Please present an inquiry, and Google Bard shall promptly furnish a concise rejoinder. However, it is essential to note that this artificial intelligence tool developed by Alphabet (GOOGL) does not possess the capability to provide a definitive response in the form of a binary “yes” or “no” to the inquiry at hand: Is it advisable to purchase shares of Google stock at the present moment?

Alphabet places a significant emphasis on the core principles of E-E-A-T, namely, experience, expertise, authoritativeness, and trustworthiness. The technology above conglomerate, known for its prowess in search, advertising, cloud computing, and artificial intelligence, seeks to extend its vision to encompass the realm of robust AI chatbots, exemplified by the notable Google Bard.

When inquired about the opportune moment to acquire Google stock, a response of impartiality and equilibrium shall be provided. The following elucidation shall outline several rationales for considering an investment, encompassing the company’s preeminent market standing in search and its pioneering advancements in domains such as artificial intelligence and autonomous driving.

We will additionally elucidate the rationales behind potential reservations regarding investment in Google stock, encompassing heightened competition from peer entities within the esteemed cohort of Magnificent Seven stocks, as well as formidable artificial intelligence (AI) entities such as Amazon.com (AMZN) and Microsoft (MSFT). Tesla (TSLA) was not mentioned in this prompt’s previous response.

Ultimately, the determination regarding the acquisition of Google stock rests solely within your purview, as articulated by Google Bard.

In technological advancements, Microsoft Bing and Google Bard compete for dominance, each embodying a distinct characteristic that sets them apart. As per the MIT Technology Review article published in March, it is noteworthy that Bard distinguishes itself from Bing Chat by abstaining from referencing search results. Instead, all the information Bard provides is internally generated by the model.

Artificial Intelligence Is Driving Demand For Companies Like Alphabet, Nvidia And More

Every month, IBD releases a comprehensive compilation of newly acquired holdings by top-performing mutual funds.

During August, significant investments in Meta, Tesla, and Google stocks contributed to a notable surge of enthusiasm surrounding artificial intelligence among prominent financial professionals. In October, substantial investments in Meta, Alphabet, and Nvidia stocks once again underscored the ongoing momentum of the AI revolution. In November, Amazon surpassed Nvidia, Meta, Google stock, and other prominent Magnificent Seven stocks as leading funds acquired a substantial $16.2 billion worth of AMZN stock.

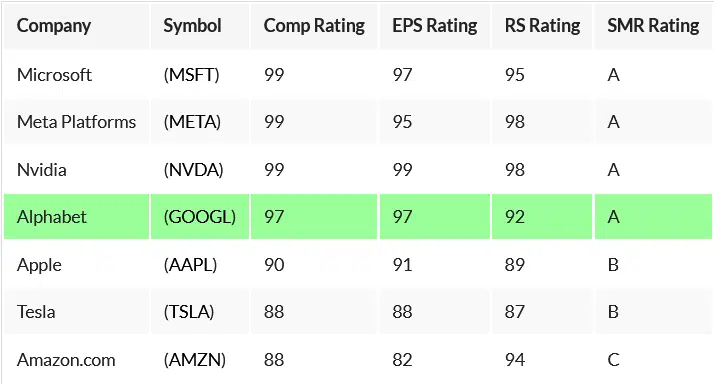

The tabular representation illustrates Alphabet’s comparative analysis and the remaining Magnificent Seven stocks concerning Composite Rating and other pertinent metrics. The Google stock has achieved a commendable rating of 97, indicating its superior performance relative to 97% of all stocks listed in the IBD database.

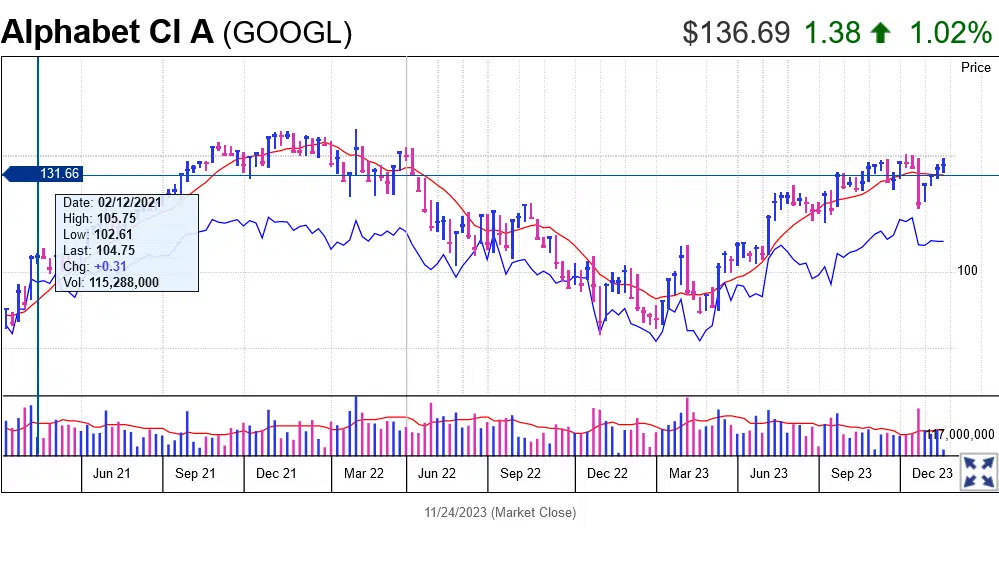

The Stock of Google Continues to Rise Near a New High

Alphabet’s stock price experienced a significant decline after releasing its Q3 earnings report on October 24th, breaching its 50-day moving average. The growth of cloud-computing sales fell short of expectations, indicating a potential decline in market share for the company in light of the intensifying competition with Microsoft in artificial intelligence.

However, as of November 14th, the stock of Google exhibited a recovery and surpassed its 50-day moving average. Demonstrating its robustness, the stock maintained its support level at the benchmark above and subsequently rebounded, potentially paving the way for a prospective breakout.

However, the adverse impact resulting from a significant and abrupt decline in earnings has led to a notable deterioration in Alphabet’s Accumulation/Distribution Rating, which currently stands at a D+. The volume ratio of the asset in question is presently at a neutral level of 1.0. It is advisable to focus on identifying key metrics that exhibit potential for improvement while also monitoring the relative strength line’s ongoing trajectory toward a 52-week high.

Google’s stock has recently achieved a notable milestone, as it has successfully established a new buy point of 141.22 within a flat base formation. The AI leader experienced a marginal decline of slightly over 1% during the abbreviated trading session on Black Friday. The recorded volume exhibited a notable deviation from the established average.