U.S. investment powerhouses Pimco and Vanguard have acquired Turkish resources in recent weeks, demonstrating their confidence in the country’s ability to sustain high-interest rates following a period of unpredictable policy decisions under President Tayyip Erdogan.

Interviews with leading financial experts at these companies reveal that two of the largest investors globally, who collectively manage almost $10 trillion in assets, have become optimistic about Turkey due to its recent economic stability after Erdogan’s re-election in May.

Investments in the Turkish Economy Remain Attractive for Companies

Pimco and Vanguard did not provide further details regarding the exact magnitude of their acquisitions. However, these investments indicate a sense of trust and optimism following a significant period of foreign outflows that had previously marginalized Turkey within the global emerging markets.

“We have a positive outlook on Turkish assets, especially those denominated in the local currency. This is because of the measures taken to control spending and inflation through tighter financial conditions, as well as the gradual relaxation of regulations that have been distorting asset prices,” stated Pramol Dhawan, the company’s managing director and director of market research at Pimco, a global investment management firm with almost $2 trillion in assets under its supervision.

In the latter half of the year 2020, Vanguard made a purchase of Turkish domestic bonds sans insuring. After Nick Eisinger and a few other investors traveled to the nation for talks, this decision was reached subsequent to their trip.

“It was a significant turning point,” Eisinger mentioned in a separate interview, highlighting that benchmark yields later decreased by 500-600 basis points from November to mid-December, prior to experiencing a partial recovery this week.

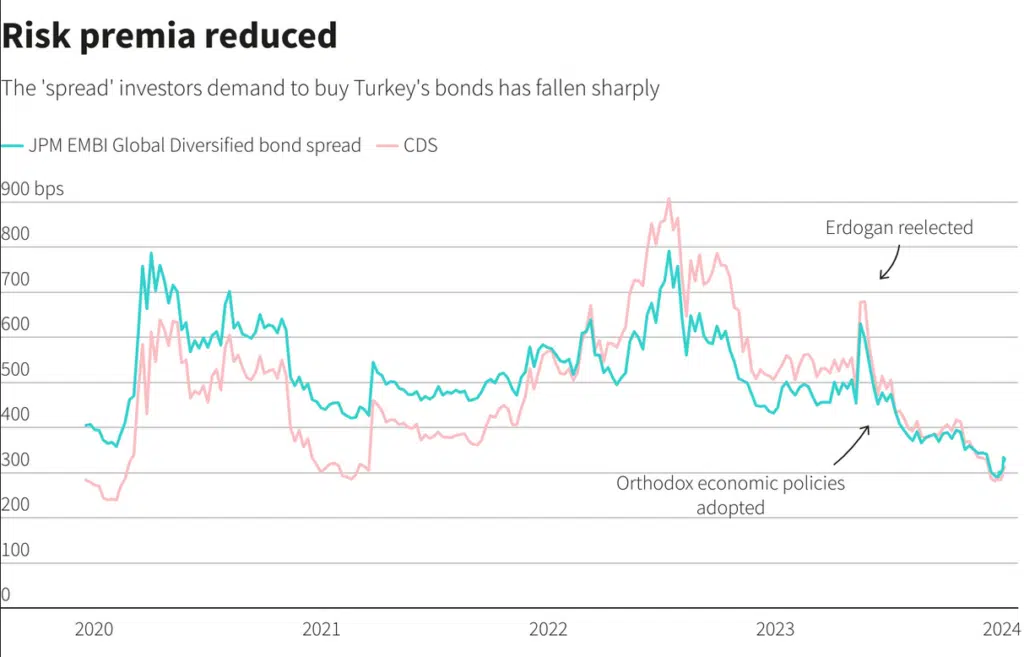

Foreign purchasing activity reached its highest point in six years last month, while credit default swaps (CDS), a significant indicator of risk, have dropped to less than half of their May levels.

This represents a remarkable shift from the period when international investors mainly withdrew from Turkey, as Erdogan implemented a strategy of reducing interest rates despite high inflation. Additionally, the government exerted greater control over foreign exchange, debt, and credit markets, resulting in their predominantly state management.

In June, Erdogan appointed a fresh cabinet and central bank leader, Hafiz Gaye Erkan, who subsequently raised rates by a significant 3,400 basis points to 42.5% in order to control the inflation that approached 65% in the previous month.

The bank has expressed its intention to cease the aggressive increases in interest rates as soon as possible while continuing to uphold a stringent monetary policy for as long as necessary. Authorities have also started unraveling numerous regulations to liberate banks and financial markets.

Dhawan from Pimco suggested that in order to reduce inflation to target levels, it is necessary to have a phase of genuine currency appreciation along with strict fiscal measures. This is due to the significant domestic demand, high levels of dollarization, and the prolonged depreciation of the lira.

“We are already beginning to witness the emergence of certain advantages resulting from this well-coordinated policy framework,” he stated, emphasizing that the increasing foreign exchange reserves have alleviated a significant worry among investors.

Risk of Erdogan

While confident investors may exercise caution, there is a strong likelihood of increased foreign interest in the market due to the allure of potentially significant bond returns. According to Reuters, Amundi, the largest asset manager in Europe, has adopted a more optimistic stance towards Turkish assets.

According to investors, there is a concern that Erdogan may become impatient with the arduous process of returning to orthodoxy, which may result in an economic slowdown. This comes as his ruling AK Party aims to regain control of major cities in the upcoming nationwide local elections on March 31.

Five years ago, Erdogan experienced significant electoral defeats in Istanbul and Ankara, which were his most significant losses in over two decades of being in power.

In order to enhance his campaign prior to the election in the previous year, Erdogan – who has previously expressed strong opposition towards interest rates – utilized the budget and central bank to achieve unprecedented levels of social spending and employed foreign reserves to stabilize the lira.

In the past five years, he has dismissed four central bank chiefs, undermining the autonomy of the institution. As a result, the ownership of government bonds by foreign entities experienced a significant decline, plummeting to less than 1% from its previous level of 20% in 2018. However, it later recovered and surpassed the 1% mark towards the end of last year.

“The true measure of the situation lies in the upcoming months,” according to Vanguard’s Eisinger, considering the elections and the central bank’s dedicated efforts to combat inflation.

Vanguard made an investment when Turkish bond yields were significantly high, reaching around 35%. According to the source, they have the potential to increase their position in this investment. “If yields increase, we might consider engaging in more of that trade.”

JPMorgan, a prominent Wall Street bank, expressed optimism about the potential of Turkey’s lira as an emerging market opportunity for 2024. Similarly, UBS advised its clients to consider a “tactical long” position on the currency in November.

Erkan, the recently appointed head of the central bank and former Goldman Sachs banker, along with Finance Minister Mehmet Simsek, will be showcasing Turkey’s policy vision to international investors in New York next Thursday.