Monzo, the digital challenger bank valued at $4.5 billion, has introduced a new feature enabling its users to engage in investment activities. This marks the bank’s initial venture into the extensive financial investment market.

The feature above, referred to as “Investments,” will allow Monzo’s esteemed clientele to engage in investment activities by allocating funds towards various investment vehicles overseen by the renowned asset management entity BlackRock.

CNBC was granted exclusive access to the product within the premises of Monzo’s headquarters during the previous week. The rollout is scheduled for Tuesday, enabling users to engage in investment activities with a minimum amount of £1.

The strategic decision will position Monzo in direct competition with well-established financial institutions such as Chase, which currently provides online investment management services through its subsidiary, Nutmeg. Additionally, Monzo will face competition from established asset management firms and emerging startup competitors, including Chip, Moneybox, and Plum.

Monzo currently offers its customers the option to allocate their funds into savings pots that generate interest. However, it should be noted that this marks the inaugural foray of the organization into the realm of investment.

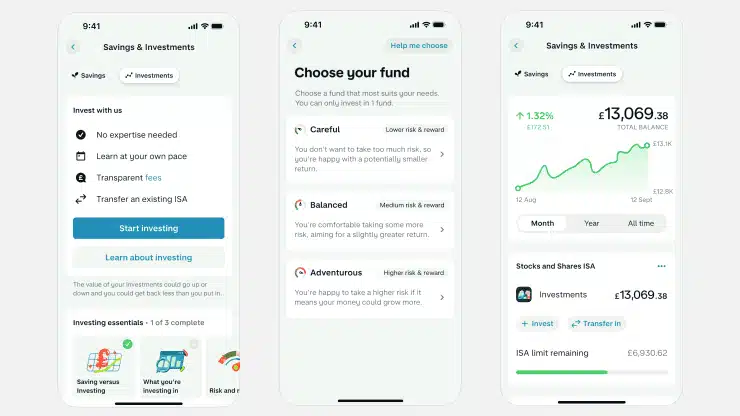

The application process is characterized by its inherent simplicity and ease of navigation. Customers will be invited to join a waitlist to gain access to the product. Users who meet the eligibility criteria and successfully enroll in the waitlist will receive an invitation to establish an investment portfolio.

Subsequently, individuals will be directed to a series of screens wherein they shall be acquainted with the product and presented with the opportunity to select from a curated assortment of three funds meticulously chosen by BlackRock, each catering to distinct risk profiles.

The decision at hand pertains to selecting three investment vehicles overseen by BlackRock: Careful, Balanced, and Adventurous. On the conservative end of the spectrum lies a fund characterized by a lower level of risk and correspondingly modest returns. Conversely, the moderate fund entails a reasonable degree of risk and offers commensurate rewards. Lastly, the aggressive fund entails higher-risk allocations that have the potential to yield significantly more significant returns.

British Investors’ Lack of Expertise and Experience

According to TS Anil, the esteemed co-founder and CEO of Monzo, the company has diligently endeavored to introduce an investment feature to address the prevailing shortage of knowledge among British individuals about investing.

In the words of Anil, during an interview with CNBC before the product launch, it has been observed that customers encounter numerous barriers when attempting to initiate their engagement. The primary objective of our product is to effectively eliminate these barriers, thereby facilitating a seamless and unhindered customer experience.

One of the primary obstacles encountered is the prevailing notion that investing needs more affordability, impeding individuals from initiating their investment journey. Monzo Investments offers a minimum investment threshold of £1.

Anil further elucidated that another prevalent concern among individuals is a sense of being inundated, stemming from a perceived lack of requisite knowledge to initiate their endeavors. Consequently, we have diligently incorporated comprehensive knowledge and equipped them with the necessary tools to facilitate informed decision-making.

Another concern that arises is the perceived lack of personalization. In response, we present three straightforward alternatives designed to cater to individual risk preferences, thereby ensuring a customized experience.

Based on research conducted by YouGov on behalf of Monzo, it has been found that a significant proportion, precisely 69%, of the United Kingdom’s population lacks clarity regarding the appropriate avenue to pursue to access an investment product that is both user-friendly and easily accessible. Additionally, 60% of adults are predisposed to engaging in investment activities, provided the minimum requirement is set at a low threshold.

