In the realm of financial markets, it has been humorously remarked by the esteemed economist Paul Samuelson that the predictions of recessions have occasionally exceeded the actual occurrences, with a ratio of nine anticipated downturns for every five that materialize. Today, an accusation has been made against them for perpetuating a recurring pattern of raising false alarms. In 2022, a prevailing sense of pessimism permeated trading floors globally as asset prices experienced a significant decline, eliciting vocal responses from consumers and raising concerns about the likelihood of recessions. However, Germany is the sole prominent economy to have encountered such an occurrence, albeit relatively subdued. In many nations, contemplating a “soft landing” becomes more feasible, wherein monetary authorities triumph in curbing inflation without impeding economic expansion. The markets have been immersed in a prolonged celebratory ambiance by prevailing trends. During the reduced activity in the summer, an opportunity arises to contemplate the progress made thus far in the year. Herein lie a few insights that investors have acquired.

The Fed Was Very Serious…

Interest-rate expectations at the year’s onset were situated in an unconventional position. Over the preceding nine months, the Federal Reserve had diligently implemented measures to enhance its monetary policy’s efficiency, mirroring the expeditious approach observed during the 1980s. However, investors’ conviction in the central bank’s hawkishness continued to elude them persistently. At the onset of 2023, market indicators suggested that rates would reach their highest point below 5% during the initial six months of the year, after which the Federal Reserve would initiate a reduction. According to the central bank’s officials, interest rates were anticipated to surpass 5% by the end of the year, with no reductions expected until 2024.

The relevant authorities eventually achieved the prevailing outcome. Through the persistent elevation of rates amidst a minor banking crisis (as detailed below), the Federal Reserve ultimately instilled a sense of earnestness among investors regarding their commitment to mitigating inflation. The current market anticipates that the Federal Reserve’s benchmark rate will reach 5.4% by the end of the year, slightly lower than the central bankers’ median projection. The mentioned outcome represents a significant achievement for a central bank that had previously experienced a less proactive response to inflationary pressures, negatively impacting its reputation.

…But the Majority of Borrowers Can Ride Out the Storm

In the era of affordable capital, the notion of significantly elevated lending expenses occasionally resembled a mythical creature, both fearsome and difficult to fathom. The arrival of the snowman has thus resulted in a dual element of astonishment. The manifestation of elevated interest rates has been undeniably tangible yet lacking in intimidation.

Since the commencement of 2022, the mean interest rate on a composite of the most precarious (or “junk”) liabilities possessed by American enterprises has experienced an increase from 4.4% to 8.1%. A limited number of individuals, however, have experienced financial challenges. The default rate for high-yield borrowers has experienced an upward trajectory within the preceding 12-month period, albeit at a modest level of approximately 3%. The observed value is significantly below historical benchmarks during periods of heightened tension. Following the global financial crisis from 2007-09, it is worth noting that the default rate experienced a significant increase, surpassing the threshold of 14%.

The potential for further adverse outcomes remains. Numerous enterprises continue to deplete their cash reserves accumulated amidst the pandemic while depending on highly affordable debt secured before the commencement of interest rate escalation. However, a glimmer of optimism can be discerned. Interest-coverage ratios for borrowers with lower credit ratings, which assess the relationship between earnings and interest expenses, are currently at their most robust point in the past two decades. The upward trajectory of rates may pose challenges for borrowers, yet it has yet to reach a difficult juncture.

Not All Bank Failures Result in a Return to 2008

During the tumultuous weeks that ensued after the collapse of a particular financial institution known as Silicon Valley Bank, an American lender of moderate stature, on the fateful day of March 10th, a sense of distressing familiarity began to permeate the unfolding circumstances. Following the collapse, there were subsequent runs on additional regional banks, including Signature Bank and First Republic Bank, which also experienced significant strain. These events appeared to be accompanied by a sense of global contagion. In a recent development, a well-established Swiss investment bank, Credit Suisse, was compelled to enter a hasty union with its longstanding competitor, UBS. At a particular juncture, there appeared to be a precarious situation surrounding Deutsche Bank, a financial institution hailing from Germany.

