The CDD quantifies the amount of money spent and the amount of time an asset was idle. The asset’s value is multiplied by the number of dormant days to determine the CDD for the help. CDD values may be used as a market indicator to track changes in investor behavior, particularly among whales with extensive enough crypto holdings to sway the market.

Main Points

- Coin Days Destroyed (CDD) examines how long a crypto asset was idle before being transferred. It is calculated by dividing the time a purchase was inactive by its value after being moved.

- It is a statistic used to research how long-term investors react to current market situations and to make predictions about following trends.

- A high CDD shows that the market is being re-entered by assets that have lain inactive for a considerable time. A low CDD indicates that the trade volume’s underlying assets are the usual ones.

- Binary CDD measures market strength by comparing the results of adjusting the CDD to the entire supply to the average CDD for that item.

Like the one below, you’ve probably seen tweets and wondered what they mean for the market.

💤 💤 💤 💤 A dormant address containing 1,128 #BTC (31,587,849 USD) has just been activated after 10.5 years!https://t.co/W87gdQJ0lo

— Whale Alert (@whale_alert) April 21, 2023

At first glance, a seasoned Bitcoin investor has recently opted to transfer their holdings. However, this circumstance carries more profound ramifications. The Coin Days Destroyed (CDD) metrics endeavor to analyze occurrences of this nature and provide insights into their implications for the market.

Coin Days refer to the duration of time during which a cryptocurrency asset remains stationary without any transactional activity. The value increases with each passing day. Upon the asset’s relocation, whether dispatched to an exchange or employed in a peer-to-peer transaction, the Coin Days undergo destruction, signifying that it is reset to zero.

If a quantity of 20 Bitcoins remains in a wallet for two weeks, the resulting Coin Days metric would be equivalent to 14 days. The Coin Days metric would be reset to zero after transferring said asset on the fifteenth day. The value of CDD is utilized in various calculations.

What is the significance of CDD?

The quantification of a cryptocurrency’s financial feasibility is frequently based on the daily volume of transactions it records. It is believed that an increase in market participation occurs when this phenomenon reaches its peak, as more buyers and sellers are presumed to be entering the market. However, this is only sometimes an accurate assessment. The process of examining the value of a transaction and the duration of dormancy of an asset is conducted by CDD concerning the unspent transaction output (UTXO) for newly introduced holdings in the market.

The values above are utilized in the computation of CDD values, which are considered to be a more dependable depiction of the pace at which fresh sellers or assets are introduced into the market. The metrics above support the daily transaction volume as a more knowledgeable gauge of market potency and specifically scrutinize the actions of extended-term holders and large investors.

How to Calculate CDD

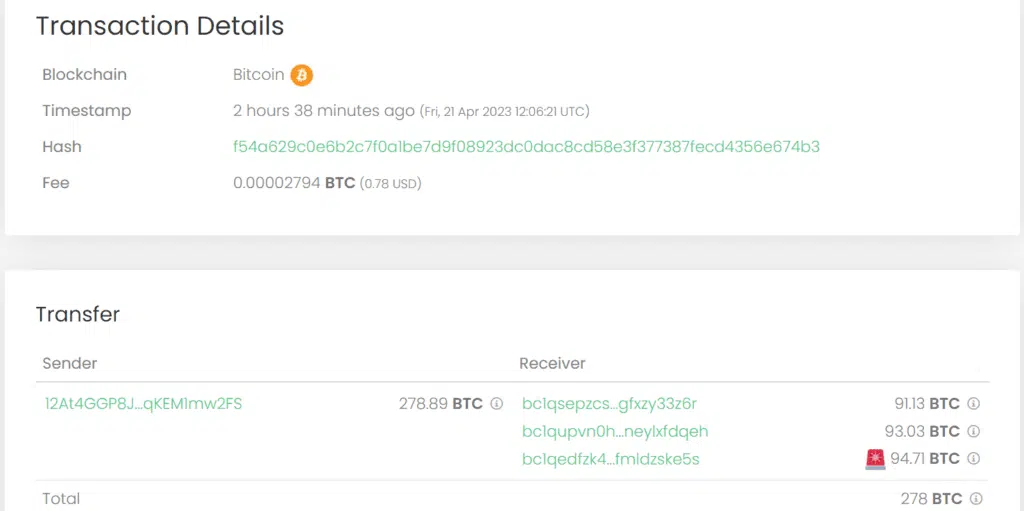

The calculation of CDD involves multiplying the value of an asset by the duration of its dormancy period, expressed in days. Upon closer examination of the tweet presented at the outset of this article, it is evident that the investor in question has transferred approximately 278 BTC in the recorded transaction.