In the interim, it has been observed that a significant proportion, precisely 24%, of adults residing in the United Kingdom who engage in investment activities have acknowledged resorting to an improvised approach in their decision-making process.

The figures above have been derived from a representative sample of 2,035 adult individuals residing in the United Kingdom. The fieldwork for the research project was conducted within the time frame of July 27 to July 28.

The investments pots feature will be introduced within a section of the Monzo application’s home screen, specifically called Savings & Investments. Monzo has announced that the product will be gradually introduced to all customers who meet the eligibility criteria in the upcoming weeks.

However, when Monzo’s data indicates that a customer is experiencing financial hardship, such as falling behind on debt repayments, the option to initiate new investments will be absent from their account.

The feature additionally gives users the flexibility to modify, terminate, or retract their investments at any given moment, thereby enabling them to disengage from their investment even after their initial commitment.

Monzo has successfully reached a significant milestone in the United Kingdom, with its customer base surpassing 8 million individuals. This achievement comes a mere eight months after the bank accomplished the notable feat of acquiring 7 million users.

The organization is currently exploring opportunities to expand its presence within various segments of the financial services industry, aiming to diversify its revenue streams and progress toward achieving sustained profitability over a fiscal year.

Monzo has recently announced its attainment of profitability during the initial two months of 2023. This significant achievement can be attributed to the notable increase in lending income, primarily driven by the higher interest rates in the United Kingdom.

Monzo has announced its intention to implement a fixed fee structure of 0.59% on monthly investments made by its customers. This fee encompasses a fund fee of 0.14% and a platform fee of 0.45%, both of which are essential service components. For a customer with a total investment of £1,000 ($1,250) in Monzo, the corresponding monthly fee would amount to approximately 48 pence.

It’s a Start. Who’s Next?

During a recent briefing with CNBC, Monzo executives expressed their intention to introduce a comprehensive financial product encompassing various services such as budgeting, spending, money transfers, and borrowing. The aim is to allow individuals to invest within an integrated ecosystem of financial offerings.

Monzo positions itself as a “financial control center” that caters to the needs of banking customers in managing their financial affairs rather than adopting the “super app” approach that encompasses a wide range of services alongside banking and financial offerings.

Revolut, a prominent competitor of the company in question, has consistently emphasized its objective of establishing itself as a comprehensive financial super app encompassing a wide range of services, including banking, trading, insurance, travel, and other offerings.

Monzo has demonstrated a pioneering stance among licensed neobanks in the United Kingdom by proactively venturing into investment offerings. Starling Bank and Zopa, two prominent competitors in the financial industry, still need to incorporate investment functionalities into their respective platforms.

However, it should be noted that several fintech platforms, such as Revolut and Freetrade, have already implemented the functionality for users to engage in stock trading. Wise additionally provides a comprehensive investment management solution.

When queried regarding the timeliness of Monzo’s market entry, Anil expressed the viewpoint that the company’s arrival is still valid.

One could posit that there was a delay of approximately 500 years in our engagement with the banking industry, as stated by the individual in question. In light of the nation’s recent experience with a significant cost of living challenge over the past two years, valuable feedback from our esteemed clientele has emphasized the growing importance of making prudent financial choices. Consequently, introducing this product is particularly suitable for addressing these prevailing concerns.

According to Gautam Pillai, the esteemed head of fintech research at Peel Hunt, a prominent investment bank, Monzo’s recently introduced investments feature has the potential to enhance customer retention.

Monzo possesses the potential to pursue a greenfield opportunity. There is no cause for concern regarding the brownfield site. According to Pillai’s statement to CNBC, it can be inferred that the subject in question does not possess a genuine requirement for it.

Monzo is among the British financial technology companies that have captured the attention of investors as a prospective contender for an initial public offering in the upcoming year.

According to Anil, the company perceives an initial public offering (IPO) as a significant achievement in its business trajectory rather than a short-term objective. Anil stated that the company needs more immediate intentions to pursue a public listing.