The current financial situation is getting more and more complicated. Recent news about the US debt ceiling problem and the possibility of the world’s leading country going bankrupt has caused some people to think about investing their money in safe investments like gold and bitcoin.

While there are significant differences between cryptocurrency and gold, especially in how they relate to the stock markets, there is a growing connection between them.

Let’s learn more about this topic in this piece.

Bitcoin and Gold as Safe Havens for the US Debt Limit Crisis

Buyers tend to look for a “safe haven” to invest in when the economic situation is unclear. Gold and Bitcoin are now under scrutiny as possible options. As a result of the March banking crisis, which led to the collapse of central banks such as Silicon Valley Bank, the United States now faces a “debt ceiling crisis.”

Us Debt Grows by the Day

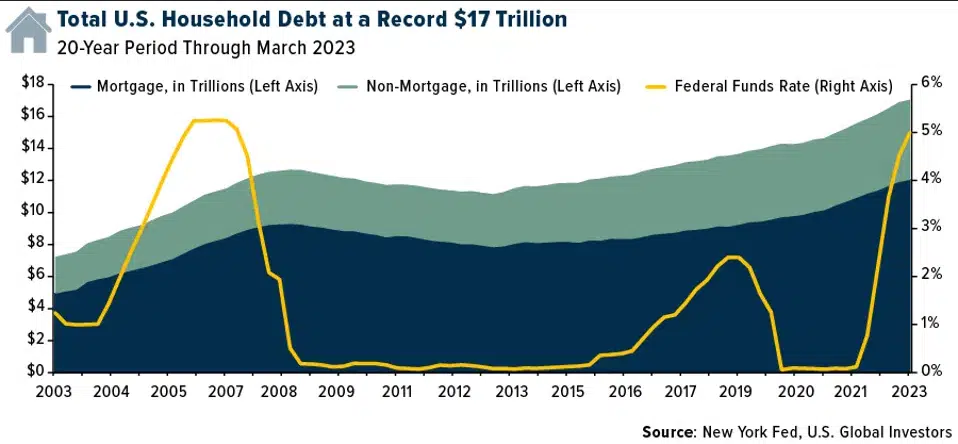

The US federal debt limit is $31.4 trillion, almost reached as the government and families have recently accumulated a lot of debt. According to the Federal Reserve Bank of New York, US household debt exceeded $17 trillion for the first time in the first quarter.

Even though the Federal Reserve introduced tighter monetary policy in March 2022 by raising interest rates on government bonds, families continue to build up debt quickly. This supports the idea that the change in lending rates has remained relatively the same as how Americans borrow money.

Since the Federal Reserve began tightening monetary policy, consumers have accumulated more than $860 billion in mortgage debt, $145 billion in credit card debt, $93 billion in car loans, and $14 billion in school loans. Buyers look for a “safe haven” investment when the economy is uncertain. Gold and Bitcoin are being watched closely to see if they can become such investments.

The current federal funds rate is between 5% and 5.25%. But this has not yet had much impact on the current trend of credit card debt in the US. Interest rates have remained relatively high between the end of 2022 and the end of March 2023. However, figures show that Americans’ credit card interest has reached a new all-time high of $1 trillion, the most significant debt in history.

Figuring out how much debt you owe on your card is expensive because the average interest rate is 20.92 percent. Although it may seem wild for Europeans to ask for credit at such high rates, this is a common way to get into debt in the US, where many families have commitments on several credit cards.

Experts Sound the Alarm About Debt

Investors are concerned about high-interest rates and the country’s enormous debt. If the debt limit is not raised as it has been in the past, it could lead to a debt problem in the US. In tough times, buyers prefer to invest their money in gold or bitcoin. Let’s get a better understanding of how investors feel in tough times.

At a recent Bitcoin conference in Miami, people were asked which investment to choose if the US debt limit was exceeded. Everyone present agreed that they should invest in gold and its digital equivalent. Even so, there may need to be a more credible rationale for this view, as the people who attended the meeting favored Bitcoin and the cryptocurrency market in general.

