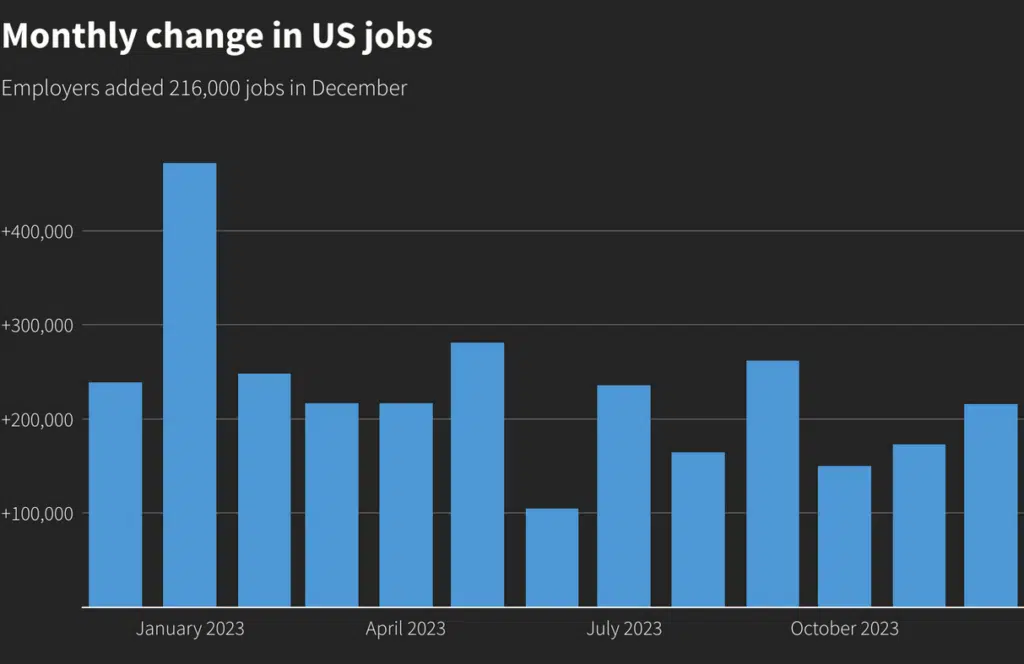

The Labor Department’s Bureau of Labor Statistics reported that last month, the number of jobs in the nonfarm sector increased by 216,000. According to economists, the projected increase in payrolls was 170,000 jobs. In 2023, the economy saw an increase of 2.7 million jobs, which is a significant decrease compared to the 4.8 million jobs that were generated in 2022.

This indicated a decrease in the need for cooling in the economy, which can be attributed to the series of interest rate increases implemented by the U.S. central bank starting from March 2022. Approximately 100,000 positions per month are required to match the expansion in the working-age population.

The increase in employment last month was primarily driven by the government’s efforts to restore education staffing to pre-pandemic levels. A total of 52,000 jobs were added as state and local authorities focused on hiring.

The growth of government payrolls in 2023 was impressive, with an average of 56,000 jobs added per month. This marked a significant increase compared to the average monthly gain of 23,000 jobs in 2022.

The number of jobs in the healthcare industry rose by 38,000, with growth seen in both ambulatory healthcare services and hospitals. The construction sector experienced a significant increase in employment as a result of the hot climate, with the number of workers in the industry growing by 17,000.

Employment in the leisure and hospitality sector increased by 40,000. The number of jobs in the industry is 163,000, lower than pre-COVID-19 levels. The number of people employed in the retail sector increased by 17,400.

The payrolls in professional and business services increased by 13,000. However, temporary help services experienced a decline of 33,300 positions. Job opportunities in the industry, viewed as an indicator of future recruitment, have experienced a continuous decline for 11 consecutive months.

The number of manufacturing jobs rose by 6,000. However, there was a significant decline of 22,600 jobs in the transportation and warehousing sector.

The job market continues to be highly competitive, with a ratio of 1.40 job openings for each individual seeking employment in November. That is translating into higher wages, which continue to be at a high level.

Hourly earnings experienced a 0.4% increase in December, which was consistent with the previous month’s growth. This resulted in a rise in the year-on-year wage growth rate to 4.1% from 4.0% in November.

Salary expansion is significantly higher than its pre-pandemic norm and the range of 3-3.5% that most decision-makers consider in line with the Federal Reserve’s 2% inflation objective.

Financial markets initially decreased the chances of a March rate cut to approximately 53% but later increased them to around 65% as traders analyzed the varied employment reports. Next Thursday, all eyes will be on the upcoming consumer inflation report for December.

The performance of stocks on Wall Street was varied. The value of the dollar declined in relation to a variety of currencies. Prices of U.S. Treasury bonds experienced a decline.

The Details of the Household

Last month, the Federal Reserve decided to maintain its policy rate within the range of 5.25% to 5.50%. In their latest economic projections, policymakers indicated that the extensive monetary policy tightening implemented over the past two years has concluded, and they anticipate a decrease in borrowing costs by 2024.

Last month, more industries experienced job growth, alleviating worries that hiring was overly focused in specific sectors.

In the December employment report, the government included updates to the seasonally adjusted household survey data, which is used to calculate the unemployment rate for the previous five years.

The modifications had minimal effect on the unemployment rate or the rate of people actively participating in the workforce. The unemployment rate has increased from a historically low level of 3.4% in April due to a surge in individuals entering the workforce, partly attributed to a rise in immigration.

However, the situation took a turn in December as a staggering 676,000 individuals decided to exit the workforce. Consequently, the rate of labor force participation, which represents the percentage of individuals in the working-age population who are employed or actively seeking employment, declined to 62.5%.

This marked a significant decline from the previous month, dropping to the lowest point since February. The participation rate among individuals in their prime working years reached its lowest point since March.

Participation rates declined for both genders, as well as for workers born in the United States and those born abroad. Several economists have suggested that the decrease in both household employment and the workforce can be attributed to retirements at the end of the year.

“Monthly fluctuations might have had an impact, but we cannot be certain until the next release,” commented Daniel Vernazza, the chief international economist at UniCredit Bank in London.

The number of people employed in households dropped by 683,000. On the other hand, it’s highly unpredictable. The employment-to-population ratio, seen as an indicator of a nation’s capacity to generate jobs, dropped to its lowest point in a year at 60.1%, down from 60.4% in November.

A more significant number of individuals opted for part-time employment due to economic circumstances, with the figure experiencing a rise of 217,000. The overall unemployment rate, which takes into account individuals who are actively seeking employment but have become discouraged and those who are working part-time due to a lack of full-time opportunities, increased slightly from 7.0% to 7.1% in November.

“The job market isn’t as tight as you may believe,” stated Sung Won Sohn, a professor of finance and economics at Loyola Marymount University. “I anticipate the Federal Reserve to decrease interest rates on multiple occasions during the first half of the year.”