Australia is facing potential repercussions due to its significant financial connections with China, as the latter’s escalating economic challenges threaten its trade allies.

China’s economic expansion has experienced a notable deceleration, accompanied by a decline in foreign investment. Concurrently, the nation is grappling with a deepening property crisis, wherein prominent real estate developers such as Evergrande and Country Garden are confronting significant financial challenges.

The youth unemployment rate experienced a significant increase, reaching 21.3%, prior to Beijing’s sudden suspension of the data series, thereby eliciting concerns and raising awareness.

Australia had initially strategized to capitalize on China’s post-pandemic economic revival until indications surfaced suggesting potential challenges with the significant iron ore purchaser and source of tourists.

The intergenerational report presents several noteworthy observations regarding longer life expectancy, the aging population, and climate change. Here, we outline seven key takeaways derived from this report.

The potential occurrence of a significant decline in China’s economic performance can dampen the overall economic growth of Australia. This would primarily manifest through reduced export activities and investment, particularly within the resources and tourism sectors.

The potential consequences of unemployment would entail an increase in the overall rate, thereby impeding the growth of corporate and individual tax revenues that are bolstering the Albanese government’s fiscal framework.

The endeavor to achieve forthcoming surpluses, anticipated to be realized in the fiscal year 2022-23, presents a notably challenging task, particularly considering the absence of such achievements for 15 years.

In the words of esteemed mining analyst Peter Strachan, who is based in Perth, there is a possibility of a significant economic contraction in China following a prolonged period of robust growth.

For Strachan, it is difficult to comprehend the absence of a potential economic or social crisis in China, given its remarkable growth over the past three decades.

This statement may signify a significant development or outcome.

Iron Ore Prices That Are Going Down

A review of official government data shows that China is Australia’s foremost trading partner, constituting approximately 33% of its foreign trade. This substantial trade relationship is primarily driven by exchanging significant quantities of iron ore, coal, gas, and minerals.

As noted by Strachan, it is anticipated that the deceleration of China’s economic growth will promptly influence Australia’s export sector and commodity prices, owing to China’s significant position as a major purchaser.

According to the individual’s statement, a reduction in Chinese consumption would decrease construction activities and subsequent iron ore purchases.

As the economy decelerates, there will be a reduction in the procurement of liquefied natural gas from our organization. It is anticipated that there will be a limited demand for iron ore or liquified natural gas exports to China within the upcoming 12-month period.

Iron ore prices have experienced a significant decline subsequent to reaching elevated levels in the preceding two years, primarily due to a worldwide deceleration in economic activity.

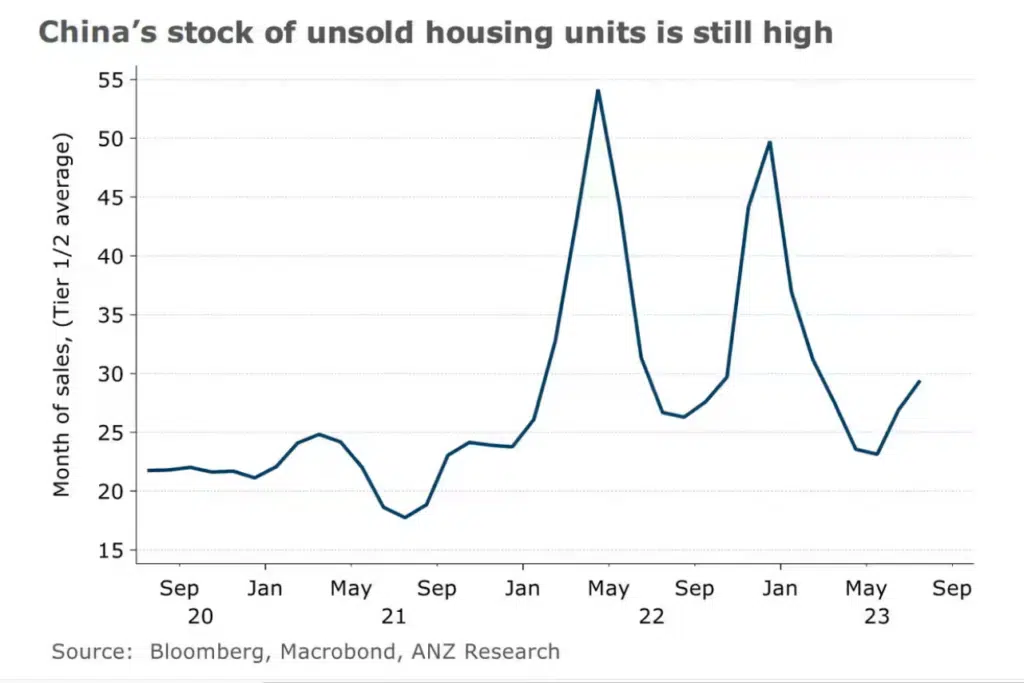

According to ANZ, the property sector in China continues to face significant challenges, and there are no indications of improvement. ANZ further highlights that this sector accounts for over one-third of the country’s steel production.

The anticipated decline in steel demand is expected to influence the pricing dynamics of iron ore negatively.

The potential ramifications of a deceleration in mining activities within Australia are subject to vigorous discourse, owing to the substantial presence of foreign ownership within prominent mining enterprises and the limited spillover effects of their profits onto other sectors of the economy.

During mining pullback, resource towns tend to experience increased affordability. However, it is essential to note that the decline in iron ore prices can have a consequential impact on the tax revenue generated. Additionally, many companies have been established to provide services to miners.

The iron ore royalty income of the Western Australian government experiences a decline when there is a reduction in prices and export volumes. This occurrence ripple effect across the nation, as it impacts the distribution of GST revenue among the various states.

