The temporary cessation of the bond market on Monday provided a much-needed respite for numerous investors grappling with an exceptionally arduous fixed-income phase.

By various metrics, the recent developments in the bond market have yielded outcomes deemed the most unfavorable in the annals of investor history.

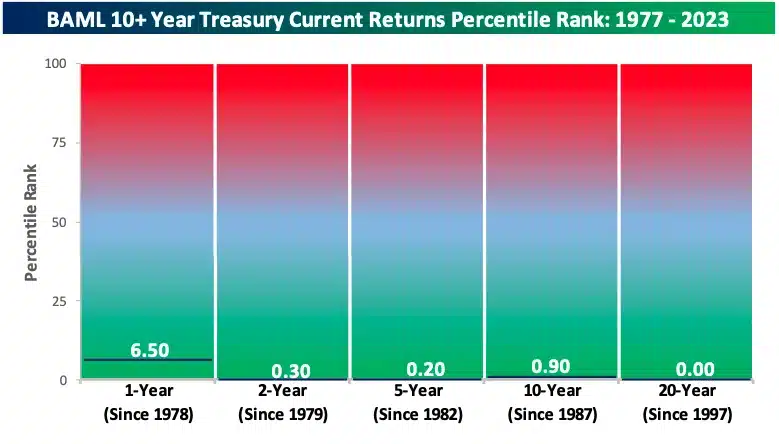

The recent data publication by Bespoke Investment Group has shed light on a disturbing trend in the financial realm. According to their findings, the annualized returns of long-dated Treasury notes and bonds, measured by the BofA Merrill Lynch 10+ Year US Treasury Index, have reached an unprecedented low over the past two decades. This revelation is a stark reminder of the challenging and unfavorable conditions plaguing this particular sector.

Furthermore, the returns observed over fewer years for these financial instruments have exhibited a lackluster performance, failing to demonstrate significant improvement.

Throughout the past two–, five, and ten-year rolling periods, it has been observed that the returns on long-dated Treasuries have consistently outperformed the vast majority, surpassing the 99th percentile threshold. The historical returns of this index have exhibited a noteworthy trend over the past year, with all recorded returns exceeding the initial percentile threshold.

Treasury Bond Yields Have Declined Markedly

Based on the comprehensive data provided by Bespoke, it is evident that investors in long-dated Treasuries have experienced a notable downturn in their annualized total returns across various timeframes. Specifically, the negative trend is observed over the last 1-year, 2-year, and 5-year periods. This signifies a challenging landscape for those who have invested in such assets, as the returns have not been favorable during these durations.

Over the past two years, individuals who have invested in long-dated Treasury bills have unfortunately encountered annualized losses of a significant 17.6%. Over the past decade, the returns have exhibited marginal positivity, amounting to a mere 0.8% annually.

Throughout the past four and a half decades, it is worth noting that long-dated Treasuries have exhibited a consistent performance pattern. Specifically, when examining the mean yearly return over various rolling timeframes such as 1, 2, 5, 10, and 20 years, it becomes evident that these Treasuries have consistently yielded returns surpassing the 8% threshold.

To put it briefly, the market’s historical trajectory unequivocally substantiates the notion that the probability of incurring substantial financial losses while wagering on bonds is exceedingly low.

Throughout the past few weeks, the attribution of the stock market’s sell-off has been predominantly ascribed to the mounting pressure experienced within the bond market.

Strategists have encountered significant challenges in the ongoing quest to identify a singular catalyst behind the surge in yields. However, it is crucial to acknowledge that the symptoms hold greater significance than the underlying ailment.

In recent times, investors who have perceived that bonds offer a relatively secure investment due to their fixed-income nature have witnessed the erosion of this perspective. How investors endeavor to reassemble these fragmented components will undoubtedly exert a substantial influence on the behavioral patterns exhibited by financial markets during the concluding trimester of the calendar year.