The assets above have remained inactive for 10.5 years, equivalent to approximately 3,833 coin days, excluding leap years. Upon transaction verification, the Coin Days metric for the 278 bitcoins above has been reset to zero.

The calculation for Coin Days Destroyed is determined as follows:

The formula for calculating CDD is multiplying the value sent with the coin day.

Here,

The calculated value of cumulative degree days (CDD) is 278.89 * 3,833 = 1,068,985.37 ~ 1.07 million CDD.

Next, let us examine the potential actions investors can undertake with the information obtained from CDD.

How to Use the Indicator of Coin Days Destroyed

The accuracy of CDD computations is influenced by the mobility of high-value assets and assets that have been stationary for an extended period. The following are various methods for interpreting CDD values:

Short-term high CDD: A sudden surge in CDD accompanied by a rise in trading volume implies that investors with long-term investment horizons are divesting themselves of their assets, either partially or entirely, to realize gains. Typically, this is concurrent with a rise in on-chain activity about said asset.

Sustained high CDD: A sustained high Cumulative Delta Divergence (CDD) is considered a signal of enhanced market strength when it persists with the daily trading volume over an extended period. This phenomenon is commonly observed during bullish and bearish market conditions, wherein investors with long-term investment horizons tend to withdraw from a project due to market conditions or issues related to the project’s protocol.

Short-term Low CDD: A short-term low cumulative distribution divergence (CDD) scenario is characterized by a reduced CDD, accompanied by either an elevated or unaltered daily trading volume. This phenomenon indicates that investors are currently retaining their assets, and the typical liquid assets influence the alteration in trading volume. The level of on-chain activity about the support has remained low despite fluctuations in the daily trading volume.

Sustained Low CDD: A prolonged period of low CDD indicates a growing confidence among investors in the asset and a tendency to retain their investments for an extended duration. A long period of quiet, cumulative distribution days (CDD) is commonly interpreted as a favorable indication and implies a potential reversal following a market correction. This is due to the deceleration in the rate at which inactive assets are introduced into the market.

The present study examines the concepts of Supply-Adjusted Cooling Degree Days (CDD) and Binary CDD from an academic perspective.