The Chinese Tourist Industry Is Collapsing

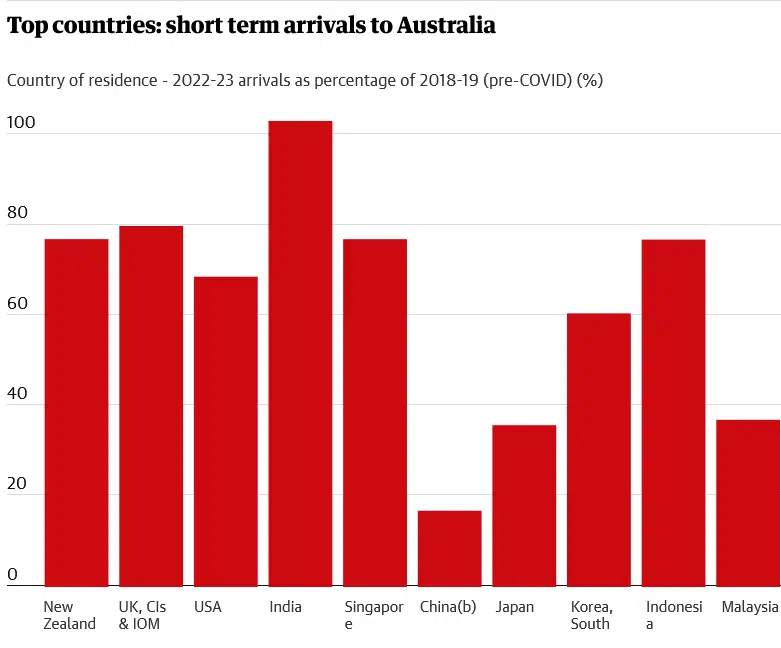

With the resumption of international travel amidst the ongoing pandemic, there was an optimistic anticipation for a significant influx of Chinese tourists, known for their propensity to spend generously, to return to Australia. However, the actual outcome revealed a considerably modest volume of visitors.

According to the data provided by the Bureau of Statistics, the number of individuals who engaged in short-term stays originating from the island country of Singapore during 2022-23 surpassed the corresponding figure for all of China.

The significant decline in Chinese visitor numbers, a mere 17% of pre-pandemic levels, can be attributed to limited flight availability, exorbitant airfares, and a government-imposed prohibition on group tours. Notably, the ban above has only recently been lifted after the Beijing authorities relaxed travel constraints.

Grant Wilckens, the esteemed chief executive of G’day Group, has expressed that the prevailing property downturn has presented itself as a formidable challenge during a susceptible period.

The population base is of considerable magnitude, having previously exhibited a substantial influx. This development serves as an additional deterrent for their prospective arrival or a postponement of their intended journey, as articulated by Wilckens.

The downtown property in China is indeed a matter of concern. According to the individual, there has been a significant decline of approximately 60% in the volume of Chinese travelers visiting his establishments compared to the levels observed before the onset of the pandemic.

The correlation between domestic travel and international tourist arrivals is intricately tied to broader economic indicators, whereby any economic downturn generally results in a decline in travel activity. The phenomenon above subsequently exerts an influence on the employment statistics within the domain of the tourism industry.

The international student market is also experiencing similar effects.

The Chinese travel industry has encountered significant obstacles due to a sequence of product prohibitions and tariffs initiated by the country against Australia in the latter part of 2020 following a decline in bilateral relations.

In the words of Wilckens, the potential for increased air travel between China and other countries could be facilitated by a subsequent relaxation of trade restrictions.

The action above effectively facilitates cargo transportation within aircraft, thereby generating a heightened need for inbound and outbound flights in Australia, accommodating the presence of tourists aboard said flights.

A Falling Value for the Australian Dollar

The Australian dollar exhibits a notable susceptibility to fluctuations in iron ore prices, resulting in a tendency for the local currency to experience depreciation during periods of price weakness within the resources sector. This currency, widely regarded as a commodity currency and a proxy for the Chinese economy, is subject to the influence above.

The Australian dollar experienced a decline last week, reaching a value of US63.63c, marking its lowest point since November of the previous year. The greenback’s depreciation is similar to levels observed during the global financial crisis.

According to Carlo Pruscino, a senior sales trader at CMC Markets, currencies serve as indicators of economic well-being, thus implying that a prolonged deceleration in China’s economic growth would likely exert adverse pressure on the yuan and the Australian dollar.

According to Pruscino, if the Chinese slowdown persists, there is a possibility of a protracted decline in the demand for Australian exports, reducing Australia’s revenues.

Offshore investors may resist engaging with the Australian dollar, opting instead for nations with a lesser degree of export dependency.

The depreciation of the Australian dollar can confer a competitive advantage to exporters, as it renders their merchandise comparatively more affordable relative to counterparts originating from nations with more robust currencies. Furthermore, it is a significant attraction for international tourists, who benefit from favorable exchange rates.

From an alternative perspective, individuals involved in the importation industry and Australian citizens intending to travel overseas may experience a reduction in their ability to make purchases due to decreased purchasing power.

China has the potential to implement measures aimed at stimulating its economy. This strategy has historically resulted in the escalation of resource prices and subsequent appreciation of the Australian dollar. However, it is worth noting that a subset of economists expresses concerns regarding the potential consequences of this approach, precisely the possibility of Beijing assuming excessive debt levels.

The efficacy of the prevailing investment model, which entails allocating resources toward the development of roads, residential properties, industrial facilities, and bridges, needs to be revised in light of the substantial underutilization and vacancy rates observed within existing infrastructure.

To date, Chinese authorities have unveiled a series of modest initiatives, resulting in a lackluster market response, thereby exerting downward pressure on iron ore prices and the Australian dollar.