The current state of the stock market is characterized by a certain level of risk, which may indicate an impending market crash. However, such arguments tend to be disregarded in the long run. Since 1900, the average annual real return on stocks in the U.S. has averaged 6.4%.

Over thirty-plus years, the original value of $1,000 has changed significantly, increasing purchasing power to $6,400. Bonds, as the primary alternative, cannot achieve comparable results. Assuming an average annualized historical return of 1.7% would yield a modest $1,700. Cash performance would be even more unfavorable.

There May Not Be an Economic Downturn

The lesson for today’s investors, a significant portion of whom were unprepared for the current bull market, seems clear. Disregard the possible manifestations of an economic downturn, which may or may not occur. Pursuing a long-term investment strategy is advisable by buying and holding stocks, allowing for potential returns that can effectively mitigate the effects of temporary market downturns.

Unfortunately, there is a caveat here. The focus of modern analysis is on prospective returns rather than historical returns. Based on the above metric, stocks currently have higher valuations, making them comparatively more expensive and yielding lower returns than bonds. This trend has been observed for only a short time.

The phenomenon of stocks consistently outperforming bonds is due to several key factors. A store represents a legal right to a portion of a company’s future earnings, which introduces uncertainty into potential returns. On the other hand, a bond means a contractual obligation to pay a predetermined series of interest and subsequent principal repayments.

The possible insolvency of the borrower, as well as fluctuations in interest rates or inflation, can affect cash flow estimates. However, the stock in question represents a comparatively higher level of risk, necessitating a commensurately higher return potential. The difference between the two types of supplies can be attributed to what is known as the “risk premium.” This term refers to excess of 4.7 percentage points of the annualized return of equities over bonds.

What Can Be Expected in the Coming Years?

Determining a bond’s potential return can be simplified by calculating its yield to maturity. Estimating stock returns can be challenging, but a convenient metric is the “earnings yield,” which is the division of expected earnings for the coming year by the current stock price.

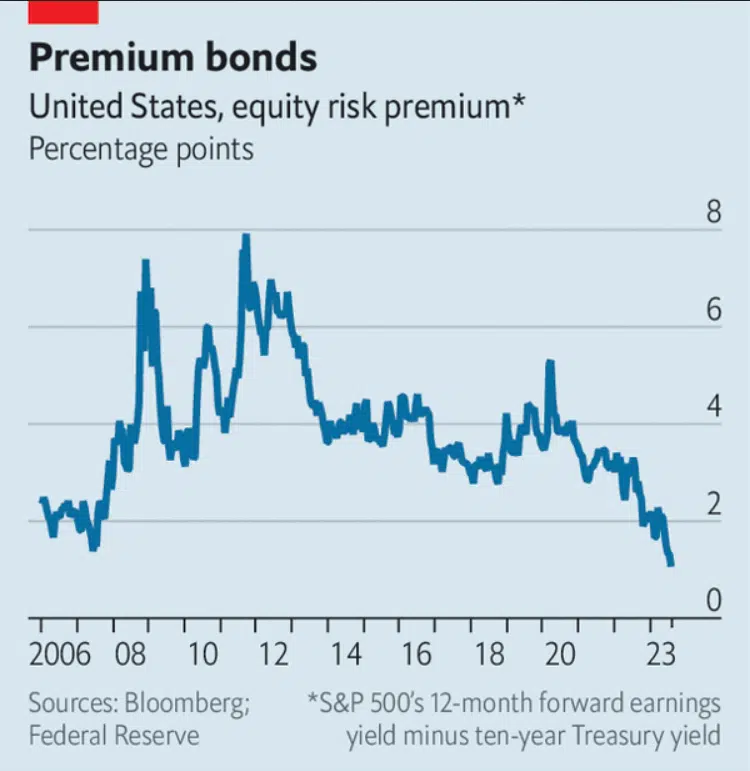

Combining the above components, namely ten-year Treasuries and the S&P 500 Index, a simple measure of the equity risk premium can be derived that takes a forward-looking rather than retrospective view. The graph shows a significant decline in the premium over the past year.

Attention should be paid to the various components affecting the dynamics of the equity risk premium, namely earnings, Treasury yields, and stock prices. Expected revenues and Treasury yields are currently in line with October levels, which coincides with the period when stock prices hit their lows. Since then, however, there has been a substantial increase in stock prices, which has caused their yields to decline and thus to converge to relatively safe Treasury yields.

Three possible implications follow from this. Investors may believe that earnings will rise substantially, which could be attributed to the surge in productivity due to artificial intelligence. People may think that the probability of underperforming returns has decreased and thus rationally reduce the associated risk premium. On the other hand, people may be concerned about the perceived increase in risk associated with Treasury bonds, which serve as a measure of stock performance.

Different Scenarios

The ideal situation assumes a consistent increase in returns. An alternative view, however, is not so optimistic: it suggests that investors may have allowed renewed enthusiasm in the market to trump rational thinking. According to Ed Cole of asset management firm Man Group, the compression of the equity risk premium can be interpreted as speculation on a “soft landing” scenario.

This scenario assumes that central banks will effectively contain inflationary pressures without causing a recession. There is now an increased validity to such a scenario due to moderate price increases and the successful avoidance of recession by most countries worldwide. However, it is worth noting that surveys conducted among manufacturers still indicate a prevailing state of recession in the sector. Furthermore, the full impact of higher interest rates may not be felt.

A third possible scenario involves a deviation from the propensity to be enthusiastic about equities, as investors are, on the contrary, trying to avoid this particular option. In the previous year, bond yields in the U.S. fell significantly, by 31% in real terms. Similarly, bonds suffered significant losses of 34% in developed markets, the worst decline in a century.

According to Sharon Bell, a representative from Goldman Sachs, a financial institution, it is not unexpected that confident investors may exhibit caution towards bonds and prefer to invest in shares. This inclination is particularly evident if these investors believe that inflation has experienced a sustained increase, as claims tied to nominal earnings offer protection against such circumstances.

Conversely, bonds that derive value from fixed coupons do not possess this protective attribute. Simultaneously, governments are poised to increase debt issuance to address the challenges of aging populations, defense expenditures, and the imperative of reducing carbon emissions. This trend is occurring against the backdrop of diminishing participation by central banks as purchasers.

The outcome will entail an increase in bond yields and a reduction in the equity risk premium due to mechanical factors. The statement above suggests a potential shift in the prevailing regime, wherein the equity risk premium is anticipated to experience a sustained decrease over an extended period, as opposed to a temporary adjustment that a decline in stock prices would rectify.

Irrespective of the underlying catalyst, investors have currently positioned their investments in anticipation of an upward trajectory in profitability. In a recent analysis conducted by Duncan Lamont, an esteemed representative from Schroders, a prominent investment firm, a comprehensive comparison was made between the historical returns on the S&P 500 index, dating back to 1871, and the yield gap observed about ten-year Treasury bonds.

The individual discovered that the relationship has proven unproductive in guiding short-term market fluctuations. In the context of a more extended timeframe, a discernible correlation becomes evident. For stocks with a low initial yield gap to exhibit favorable performance over a decade-long period, substantial real earnings growth has been a crucial determinant.

The efficacy of animal spirits in propelling progress is limited, as the ultimate success factor lies in the tangible outcomes of earnings. A slight deviation from the current trajectory would suffice for a prudent long-term investor to ascertain that the present market conditions are excessively overvalued.