CME Group (CME), which is now in the lead, Meta Platforms (META), and Arista Networks (ANET), both of which have also gained attention, are some of the stocks that are worth keeping an eye on this week.

CME stock exhibited a breakout pattern on Friday following a successful rebound from crucial technical support levels. Arista jumped out to an early lead in the competition. Facebook and Instagram are both owned by Meta, which has been granted permission to enter various new markets.

The stocks mentioned above, except CME, are all included on the IBD 50 list, which comprises a number of notable growth stocks. The IBD Leaderboard features both Meta and ANET stocks among its participants.

The Importance of Relative Strength Cannot Be Overstated

Currently, the strength-to-weight lines for all entities are at 52-week highs, indicating that the entities are performing exceptionally well compared to the S&P 500. The rate of change (RS) line is represented by the line that is colored blue in the charts that have been provided.

The vast majority of these well-known stocks are highlighted on the MarketSmith RS Line Blue Dot screen, a compilation of stocks either going through consolidation patterns or having breakouts, accompanied by relative strength (RS) lines achieving new highs. This screen focuses on equities that have reached new highs in their RS lines. A particularly bullish disposition is displayed in the attribute above, which can be described as having already been mentioned. On the charts provided by MarketSmith, stocks that correspond to the requirements that have been outlined will have a blue dot placed at the point where their Relative Strength (RS) lines end. This visual indicator will be displayed on the charts.

It is recommended that investors make a concerted effort to look for equities showing signals of relative strength, which can be interpreted as a rebound or recovery from essential milestones.

The stock market has been exhibiting signs of difficulty for quite some time, but the fact that trade activity took a turn for the better on Friday is being taken as a positive omen.

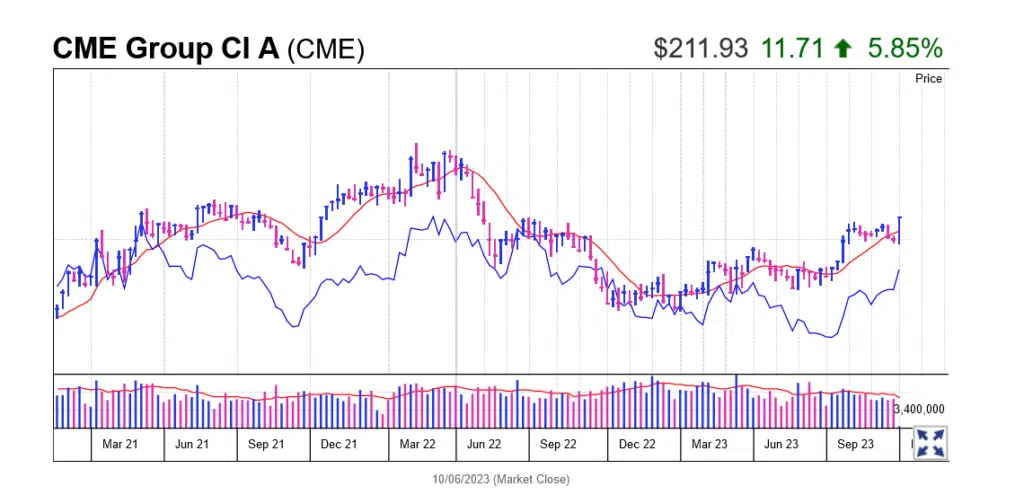

CME Stock

The value of a share of stock in a corporation that runs a futures market increased by 2.2% on Friday, reaching 211.93 dollars in the process. Because of this increase, the store could break through the intraday buy target 209.31. During the past week, the price of CME stock showed a significant growth of 5.85 percent. Not only did the stock above have consistent increases in trading volume, but it also successfully recaptured the 50-day and 10-week moving averages.

CME Group recently stated that September had the second-largest aggregate daily quantity (ADV) in the market’s history, with 22.7 million options being traded. The company reached an average daily volume (ADV) for the third quarter of 22.3 million contracts, which is the second-highest recorded volume for the company’s third quarter in its entire existence.

When evaluated using important IBD ratings, CME stock demonstrates a strong performance, which is positive. The IBD Composite Rating for the company currently stands at 92, which indicates excellent performance. In addition, it has an EPS Rating of 87 and an RS Rating of 90, both noteworthy numbers out of a maximum of 99, indicating that it is an excellent product.

The 90 Comparative Strength Rating demonstrates that CME shares have outperformed 90% of the companies held in IBD’s portfolio over the past year. This is evidenced by the fact that the rating was set at 90.

