According to the latest data released on Friday, residential property prices in Germany have experienced a continued decline, with a significant drop of 10.2% in the third quarter compared to last year. This development serves as yet another concerning indication for the real estate industry within Europe’s largest economy.

The Most Serious Downturn in the German Real Estate Market Since 2000

The trend of consecutive quarterly declines, marking the fourth occurrence, represents a significant downturn in Germany’s real estate market. Notably, this decline is the most substantial recorded since the inception of data collection by Germany’s statistics office in the year 2000. This development emphasizes the severity of the ongoing property crisis, considered the most significant in the nation’s recent history.

According to Konstantin Kholodilin, an expert from the economy department of the German Institute for Economic Studies (DIW), Germany experienced a significant speculative price bubble until 2022, which is considered one of the most substantial occurrences of its kind in the past five decades.

The decline in prices has been observed consistently over some time. The current situation can be characterized as a significant downturn or decrease, as the previously inflated market conditions have experienced a sudden and substantial correction.

The Main Reason for the Difficult State of Affairs in the Real Estate Market

Over several years, the real estate industry in Germany and other European countries experienced a significant upswing, primarily driven by favorable interest rates and robust demand.

However, the recent significant increase in interest rates and associated expenses has abruptly halted the prosperous streak, consequently pushing developers into insolvency. This unfortunate turn of events can be attributed to the scarcity of bank financing and the subsequent freeze in business transactions.

In the third quarter, major German cities experienced a significant decline in the prices of single- and two-family homes, with a notable decrease of 12.7%. Additionally, apartment prices also dropped 9.1% during the same period.

Adding to the Existing Problems Will Be the Problem of Job Losses

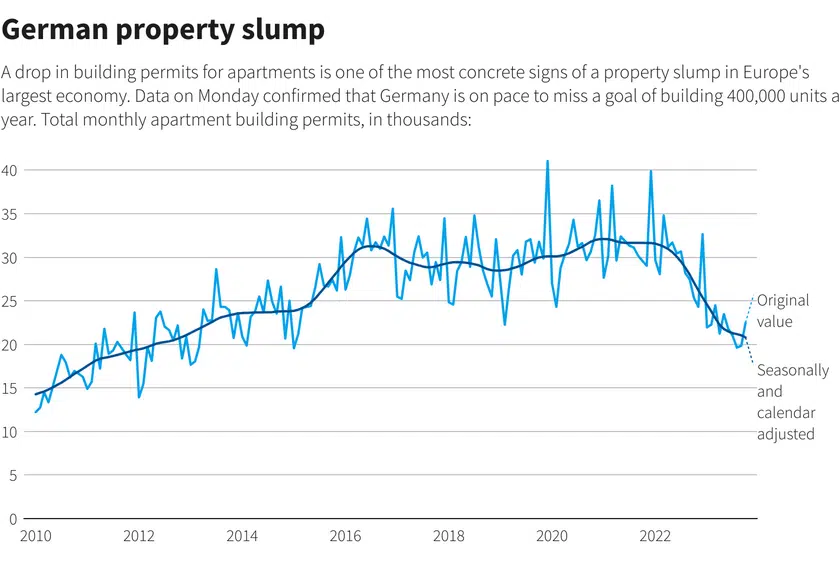

Based on the latest available data, it has been observed that there was a notable decline in requests for the building sector during October—specifically, a seasonally adjusted decrease of 6.3% compared to the previous month.

In response to the German Construction Industry Federation, it has been projected that the home construction sector is poised to experience a continued decline in employment opportunities.

Signa, a prominent Austrian property company with significant operations in Germany, recently initiated insolvency proceedings, marking a substantial development amidst the ongoing property crisis in the region.