According to the most recent data from Glassnode, Bitcoin miners have facilitated the entry of a record-breaking $128 million into various crypto exchanges. The context of this issue is crucial in the study of cryptography. Your stated amount is 315 percent of their daily revenue, which is a very concerning indicator.

This means there will soon be a lot of selling pressure, which is expected to lessen as miners make up for their losses during the current “crypto winter.” During the above cycle, Core Scientific became a significant player in the United States when mining Bitcoin. The prestigious corporation was worth an astounding $4 billion when it first went public in July 2021 under the CORZ ticker.

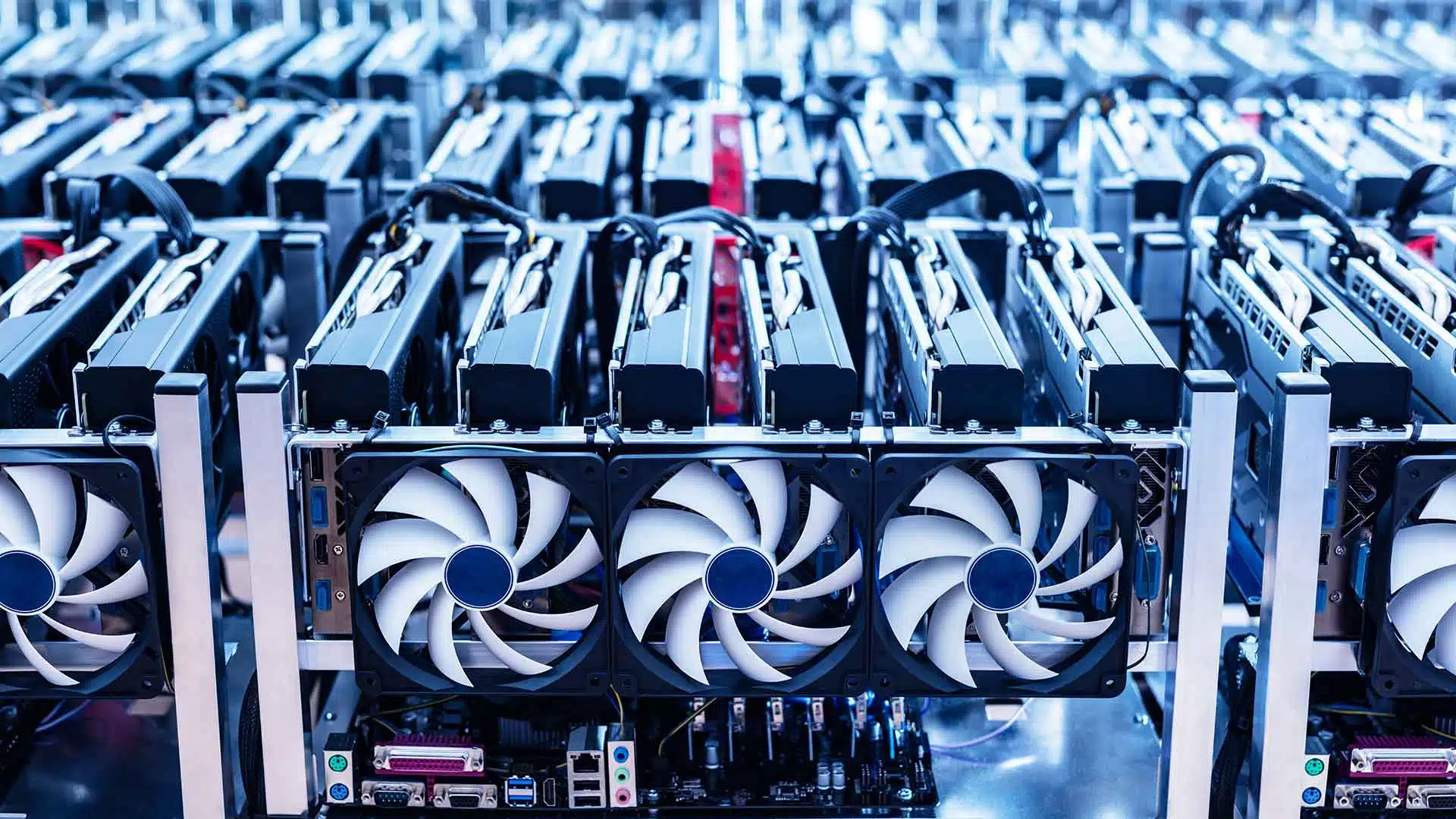

Bitcoin mining cycles follow bull and downturn markets. Photo: glassnode

Because of the FTX incident and the broader decline of the cryptocurrency market in December, CORZ filed for bankruptcy. Intelligent investors may consider Bitcoin mining operations to obtain indirect exposure to the cryptocurrency in light of the recent shift in sentiment toward greed after BlackRock filed for an ETF.