Fortunately, a comprehensive financial crisis was successfully avoided. Since First Republic’s failure on May 1st, there has been a need for subsequent bank failures. The impact was swiftly disregarded by the stock markets, with the KBW index of American banking shares remaining approximately 20% lower since the commencement of March. Contrary to initial concerns, the anticipated persistence of a credit crunch has yet to materialize.

However, this favorable result did not come without expenses. The bank failures in America were addressed through a comprehensive and innovative bailout initiative implemented by the Federal Reserve. An implication arises wherein lenders of moderate size are now regarded as significant systemic importance, thus falling under the “too big to fail.” This may incentivize banks to engage in imprudent risk-taking, operating under the presumption that the central bank will provide remedial measures in the event of failure. The occurrence of the Credit Suisse takeover, in which UBS shareholders were excluded from voting, circumvented a meticulously formulated “resolution” plan that outlines the regulatory protocols for addressing a distressed financial institution. Such rules are fervently endorsed by officials during periods of tranquility, only to be disputed when confronted with a crisis. The enduring challenge in finance still needs a universally embraced resolution.

A Reversed Yield Curve Doesn’t Mean the End of the World Right Away

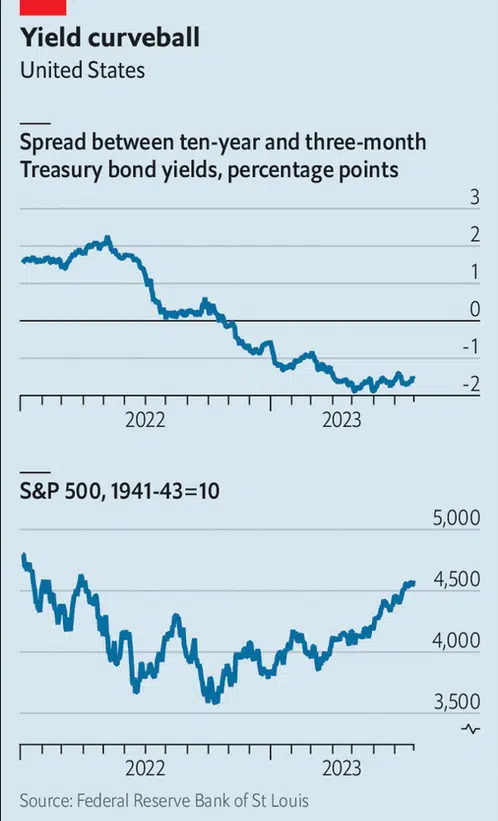

The current upswing in the stock market has led bond investors to anticipate an impending recession, despite its absence thus far. Yields on long-dated bonds are generally observed to surpass those on short-dated bonds, thereby providing longer-term lenders with appropriate compensation for the heightened risks associated with their investments. However, starting last October, an inversion in the yield curve has been observed, with short-term rates surpassing long-term rates (refer to the chart).

The indicated phenomenon serves as a highly reliable indicator within financial markets, suggesting the imminent arrival of an economic downturn. The thought process can be summarised as follows. If short-term rates exhibit an upward trajectory, it is plausible to infer that the Federal Reserve has implemented measures to constrict monetary policy to moderate economic growth and mitigate inflationary pressures. If long-term rates exhibit a downward trend, the Federal Reserve will likely achieve its objectives over time, leading to a potential economic downturn necessitating future interest rate reductions.

The observed occurrence of this inversion, as quantified by the disparity between ten-year and three-month Treasury yields, has been recorded on a mere eight occasions within the last half-century. An economic downturn succeeded in every instance. Indeed, during the onset of the recent inversion in October, the S&P 500 experienced a fresh nadir within the annual timeframe.

Since then, however, the economic landscape and the stock market have exhibited remarkable resilience, surpassing conventional expectations. The current circumstances do not warrant a moment of relaxation, as further disruptions remain possible before the desired decline in inflation, prompting the Federal Reserve to initiate rate reductions. However, it is increasingly likely that an ostensibly infallible indicator has experienced a malfunction. In a year characterized by unexpected occurrences, that particular event would undoubtedly stand out as the most remarkable.