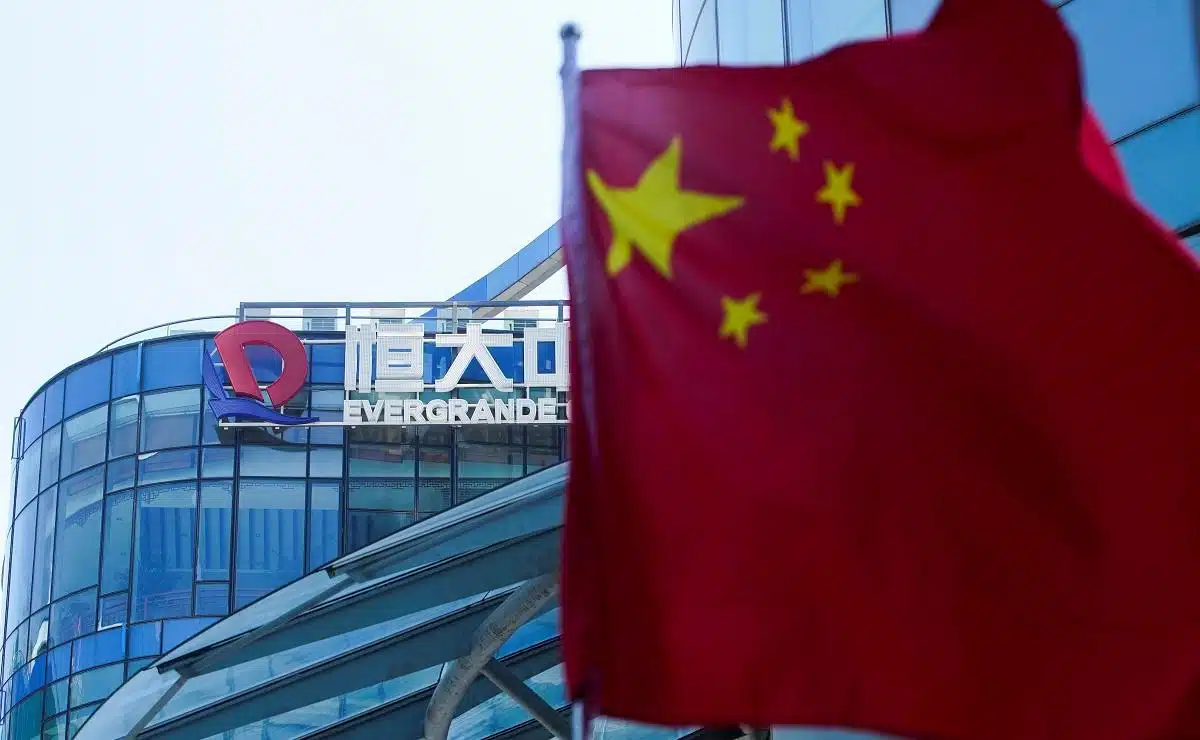

According to state media, a property project in China supported by the government has obtained the initial development loan through an allowlist mechanism. Additionally, two other prominent cities have relaxed restrictions on home purchases. These developments come amidst growing concerns about Evergrande’s financial troubles.

The most recent actions contribute to a series of strategies implemented by the second-largest global economy in the previous year to stimulate the real estate industry. This sector is responsible for a significant portion of China’s GDP and has endured a unique debt crisis following regulatory actions against its excessive borrowing.

New Home Prices in China Have Fallen Sharply

Despite the various steps taken, the property market concluded the previous year with the most significant drops in the price of new homes in almost a decade. This has dampened expectations of a broader economic rebound and reignited calls from investors for more robust policy actions.

If a Hong Kong court decides to liquidate China Evergrande (HK:3333) Group, it could negatively impact the demand for properties. Homebuyers may become more cautious due to concerns about the financial stability of other private developers.

According to official media reports on Tuesday, Suzhou and Shanghai, two prominent cities in China, have joined Guangzhou in relaxing restrictions on home-buying. This move aims to stimulate demand from potential homebuyers.

Investors did not show enthusiasm for the new support, as evidenced by the decline of Hong Kong’s Hang Seng Mainland Properties Index and China’s CSI 300 Real Estate Index, which both dropped by 2.1% and 2.5% on Wednesday, respectively.

Shortly after the government implemented the “project allowlist” mechanism, a loan in the amount of 330 million Chinese currency, which is equivalent to 46 million dollars, was swiftly approved for a development that was supported by the state, as stated in the official report published by the Securities Times on Wednesday.

City governments are required to provide a compilation of local property projects eligible for financial assistance in accordance with this mechanism. In addition, they are required to work with the banks in the area to meet the funding requirements of these projects.

According to a report by the Securities Times, the city of Nanning, which is located in the Guangxi region, has recently distributed its first “project add” to local financial firms. This development includes a total of 107 different projects. Guangxi Beitou Industry & City Funding Group, with the support of the state, provided a development loan to a project that was being undertaken. The China Mingsheng Banking Corporation was the one who provided the loan.

Based on the public WeChat consideration of the city’s real estate officials, the city of Chongqing, which is located in the southwest, has compiled a list of 314 projects that require a total of 83 billion yuan in financing.

According to the authorities, the first group of projects that have been included on the allowlist are developments that have been initiated by private companies such as Longfor Group and Huayu Group, in addition to Cina Vanke, which is supported by the state. According to the market, the three real estate companies are considered to be in a healthy financial position regarding their finances.

The implementation of financial assistance through this system is being closely monitored by a market that has been severely impacted by a debt crisis since mid-2021. This crisis has led to the construction of unfinished homes and an increase in defaults, particularly among privately owned builders.

Several experts anticipate that the real estate market will take a significant amount of time to reach a state of stability.

A Sentiment of Homebuyers

Experts are considering the recent actions as they assess the consequences of the court’s decision to liquidate Evergrande, formerly China’s leading developer, which is burdened with over $300 billion in debts.

“According to Christopher Beddor, deputy China research director at Gavekal Economics, the sluggishness in home sales can be attributed to potential buyers’ worries regarding the purchase of pre-sold units from financially troubled developers who may not be able to deliver the project on time.”

“At the very least, the news of the organized liquidation in Hong Kong is unlikely to affect the sentiment of potential homebuyers significantly.”

According to Jonathan Krane at Krane Shares in New York, the government is prioritizing the delivery of the unfinished homes promised to buyers by Evergrande, making it highly probable that they will be fulfilled.

“According to Krane, the future implications suggest that real estate will play a lesser role in China’s economy, making way for the rise of other sectors like technology, consumer products, and services.”

In a report published on Wednesday, S&P Global Ratings highlighted the potential consequences for home sales due to Evergrande’s situation. The report also mentioned that the liquidation process, which is expected to be complex and lengthy, may result in only a minimal payout for Evergrande’s offshore creditors.