We must consider the Bitcoin halving, scheduled for April 2024, in addition to the shifting landscape, which has caused $199 million to pour into digital asset funds. Bitcoin (BTC) inflation is significantly restrained by the halving scheme, reducing Bitcoin rewards from 6.25 to 3.125 Bitcoin every four years. Therefore, this tactical adjustment makes each BTC unit worth more in the cryptocurrency market.

Riot Platforms (Riot) Has Seen a Year-To-Date Increase of 228%

Established in the beautiful state of Colorado as Riot Blockchain at the beginning of 2023, the company has since rebranded itself as Riot Platforms. Since the beginning of April, the prestigious group has displayed unprecedented optimism. They announced they had purchased 42,000 S19j Antiminer equipment from the prominent Chinese firm Bitmain. The deal’s price tag of $138.5 million was surprising.

The hash rate of Riot will increase by a staggering 93% after the other miner fleet is added. With this increase, the total hash rate can reach an impressive 7.7 EH/s, a rise of 3.7 EH/s from before. This week, Riot Platforms has made another significant change besides the abovementioned acquisition. Many mining rigs, namely 33,280 M56S+ and M56S models, have been produced by a prominent Chinese firm, MicroBT.

A key actor in the crypto sphere, MicroBT, has organized itself in a way that makes production possible in the United States. MicroBT’s willingness to spend $162.9 million on this initiative demonstrates its dedication to expanding and improving the cryptocurrency market. They want to begin unveiling their web presence before the year’s end. By 2024, Riot Platforms hopes to have a hash rate of 20.1 EH/s, which is an enormous amount.

With a fleet of 94,176 active miners, Riot’s mining capabilities would rise. By the end of May, they had reached 10.5 exahashes per second (EH/s). The stock price of RIOT has increased by a staggering 228% this year alone.

Marathon Digital Holdings (Mara) Has Seen Year-To-Date Growth of 281%

The well-known Las Vegas firm Marathon Digital has developed an intelligent strategy for expanding its hash rate capacity. Skilled engineers at Marathon increased the output of their cutting-edge S19j Pro and S19 XP rigs by a staggering 20% in December. In addition to this remarkable success, the rigs’ energy consumption decreased by almost 4 percent, which is also noteworthy.

The company has also demonstrated new technical developments in dual-phase immersion. This innovative cooling technique evaporates gas to remove heat from the equipment and then condenses the gas into a liquid for further cooling. Marathon estimates that this new method will reduce operating expenses by around 10% compared to using air for cooling.

As hashing technology improves, Marathon mined a record number of Bitcoin (BTC) in May. They increased their Bitcoin mining output by 77% compared to the previous year. The 366 percent increase is dramatic compared to the same month in 2022. The well-known organization saw a significant increase in its operating hash rate during the month, reaching 15.2 exahashes per second (EH/s). Concurrently, the installed hash rate increased to a respectable 20.1 EH/s.

More upgrades and the activation of the Applied Digital plant in Ellendale put Marathon on track to meet its audacious goal of 23 EH/s by the end of the year. The reputable organization announced in May that it held 12,259 BTC, or approximately $333.7 million. It also had $97.3 million in readily available cash and financial equivalents. The MARA stock has soared by 281% this year, making it the most valuable miner, according to astute investors.

The Year-To-Date Growth for Hut 8 Mining (Hut) Is 260%

In February, Hut 8 Mining, a well-known Canadian cryptocurrency company, made an intelligent move by telling the public about its plans to join U.S. Bitcoin Corp (USBTC), an American company with which it competes. The two miners will have a combined computing power of 7.5 exahashes per second (EH/s), according to the most current report to the Securities and Exchange Commission (SEC).

The soon-to-be-signed merger deal will create Hut 8 Corp., the illustrious eighth behemoth in autonomous mining, with a market capitalization of $990 million. Hut 8 has also gotten a significant loan of $50 million from Coinbase Credit, a well-known player in the digital currency world.

Coinbase’s (COIN) price went up by about 14% over the week, showing that the company is vital in the face of a legal dispute with the Securities and Exchange Commission (SEC). Jaime Leverton, the CEO of Hut 8, spoke effectively about the loan to improve our financial flexibility and strengthen our dynamic Bitcoin treasury management strategy as the halving event approaches.

Like many other Bitcoin mining businesses, Hut 8 had a wrong end to the year 2022. It made a lot of money, bringing in CAD$150.7 million, but it also lost a considerable amount of money, $248.8 million. In light of the merger deal, it is essential to note that the pricing dynamics have caused HUT stock to rise by 260% so far this year.