The euro area’s economy experienced a resurgence in growth, with persistent underlying inflation pressures observed. This development supports the initial propositions advocating for the European Central Bank to consider another increase in interest rates.

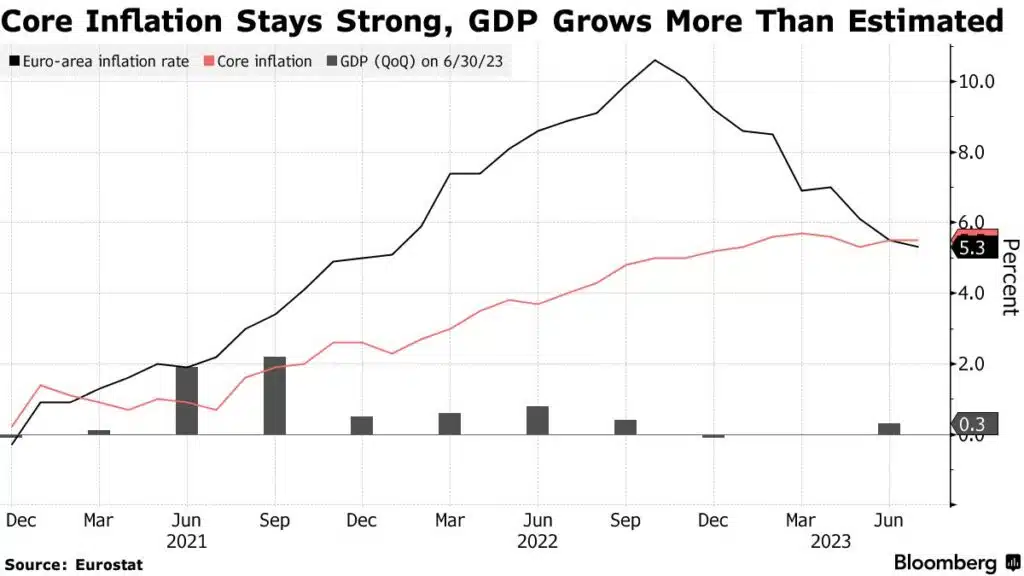

The second-quarter gross domestic product experienced modest growth of 0.3% compared to the preceding three months, following a period of contraction and lack of progress in the two preceding quarters, as per the Eurostat data released on Monday. According to a recent survey conducted by Bloomberg, economists observed a rise of 0.2%.

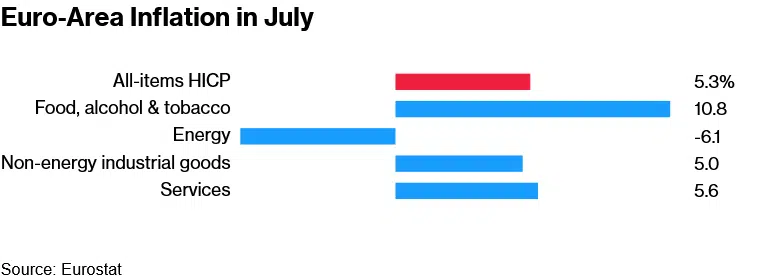

A separate report indicated that consumer prices experienced a 5.3% increase compared to the corresponding period last year, aligning with anticipated projections. However, indicative of persistent risks, the closely monitored core inflation metric, which omits unstable expenditures such as food and energy, slightly exceeded projections to remain at 5.5%, surpassing the overall indicator for the initial instance since 2021.

German bonds experienced a sustained decline after the release of the data, resulting in a persistent elevation of the yield on two-year debt, which is exceptionally responsive to fluctuations in monetary policy. The profit rose by two basis points, reaching a level of 3.07%. Money markets upheld the probability of a quarter-point rate increase by year-end at approximately 70%.

The euro zone’s GDP figure appears promising, primarily driven by a notable performance from Ireland, which experienced a growth rate of 3.3%. The country accounted for a modest share of the bloc’s total output in the previous year, representing less than 4%. Additionally, its contribution to second-quarter growth was approximately 0.1 percentage points.

Looking ahead, the has been cautioned by the ECB that the region’s outlook is considerably sad, following the recent increase in rates for the ninth time since July 2022. The flashing red confidence indicators have caught the attention of analysts, including AXA’s Gilles Moec, who cautions about a potential “hard-ish landing.”

In the wake of a manufacturing downturn that commenced a year ago, there is now a deceleration in the services sector. This pattern is expected to intensify as the summer tourism season concludes. The rate at which companies are seeking loans is experiencing an unprecedented decline. Signs of weakness are also observed in the housing and business investment sectors.

Germany, a notable European nation, is facing considerable challenges in the current economic landscape. During the recent economic downturn, a period of recovery lasting approximately six months was observed at the national level. Nevertheless, there was a lack of growth in economic productivity during the second quarter.

In the previous week, Bayer AG, alongside other prominent chemicals companies like BASF SE and Lanxess AG, voiced apprehensions regarding a diminishing outlook. Similarly, Hamburger Hafen revised its forecast due to a significant decline in volume.

At the current deposit rate of 3.75%, it can be inferred that the ECB is approaching the culmination of its rate escalation endeavors. The message of President Christine Lagarde was reiterated over the weekend, emphasizing that within the existing uncertain environment, the following policy decision in September could entail either a hike or a potential pause.

According to economists, the upcoming meeting is anticipated to be a closely contested decision, with a majority leaning towards a singular conclusive action. The figures presented on Monday could have provided a definitive answer, leaving room for further analysis as additional data reports are expected in the interim.

On Monday, Italy witnessed a decline in its GDP from April to June, accompanied by a weakening of domestic demand. On Friday, France and Spain experienced notable growth, bringing positive developments.