The October sales figures for new U.S. single-family homes were lower than anticipated, primarily due to the impact of increased mortgage rates on potential buyers. Despite builders reducing prices, the scarcity of pre-owned houses for purchase suggests that this decline is likely a temporary setback.

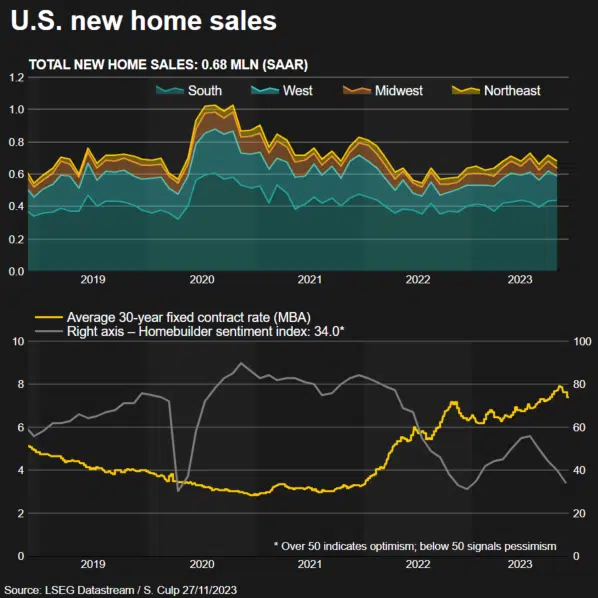

The Commerce Department’s report on Monday revealed a decrease in sales that coincided with a recent decline in homebuilder sentiment. This decline was influenced by the rise in the 30-year fixed mortgage rate, nearing 8%. As a result, builders are expecting a decrease in buyer traffic. Mortgage rates have recently decreased from their highest levels in two decades and are currently at levels last observed in late September. This could create an opportunity for an increase in sales.

In the words of Daniel Vielhaber, an economist at Nationwide in Ohio, the existing home inventory is at an all-time low, contributing to the robust stability of the new homes market compared to historical standards.

Significant Decline in New Home Sales

In response to the Census Bureau of the Commerce Department, a 5.6% decrease in new home sales resulted in a seasonally adjusted annual rate of 679,000 units in the previous month. The sales pace for September underwent a downward revision, with a decrease from the initially reported 759,000 units to 719,000 units.

Based on a survey conducted by Reuters, economists had predicted that new home sales, representing 15.2% of total home sales in the United States, would decline to a rate of 723,000 units. The percentage is the greatest in a minimum of ten years.

Sales of newly constructed residential properties are recorded upon formalizing a contractual agreement, rendering them a prominent gauge of the real estate market. Nevertheless, the volatility of such matters can fluctuate from one month to another. In October, there was a 17.7% growth in sales compared to last year.

Sales in the Northeast and heavily populated South experienced an increase every month. However, there were declines in the Midwest, known for its affordability, and in the West, where housing prices tend to be higher.

According to the National Association of Realtors, the inventory of pre-owned homes available for sale is currently approximately 50% lower than before the pandemic. In their recent report, the association stated that home resales in October experienced a significant decline, reaching a low not seen in over 13 years.

Most homeowners possess mortgage rates below 3%, resulting in a hesitancy to sell and consequently increasing the demand for new construction.

Stock market performance on Wall Street exhibited a combination of gains and losses. The dollar’s value remained unchanged in a collection of various currencies. U.S. Treasury prices experienced an increase.

Sales Are Restoring

Based on data from lending agency Freddie Mac, the average rate on the 30-year fixed-rate mortgage increased to 7.79% in late October. This marks the highest level observed since November 2000. Mortgage rates experienced a significant increase due to the Federal Reserve’s proactive measures in raising interest rates to combat inflation.

In recent weeks, there has been a decline in the 30-year fixed-rate mortgage. Last week, it averaged 7.29%, which is still relatively high. This decline can be attributed to the decrease in the 10-year Treasury yield. The market has shown optimism regarding the U.S. central bank’s decision to halt interest rate hikes and implement a more accommodating monetary policy by mid-2024.

Veronica Clark, an economist at Citigroup in New York, mentioned that a potential increase in new home sales could be observed in November or December. This is because mortgage rates are expected to decline once again. Recent home sales serve as a more immediate measure of housing demand.

In October, the median price of a new house was recorded at $409,300, reflecting a decline of 17.6% compared to the corresponding period in the previous year. The documented decline in percentage was the most significant observed since the initiation of record tracking by the government in 1964. This decline can likely be attributed to various incentives builders provide, such as price reductions, to attract potential buyers.

According to a recent National Association of Homebuilders statement, over 33% of builders reported that home prices were reduced in November. The practice of lowering prices has become commonplace in the current year.

Economists advised against placing excessive significance on the price decline, highlighting that alternative indicators, such as the Federal Housing Finance Agency’s house price index, indicated robust price expansion.

According to Daniel Silver, an economist at JPMorgan in New York, the purchasing activity of potential homebuyers is impacted by the elevated prices. While acknowledging the decline in the median sale price as reported in the new home sales data, it is essential to note that this particular metric may only provide a partially accurate representation of house prices due to its inability to account for variations in the sales composition.

Properties within the price range of $150,000 to $499,999 constituted a significant portion of the transactions that took place in the previous month. After October, the market witnessed an increase in newly available homes, with a total of 439,000 units, compared to last month’s figure of 433,000.

The majority of the inventory consisted of houses that were in the process of being built. Based on the current sales rate, it would require approximately 7.8 months to deplete the existing inventory of available houses, representing a slight increase from the 7.2 months recorded in September.

On Monday, it was also reported by the government that there was an increase in permits for upcoming home construction in October, which was higher than previous estimates. The growth rate was 1.8%, resulting in a total of 1.498 million units. According to recent reports, there has been a 1.1% increase in building permits, resulting in a rate of 1.487 million units.

Residential investment experienced a significant recovery in the third quarter, following a prolonged period of contraction, due to the high demand for new construction.

Given the ongoing limitation of mortgage rates, confident economists expressed skepticism regarding the sustained growth of residential investment during the fourth quarter. This further contributes to anticipating a significant deceleration in the overall economy. Estimations for the fourth quarter growth indicate that the annualized rate is predominantly below 2%. The economic growth rate for the July-September quarter was recorded at 4.9%.

“The potential upside to the forecast lies if builders effectively entice prospective homebuyers with incentives,” stated Bernard Yaros, the primary U.S. economist at Oxford Economics.