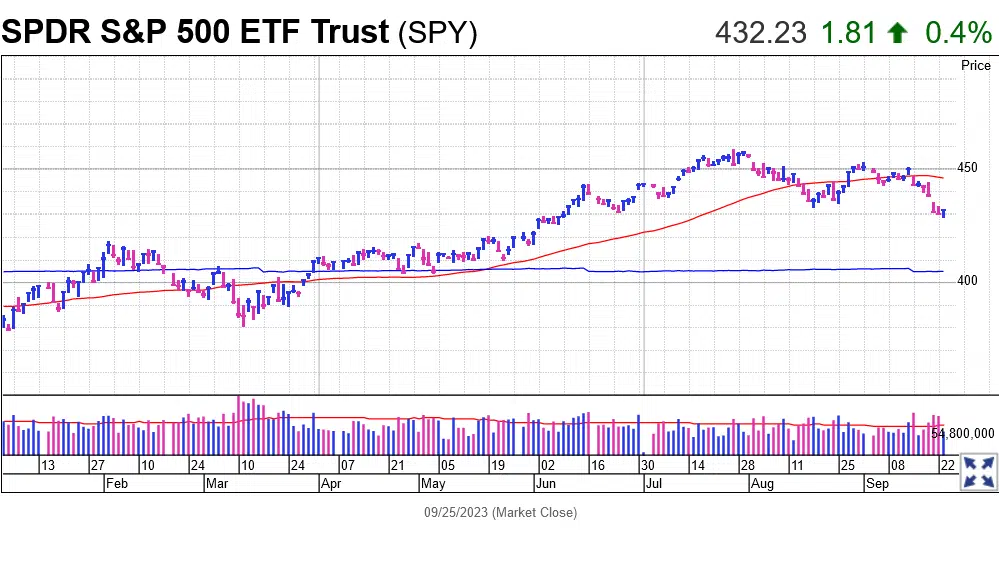

The performance of the S&P 500 during the first half of the year has been challenging, as it has experienced a decline of approximately 3%. However, industry analysts continue to express their anticipation for a promising upcoming period of 12 months.

Wall Street Analysts Hope for a Rise in 10 S&P 500 Stocks

According to a recent report by John Butters from FactSet, Wall Street analysts are anticipating substantial upward movements in the next 12 months for 10 S&P 500 stocks, namely SolarEdge Technologies (SEDG), Insulet (PODD), and Dexcom (DXCM). The observed trend indicates a substantial increase of 62% or more in the value of these stocks within one year.

The level of impressiveness is noteworthy, particularly considering the optimistic expectations held by analysts regarding the S&P 500. According to analysts, there is a prevailing belief that the primary benchmark stock index is poised to experience a substantial increase of 19% within 12 months, reaching a projected value of 5152.11, as stated by Butters. The observed figure represents an approximately twofold increase compared to the average annual total return.

A Short-Term Challenge for the S&P 500 Index

The S&P 500 is anticipated to receive positive sentiment from analysts in the forthcoming year. However, investors must bear a certain degree of discomfort during this interim period.

One of the underlying challenges pertains to a fundamental aspect. The conclusion of the third quarter has witnessed a suboptimal performance in terms of corporate profit expansion. According to analysts’ projections, it is anticipated that the S&P 500 profit for the third quarter will experience a decline of 0.2%. In the event of such a decline in profits, it would signify the continuation of a downward trend, with S&P 500 earnings experiencing a decrease for the fourth consecutive quarter, as stated by Butters.

However, it is worth noting that a sense of optimism persists within the financial community located on Wall Street. According to analysts’ projections, it is anticipated that S&P 500 companies will exhibit a 12.2% increase in profit growth during 2024. The reported figure represents an increase compared to the previously projected profit growth of 11.9% for the corresponding year, as stated by Butters.

Specific stocks, however, possess the potential to yield significantly higher returns compared to their counterparts.