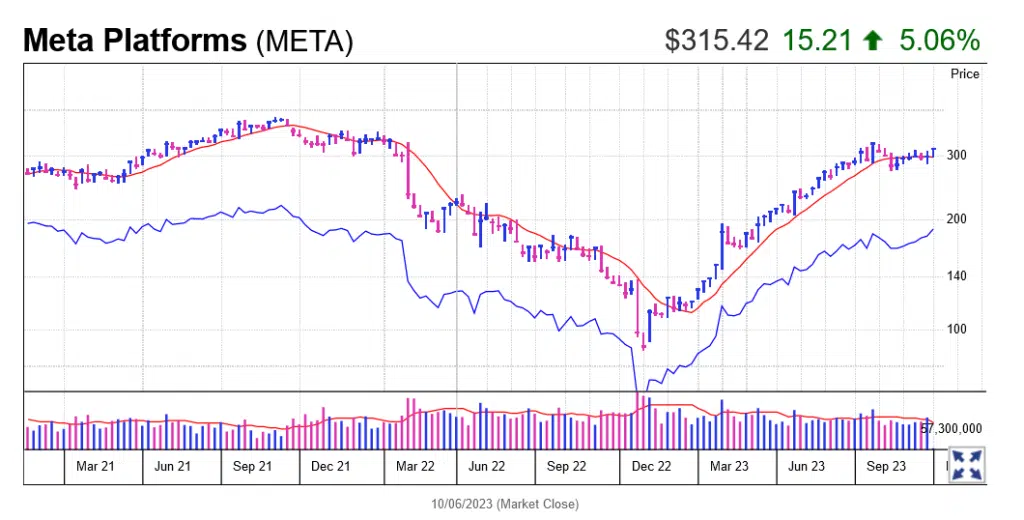

Meta Stock

On Friday, the value of a share of the business that controls Facebook and Instagram reached a new high of 315.43, following a gain of 3.5% in that share’s price. This results in a rise of 5.1% compared to the previous week’s total. The stock in question, Meta stock, has seen significant signs of recovery after rebounding from both its 50-day and 10-week lines. It is essential to highlight that the store has remained within a trading range reasonably constrained throughout the past few weeks.

According to the chart provided by MarketSmith, the share price pushed above a trim resistance level located on the cup base late last week on Friday afternoon, creating a favorable buying opportunity. Additionally, the cost of Meta stock surpassed its previous high of 312.87, which was established in the middle of September.

A time of fall in Facebook’s sales was proven by a comeback in earnings per share during the second quarter, which was indicated by recent earnings reports, which imply a resurgence in sales following the period of drop.

The strategic steps made by Mark Zuckerberg, the CEO of Meta, to streamline the organization have been met with acceptance from investors, and as a result, the firm has witnessed a resurgence in growth. These strategies involve significant personnel layoffs. The relatively recent uptick in advertising activity has substantially affected the rise in total revenue.

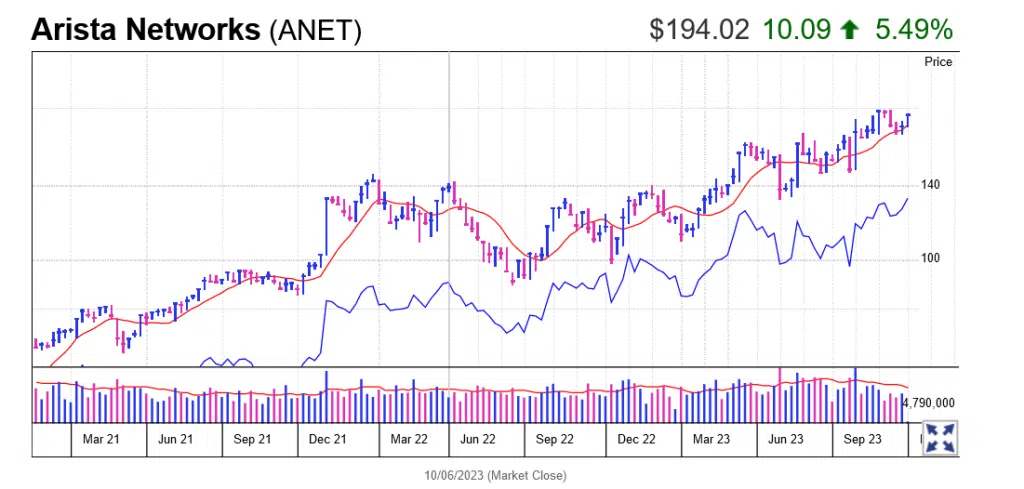

Arista Stock

The share price of the technology networking corporation increased by 3.2% week over week, reaching $194.02 towards the end of the trading week. Continuing this rising trend led to a gain of 5.5% for the week. The stock price of Arista witnessed a significant recovery, as seen by a comeback from both the 50-day and 10-week lines on the firm’s chart.

The stock of Arista now has a purchase point set at 198.70, which was determined from a flat base that was only recently constructed. The utilization of the high value of 189.90 on October 2 may have been an initial point of entry for prospective investors in the well-known networking corporation.

The relative strength (RS) line for ANET stock is currently trading at levels that are at an all-time high.

Arista is a market-leading provider of network routers for use in data centers. The company optimizes and increases communication within very packed server racks housed in “hyperscale” facilities. Meta constitutes the most notable member of the company’s clients.

The stock of ANET exemplifies a chance to make a strategic investment in artificial intelligence (AI), which significant technology conglomerates are pursuing. Given the growing interest in “generative” artificial intelligence, it is essential to acknowledge the requirement for increased power consumption and connectivity within Internet data centers.

The possibility for a recovery in sales growth in 2025, notably driven by orders for AI-powered equipment, is one of the most important factors investors in this well-known technology stock need to consider.

The growth rate has displayed signs of regression in the preceding quarters; nonetheless, it remained robust during the second quarter, as evidenced by a noteworthy 46% increase in earnings per share and a considerable 39% gain in revenue.

The current rating for shares of Arista Corporation is 98 on the Composite scale, with an EPS Rating of 98 and an RS Rating of 96.