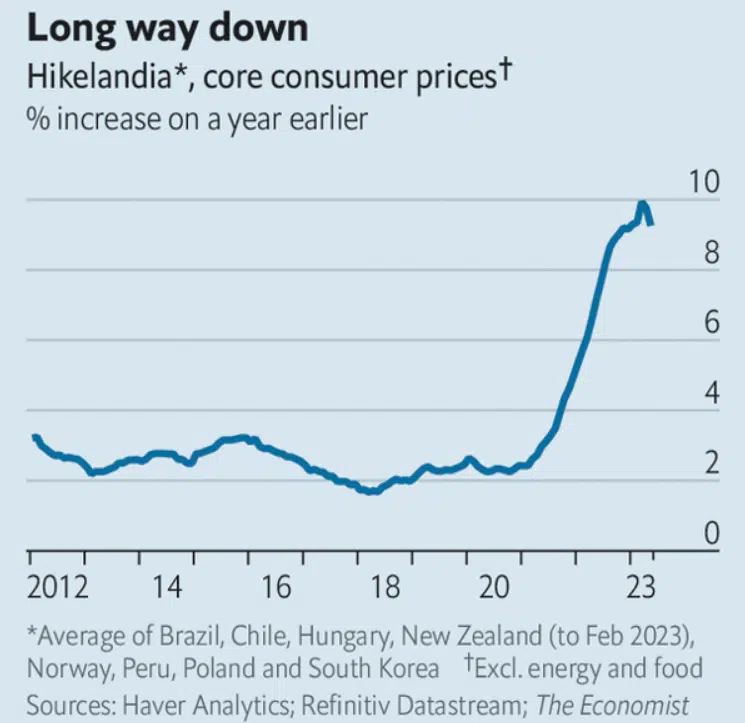

To fight the harmful effects of inflation successfully, you need to use intelligent tactics that lessen its impact on the economy. This detailed guide gives a lot of helpful information about the economy of Hikelandia, which is known for having strong and stable central bank officials.

Banks Show How Inflation Should Be Confronted

The state of the Hikelandian economy has been the subject of many studies during the previous twelve months. The central banks of these eight countries—Brazil, Chile, Hungary, New Zealand, Norway, Peru, Poland, and South Korea—have been working harder than ever to combat inflation. When the Federal Reserve in the United States decided to raise interest rates, Hikelandia was already one step ahead of them.

This astute action has favored Hikelandia, demonstrating the country’s ability to foresee and rapidly address economic changes. Since then, the institution above has raised its average policy rate by more than seven percentage points, while the Federal Reserve has increased it by just approximately five.

However, Hikelandia’s central bankers became less and less optimistic over many months as they attempted to address the nation’s mounting inflation.

At last, a paradigm shift is taking place. Even though Hikelandia’s “core” inflation, which doesn’t include the fluctuating prices of food and energy, stays high, there are signs that it will go down. This is partly because rising interest rates have affected the economy, as shown in the picture below.

The story of Hikelandia can show other central banks how to deal with inflationary forces positively.

There are indications that wage growth is beginning to moderate throughout the country. It’s fascinating that Chile’s salary growth has slowed since January when it increased at a reasonably rapid 11% annually. This occurrence contributes to lowering costs because of how it impacts each other.

The inflation rate in South Korea’s labor-intensive service sector was 4.2% in October, up from 3.8% a year earlier. However, the rate has dropped to 3.3%, so that’s good news. Poland’s annual GDP growth rate slowed to 12.3% in February from 13.4% in December.

Falling gasoline and food prices are likely responsible for the lower inflation forecasts. Most Brazilians anticipate inflation of 4% in 2019, down from the 6% average of 2022. Inflation in New Zealand is predicted to remain at roughly 1% for the next five years. From what they anticipated in December, this is a dramatic shift.

The sole representative of Hikelandia, Norway, appears mired in a sluggish economic expansion. Core prices unexpectedly rose 6.7% in May over the same month the previous year. This reached a whole new pinnacle.

Products imported from other nations now cost more due to the weakening krone. The robustness of local demand is also playing a significant role. The unexpected action taken by the central bank in June was intended to boost the economy’s performance. The market took notice since this indicated the policy rate had increased by half a percentage point.

On the outskirts of Oslo, you can see that the attitude of the central banks of Hikelandia has changed. As expected, government leaders are still taking a firm stand. South Korea’s monetary officials say they have long been committed to keeping a “hawkish” policy stance.

The monetary policy committee of Brazil is worried that long-term inflation expectations could move away from their desired level in a way that is big or lasts for a long time. But it’s important to note that most of the central banks in Hikelandia have stopped trying to raise interest rates.

The banking sector in Chile thinks the current inflationary risks have been successfully dealt with and are now in balance. The respected people in charge of setting interest rates in Hungary expect deflation to speed up even more.

There have been some financial effects of success. Both the world economy and the economy of Hikelandia grew at the same rate in the year 2021. The world economy is growing at a slow rate of 2.5% per year, but sadly, the economy of Hikelandia is stuck in a state of stagnation.

After hitting a recent low, the jobless rate in Chile went up by almost one percentage point, which was a significant change. In Brazil and New Zealand, on the other hand, it is slowly going up. Shortly, Hikelandia’s government may see a slowing economy as a cost worth paying. Before we can call these countries “Cutlandia,” inflation must decrease significantly.