The most recent data indicates that the European Union has recently witnessed an unprecedented surge in business insolvencies.

Eurostat Provides Disappointing Data

As per the authoritative statistical agency Eurostat of the bloc, it has been observed that during the second quarter of 2023, a notable surge of 8.4% in the count of businesses succumbing to bankruptcy compared with the preceding quarter. This upward trend can be primarily attributed to the prevailing challenges encountered within the food and housing sector.

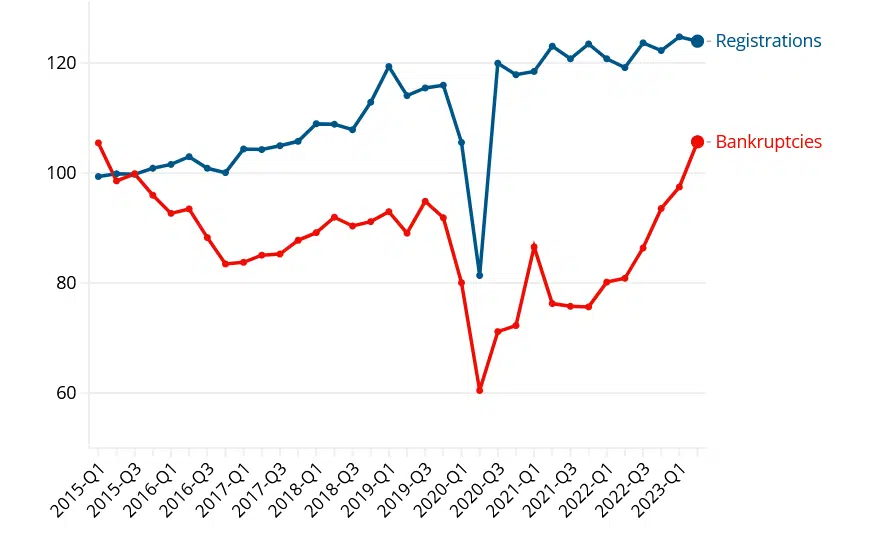

The statistical data reveals a disturbing trend, as bankruptcies have witnessed a persistent surge for an unprecedented sixth consecutive quarter. This alarming development, hitherto unseen since the inception of Eurostat’s data collection in 2015, underscores the gravity of the prevailing economic landscape.

During the fourth quarter of 2022, there was a notable increase in insolvency claims, reaching their peak. This surge can be attributed to the gradual reduction of state support initially provided in response to the COVID-19 pandemic.

The 8 Billion Euro Bailout Did Not Produce the Desired Results

In April 2020, the European Commission made a significant announcement about allocating over €8 billion in financing. This crucial initiative was designed to extend prompt relief to small and medium enterprises throughout the European Union.

In examining the aftermath of the aid packages and subsequent schemes implemented to mitigate the impact of severe financial crashes, it becomes evident that their efficacy in the post-restriction period has been less than encouraging.

Recently, there has been a persistent upward trajectory in businesses seeking legal protection through bankruptcy filings. This trend has been observed since the onset of the second quarter of 2022. Concurrently, the burden of national debts has also experienced a notable escalation, further compounding the economic challenges various nations face.

Number of new business entries and bankruptcies in the EU every three months (2015 = 100)

In a striking turn of events, it has come to light that the number of new business registrations within the European Union in 2023 has reached unprecedented heights, surpassing the records set in the preceding eight years. This notable surge in entrepreneurial activity signifies a significant shift in the economic landscape, heralding a period of heightened innovation and enterprise within the region.

In the wake of the global pandemic, the food and accommodation sector grapples with significant challenges and obstacles. The far-reaching impact of the crisis has left this industry in a state of profound struggle as it grapples with the aftermath and attempts to navigate an uncertain future.

Which Sector Has Faced the Greatest Challenges?

Across a broad spectrum of industries, a troubling surge in insolvency has been observed, leaving no sector untouched by its pervasive impact. However, with a heavy heart, we must acknowledge the profound struggles faced by the food and accommodation sector as it grapples with the most formidable challenges of all.

The sector encompassing accommodation and food services experienced a notable surge of 23.9% in the number of enterprises succumbing to bankruptcy. This decline can predominantly be ascribed to the formidable obstacles posed by the prevailing cost of living crisis.

The observed increase amounts to a staggering surge of 82.5% when juxtaposed with the preceding quarter before the implementation of pandemic-related limitations.

A worrying trend in the transportation and storage industry has emerged, notable for a significant increase in failing businesses. This disheartening phenomenon can be directly attributed to the escalating energy costs, which have profoundly impacted the industry at large.