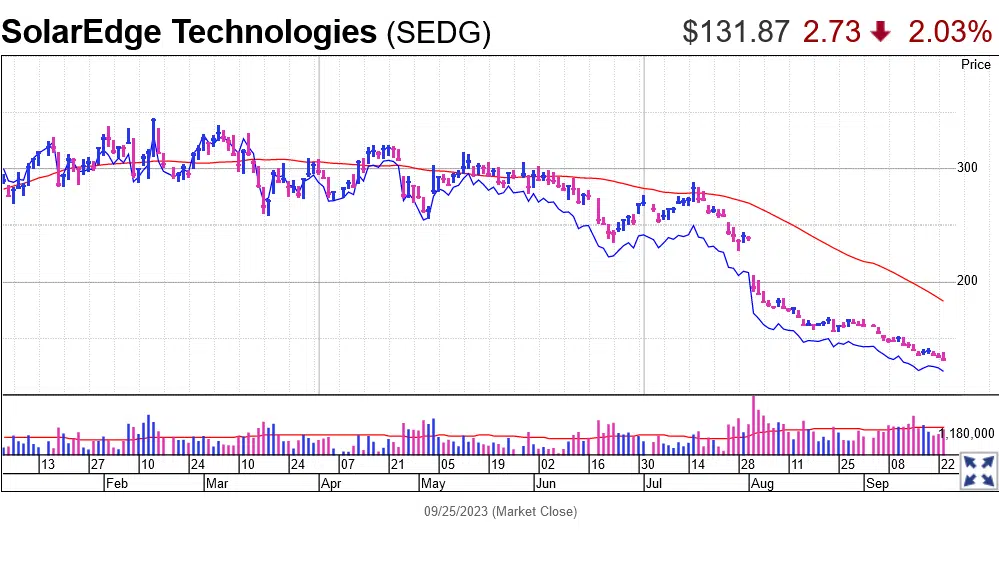

Analysts Are Hoping That Solaredge and Insulet Can Make Things Right

If a discernible pattern can be observed among the preferred S&P 500 stocks of analysts, most of them have exhibited relative underperformance throughout the current year. Is it anticipated that they will ultimately overcome the prevailing sense of lethargy?

According to analysts’ assessments, this is believed to be the case. As of the current period in 2023, it is noteworthy to observe that eight out of the ten S&P 500 stocks, which have been favorably regarded by analysts, have experienced a decline in their respective values. Indeed, SolarEdge, a prominent vendor specializing in solar power equipment, exemplifies the scenario above.

According to industry analysts, it is projected that the company’s stock will experience a substantial surge of approximately 114% within 12 months. If their assertion is accurate, it would signify a significant wave surpassing that of any other constituent stock within the S&P 500 index during the period above.

The proposition in question does not necessitate an unwarranted leap of faith. Several alternative-energy investments have demonstrated exceptional performance as S&P 500 stocks after the initiation of interest rate increases by the Federal Reserve in the previous year. Furthermore, it is anticipated that SolarEdge will experience a growth in profit exceeding 55% in the current year, followed by a projected increase of 22% in the subsequent year.

However, SolarEdge has not been included thus far. The year-to-date performance of shares indicates a decline of 52%.

Analysts express a shared optimistic outlook regarding the performance of Insulet’s shares. According to industry analysts, it is projected that the market share of the manufacturer specializing in insulin delivery products for individuals with diabetes will experience a significant increase of over 77% within the current fiscal year, even though shares have experienced a decline of 46% year-to-date. However, it is essential to note that there exists substantial empirical evidence supporting the optimistic outlook. It is anticipated by analysts that there will be a significant increase of 28.9% in the adjusted profit of the company for the current fiscal year.

Not Every Favorite on the S&P 500 Is Performing Poorly

Certain stocks favored by analysts should not be viewed solely as potential rebound opportunities.

Analysts have expressed a positive outlook on United Airlines (UAL) and anticipate a potential increase of approximately 70% in its shares over the next 12 months. In addition to the notable increase of over 14% witnessed thus far this year, it is worth mentioning. Furthermore, it is anticipated that the shares of MGM Resorts (MGM) will experience a further increase of 62% after a 9.2% ascent witnessed thus far in the current year.

It is a widely acknowledged fact that analysts do not invariably possess infallible accuracy in their assessments. However, their focus on analyzing S&P 500 stocks is more comprehensive than most market participants.