Manufacturing activity in China declined unexpectedly in May, a surprise turn of events brought about by the country’s economy. As a result, there have been renewed calls for additional stimulus measures, as the ongoing property crisis in the country’s second-largest economy continues to negatively impact the sentiment of businesses, consumers, and investors.

The Experts’ Optimism Was Not Justified

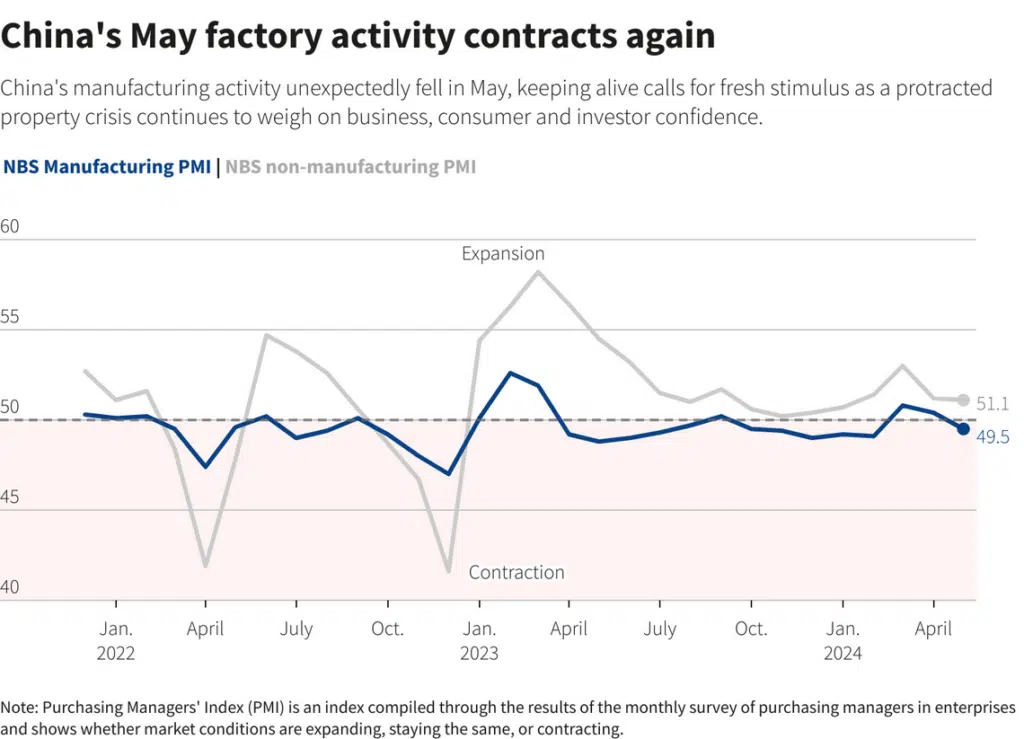

According to the National Bureau of Statistics (NBS), the official manufacturing purchasing managers’ index (PMI) fell to 49.5 in May, down from 50.4 in April. This represents a decrease from the previous four months. In addition, this is lower than the forecast that analysts had predicted, which was 50.4, and it falls below the 50-mark, which indicates growth.

The unexpected decline in manufacturing activity, which came on the heels of stronger-than-anticipated production and trade statistics, has cast a shadow of doubt on the economy’s recovery. This is a clear indication that the economy, valued at $18.6 trillion, is grappling with significant challenges.

Xu Tianchen, a senior economist at the Economist Intelligence Unit, believes that the data appears to indicate a decline in domestic demand. This is due to the fact that the housing sector is showing further deterioration, and retail sales need to perform better.

As the effects of new government initiatives, such as the property rescue plan and the issuance of special sovereign bonds, begin to take hold, it is anticipated that June will bring about positive changes. “The May reading could suggest a momentary fluctuation,” he added.

“Following two months of expansion, the sub-indices of the PM” for new orders and new export orders returned to contraction territory. At the same time, employment continued its downward trend.

Overall Growth Slowed Despite Some Good Numbers

The services sub-index of the NBS non-manufacturing survey slightly improved in May, increasing to 50.5 from 50.3 in April. However, the overall expansion, indicated by the wider services index that also includes construction, slightly decelerated in May, falling from 51.2 to 51.1 compared to the previous month. This was the case because the index encompasses construction as well.

Beijing’s efforts to shift its development model more toward domestic consumption over debt-fueled investment have been held down as a result of problems in the property industry, which have had a detrimental impact on vast parts of China’s economy.

This past month, retail sales experienced their slowest growth since December 2022, while new home prices dropped at the fastest pace in nine years. Both of these outcomes occurred in the same month. It is too soon to tell whether the struggling economy has made a significant turnaround, as these trends indicate that it is premature to make such a determination.

On Wednesday, the International Monetary Fund increased its growth projection for China, raising it by 0.4 percentage points to 5% for 2024 and 4.5% for 2025. However, the IMF cautioned that the property sector continues to pose a significant risk to growth.

Even “Historical” Stabilization Measures May Not Be Enough

This month, China “introduced measures aimed at stabilizing the property market, which has been described as “historic.” However, according to analysts, more than these steps may not be sufficient to ensure a sustainable recovery.

The IMF expressed the possibility of implementing a more extensive set of policies to tackle concerns related to the property sector. Nie Wen, an economist at Shanghai Hwabao Trust, emphasized that the decrease further strengthens the argument for additional assistance.

“It is imperative to enhance the stimulus on the demand side, “while simultaneously expediting the resolution of credit channels to prevent the contraction of financial institutions’ balance sheets, which could adversely impact the institutions expressed.