In June, there was a significant rise in the price of cryptocurrencies, which showed that market players were optimistic. This was especially noticeable in Bitcoin (BTC), which hit a new yearly high on June 23.

The altcoin market has a lot to look forward to in the coming month of July, as it has the potential to become very important. Even though the Bitcoin dominance rate (BTCD) is still going up, there are good chances that altcoins will do well if the BTC price goes through a time of stability.

In the current situation, it’s exciting for traders and buyers to keep a close eye on the market’s complex changes and take advantage of possible opportunities. MoneyAmped explores the world of digital assets by looking at three cryptocurrencies that have the potential to reach new heights in July:

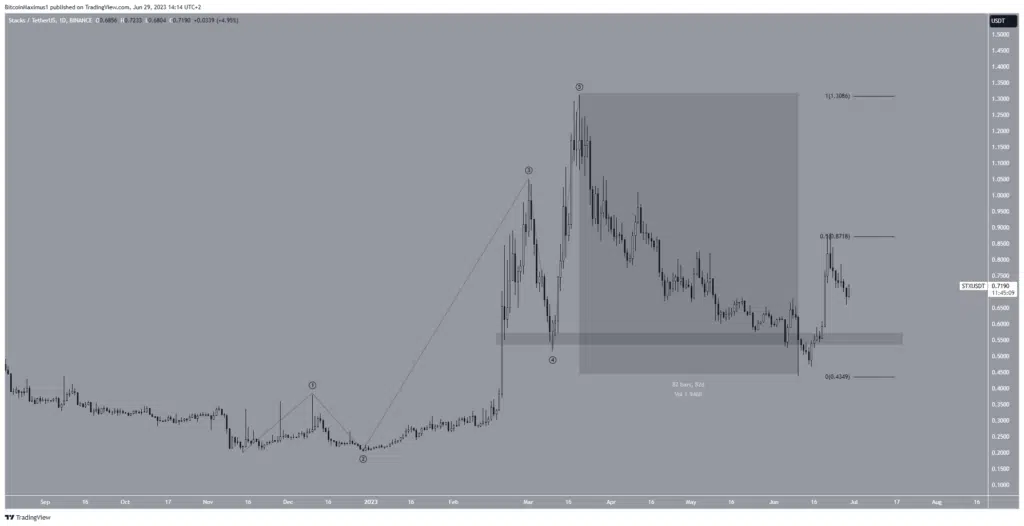

Can Stacks (STX) Start Going Up Again?

Since the beginning of the year, the price of STX has gone up by a significant amount. The price action seen looks like a fully formed five-wave impulse pattern, shown by the color black. If this is the case, the price of STX has begun a new upward design.

After reaching a high of $1.31 on March 20, the price of STX fell for 82 days, reaching a low of $0.44 on June 10. After a quick recovery, the fee returned to the $0.55 area.

The previous cipher study has been thrown out because it was not thorough enough. In cryptocurrencies, it is not unusual for departures and reclaims to cause significant price increases.

Since then, it seems likely that the price of STX has started a new five-wave rise, which could take it to $3, its historical high point.

STX/USDT Daily Chart. Source: TradingView

With the current bullish mood, if the STX price can’t keep going up past the strong 0.5 Fibonacci retracement support level at $0.87, it could fall back down to the $0.55 area.

