The United Kingdom government experienced a significant rise in borrowing during the initial eight-month period of the financial year. The increased government spending intended to address the population’s economic problems was primarily responsible for this increase.

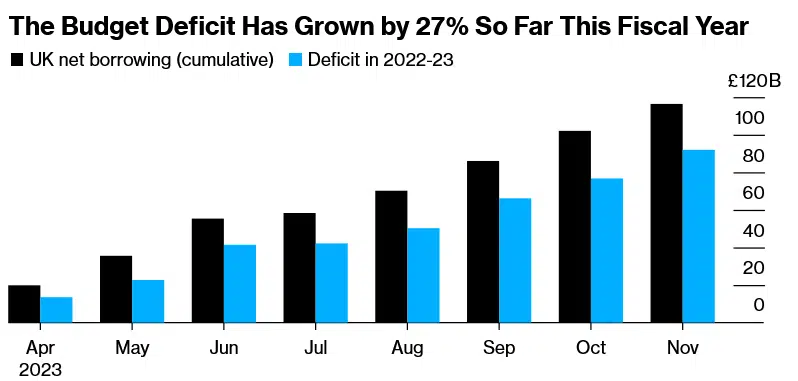

According to the Office for National Statistics, the budget shortfall between April and November has increased to £116.4 billion ($147 billion), representing a 27% rise compared to last year. In November, there was a deficit of £14.3 billion, surpassing the economists’ projected shortfall of £13 billion.

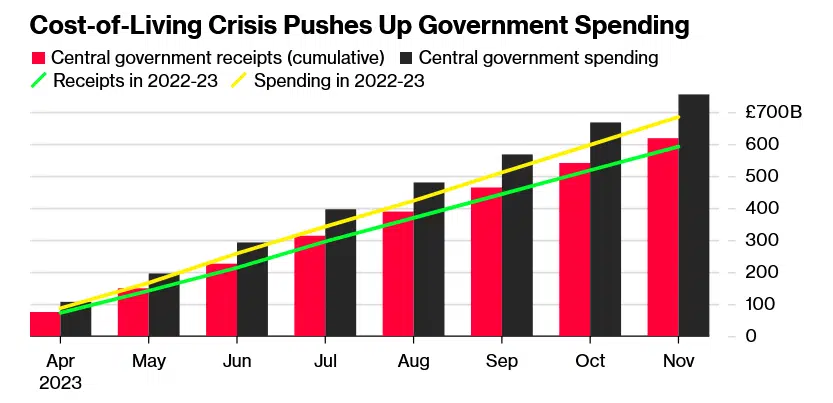

The year-to-date increase can be attributed to the allocation of funds aimed at providing compensation to British citizens in response to the significant rise in inflation, which is currently at its highest level in several decades. According to the Office for National Statistics (ONS), there was a 12% increase in welfare costs compared to the previous year. This increase occurred after a 10% raise in benefits that took effect in April. Additionally, the ONS reported a 12% rise in public-sector staff costs.

According to the Office for National Statistics (ONS), there have been significant rises in benefit payments in the past few months. These increases can be attributed mainly to adjusting benefits in line with inflation and providing cost-of-living payments.

The reported increases were partially counteracted by a 15% decrease in debt-interest payments. This reduction can be attributed to a decline in the inflation rate used to calculate transactions on index-linked obligations. In November, debt costs reached a significant milestone of £7.7 billion, marking the highest total for that month since records were first kept in 1997.

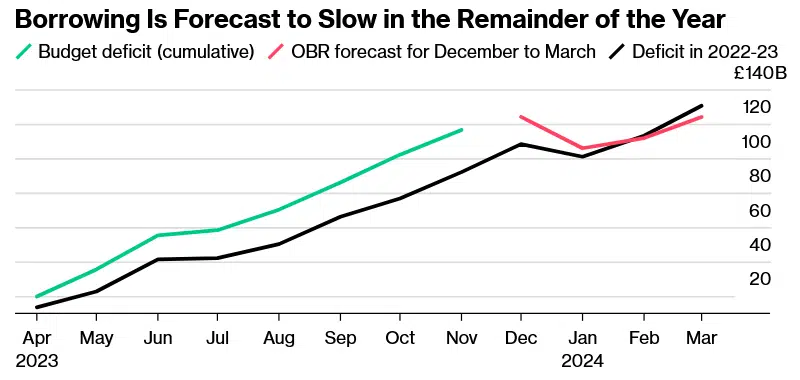

Notwithstanding the increasing expenditure, the Office of the Controller for Budget Responsibility anticipates that the overall borrowing for the fiscal year 2023-24 will amount to £124 billion, slightly lower than the £130.5 billion reported in the previous year.

The observed progress can be attributed to the government’s substantial investment last winter to mitigate the escalating energy expenses through subsidies.

In the words of Laura Trott, the assistant secretary to the Treasury, it was deemed necessary to allocate significant funds to safeguard individuals during the global epidemic and the subsequent energy crisis caused by Putin’s incursion into Ukraine.

However, we mustn’t burden future generations with the financial repercussions of these actions. The Prime Minister has greatly emphasized debt reduction, making it a key priority.

The government has observed a significant increase in tax revenue over the past eight months, amounting to £26.3 billion. This represents a 4.5% growth compared to the previous year. The rise in inflation has contributed to an 8% increase in VAT revenue, while income tax has seen a notable 9.6% increase.

The increase in corporation tax receipts by 10.4% can be attributed to the rise in the tax rate from 19% to 25% starting in April. Expenditure, which includes net investment, experienced a significant increase of £70.8 billion, representing a growth rate of 10%.

Additional borrowing of £3.8 billion was incurred during the initial seven-month financial year period, primarily due to increased expenditure.

The government is currently facing pressure to reduce taxes due to the projected increase in the tax burden, which is expected to reach levels not seen since the end of World War II. The stagnant income-tax thresholds, pushing many British citizens into higher tax brackets, are the leading cause of this increase.

In response to the Office for National Statistics (ONS), the current level of government debt stands at 97.5% of the Gross Domestic Product (GDP), which is nearly equivalent to the value of the economy. This represents the highest level of debt since the 1960s. According to the Office for Budget Responsibility (OBR), Chancellor Jeremy Hunt has an estimated £13 billion of available funds within the limits set by his fiscal rules.

These rules state that the amount of debt, excluding liabilities from the Bank of England, should decrease as a percentage of the country’s Gross Domestic Product (GDP) by the end of the fifth year of the projection.

There is a possibility that Hunt may announce additional tax reductions in the upcoming spring budget to enhance the prospects for the Conservative Party before an upcoming election scheduled for next year.

The chancellor may have increased flexibility in his decision-making due to a more rapid decline in inflation than anticipated and a decrease in market expectations for interest rates in recent weeks. The advancements have the potential to generate significant savings for the Treasury, amounting to hundreds of millions of pounds in reduced debt expenses.

According to Divya Sridhar, an economist at PwC UK, the decrease in inflation rates will positively impact borrowing figures in the upcoming year, primarily due to the influence of lagged index-linked gilts.