Gold Remains the Most Popular Asset Among Investors

Forbes tried to get a complete sample by asking 637 buyers which assets they would choose if the US stopped paying its government bills and responsibilities. The results are interesting because standard gold is the most popular choice among individual and business buyers. US bonds and bitcoin rank second and third, with institutional investors favoring 7.8% and individual investors at 11.3%.

Investors believe that standard currencies such as the dollar, Japanese yen, and Swiss franc need more suitable haven investments.

Bitcoin and gold are praised for their decentralization and low inflation over the long term. Gold, on the other hand, does not stand up to scrutiny. Cryptocurrency, on the other hand, can.

In 1933, US President Franklin D. Roosevelt signed Executive Order 6102, which made it illegal to own any gold and took it away from the people. This cannot be done with Bitcoin.

Bitcoin Will Stand Up to Any Challenge

The virtual currency that Satoshi Nakamoto created was created to withstand such attacks and work as a natural reserve that no one can control. Gold is a safe choice because its price has remained stable for a long time and has little correlation with the stock market. Over the past five years, gold’s correlation with the S&P500 index has been 0.04, while Bitcoin’s has been 0.88. This means that Bitcoin often moves in the same direction as stocks.

If the US Defaults, What Happens to Cryptocurrencies?

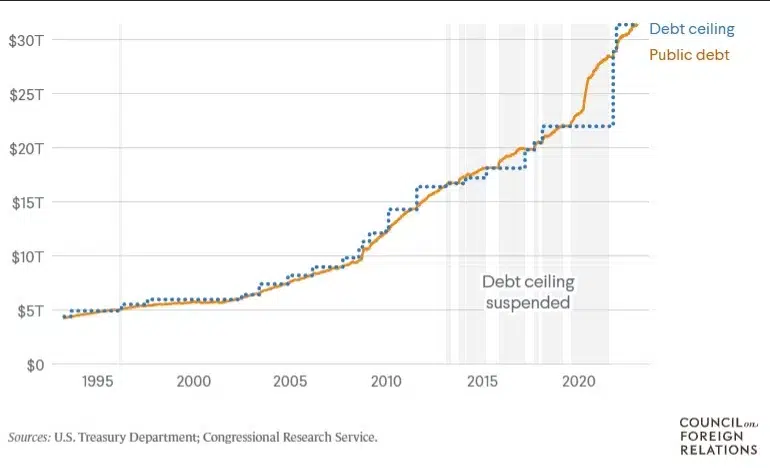

The United States is approaching the debt limit for 2021, which has people worried about the government’s ability to pay investors and the possibility of a national collapse. The “debt ceiling” for the government has been raised 78 times since 1960, with Congress last setting it at $31.4 trillion.

Before the global financial meltdown in 2007, the government’s debt had remained at most $10 trillion. Over the past 15 years, it has risen by more than 200%, making politics between the Democratic and Republican parties tense.

Even if the debt is close to the maximum amount you can borrow, there is still a chance of failure. This is because the debt limit can be raised, even one day before it is reached.

In more challenging situations, a ‘government shutdown’ could occur, in which the government cuts spending by cutting the salaries of non-essential workers and then cutting payments for goods and services and current expenditures. Markets would change immediately if this contingency plan were put in place. However, a default, which would have far worse consequences, could still be avoided.

In a worst-case scenario, the USA could not pay off its government debt obligations any time soon. This would significantly impact markets, especially those that are more risky, such as the Bitcoin market.

Even if Bitcoin and Ethereum can survive market turmoil, their prices could fall significantly. On the other hand, many tokens from the altcoin group may not survive a market crash. A default event could end such a financial ordeal, especially for cryptocurrencies that are not backed by anything substantial or have small projects like meme coins. But over time, it will likely leave those with more value in their own right.