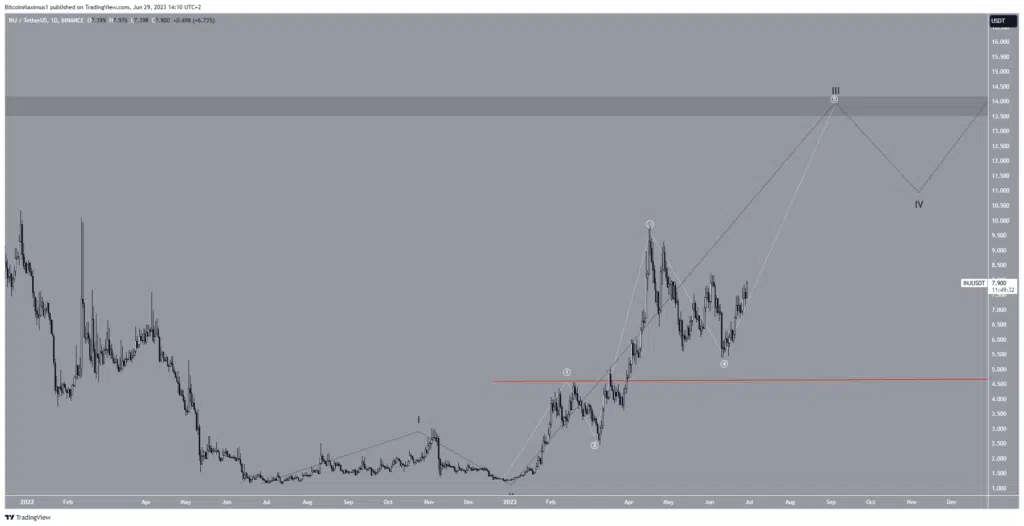

Bullish Injective (INJ) Count Can Bring Markets to New Highs

Since the beginning of the year, INJ’s value has increased by a significant amount. The way the price goes up now looks like a classic five-wave pattern, shown by the color black.

Crypto experts use the profound lessons of the Elliott Wave theory to figure out how prices move in cycles and how they interact with investor emotions in complex ways. This handy tool lets them figure out the direction of the trend with a high degree of accuracy. Based on how the market is moving right now, the INJ price is going through a big jump in the third wave of its rise.

The sub-wave count is bright white, showing that the INJ price has started the fifth and final sub-wave.

Based on the exact count, the price of INJ is expected to finish its third wave near the $14 mark, which will act as solid horizontal support. Even though this price is below its previous peak, it is the last thing that must be overcome before it reaches an all-time high.

So, if the price breaks through the difficult $14 support mark, it could go to heights that have never been seen before. This would fit in with how wave five reached its highest point.

INJ/USDT Daily Chart. Source: TradingView

If the price fell below the peak of the first sub-wave, marked by the red line at $4.58, the optimistic forecast for INJ would be thrown out.

Based on the count analysis, this situation points to a bearish outlook, which could cause the price to drop to the $3.0 mark.

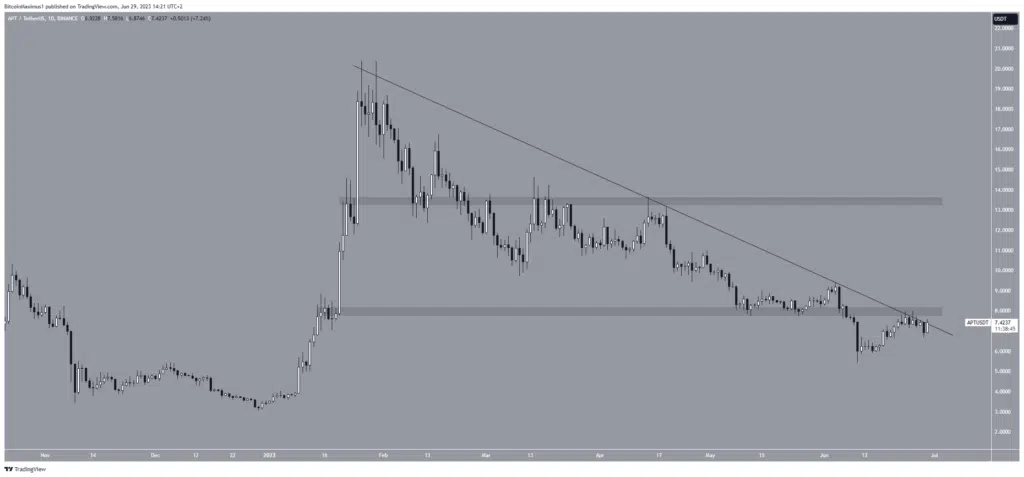

Will the Price of Aptos (APT) Start to Go Up Again?

The price of APT has been going down for a long time, breaking through a falling support line 154 times in a row. When analyzing cryptocurrencies, it’s essential to remember that the market mood is considered harmful until the price makes a clear breakout. Also, the downward movement caused the APT price to go down, breaking through the basic horizontal $8 level, which had been a solid support zone.

Even though the current price direction is down, it is essential to note that the APT price is breaking out of its set line. Given how close the $8 area is to the queue, if someone got out of the $8 area, they would get back into the column.

If the APT price breaks out, it’s important to remember that the $13.50 mark would be the last challenge before the historical peak. The lack of significant support above makes it likely that the price will rise quickly if a breakout happens.

APT/USDT Daily Chart. Source: TradingView

If APT is turned down, it could fall to the following nearby support level at $4.0.