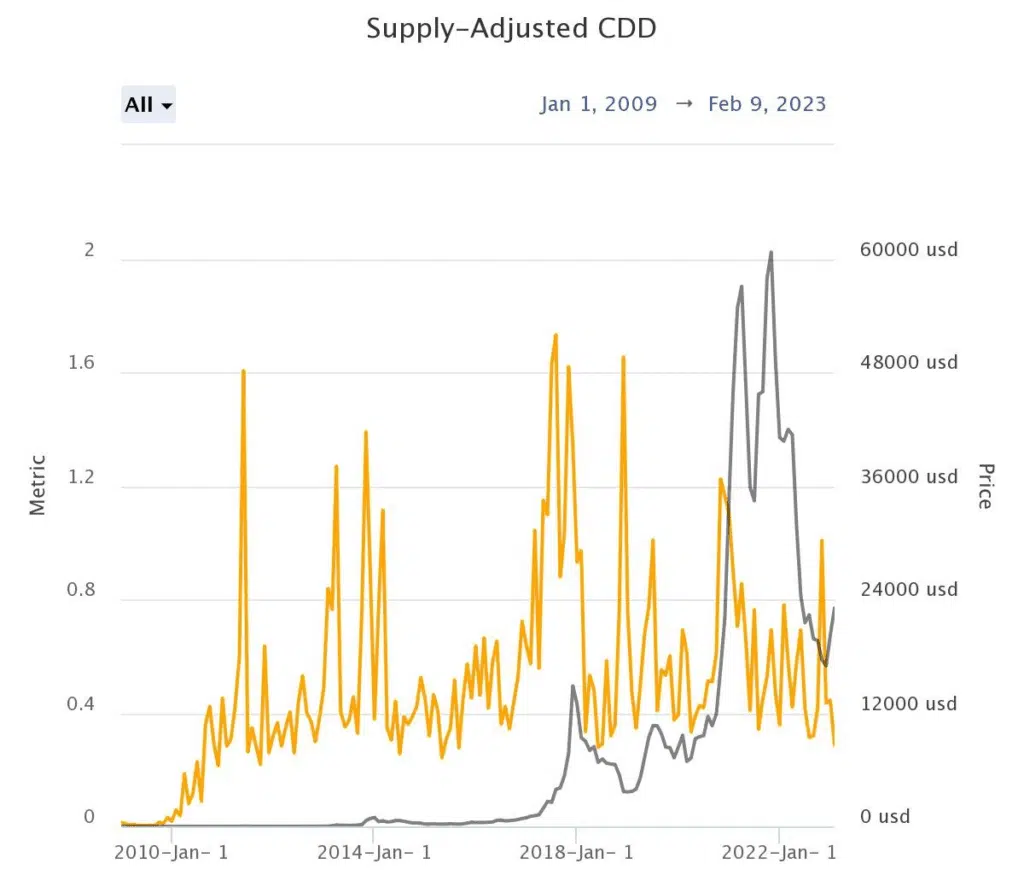

The Coin Days Destroyed (CDD) metric typically examines the transfer of coins during transactions, taking into account their duration of inactivity. However, the supply-adjusted CDD metric additionally considers the influence of the overall token supply.

Supply-Adjusted CDD

The concept of supply-adjusted CDD involves considering the overall supply of a given asset about the computed CDD metric. The proliferation of crypto-assets is leading to an increase in the issuance of assets via various means, such as mining, vesting period unlocks, or staking rewards. The increase in asset issuance results in a corresponding rise in the cumulative distribution diagram (CDD). At the same time, the supply-adjusted CDD considers the influence of each token’s supply on the overall CDD. The quotient is derived by dividing the cumulative distribution data (CDD) by the pool at the given moment. The formula for calculating Supply-adjusted Cooling Degree Days (CDD) involves dividing the Calculated CDD by the Total Supply.

Binary CDD

The Binary CDD involves comparing a value adjusted with the mean CDD and encoding the result as 1 or 0. A binary representation indicates whether the supply-adjusted CDD exceeds the mean value (1) or falls below it (0).

When the binary CDD remains at a value of 1 for an extended period, it indicates a market trend that favors buyers, commonly known as bullish. Conversely, when the binary CDD alternates between zeros and ones, it suggests a market trend that favors sellers, widely known as a bearish trend.

Conclusion

The metrics of speculative trading are fundamentally dependent on the behavior of investors. The study of CDD involves an examination of the responses of individuals who have held their investments for an extended period, compared to those who have saved them for a shorter duration, as well as evaluating the overall market’s resilience. Individuals who retain cryptocurrency ownership over a prolonged period are frequently regarded as genuine supporters of the project or possess astute financial understanding, mainly if they maintain a significant portion of the asset’s circulating supply.

The duration of an investor’s possession of a significant quantity of a cryptocurrency asset positively correlates with their significance in customer due diligence (CDD) investigations. This assertion is justifiable in that the decision to transfer their holdings following a prolonged period of retention is likely to be impacted by a noteworthy occurrence, some of which may be exclusive to their knowledge. Given their reputation as astute investors, other investors should remain informed about their actions. The appropriate calculation of CDD metrics can be advantageous for regular traders and long-term holders, as introducing inactive assets into the market can have significant consequences. In addition, investors should supplement their employment of CDD metrics with other metrics about market potency, demand, and supply to cultivate a more knowledgeable approach to trading. It is recommended to implement risk management practices. It should be noted that the present article solely serves an educational purpose and does not constitute financial advice.