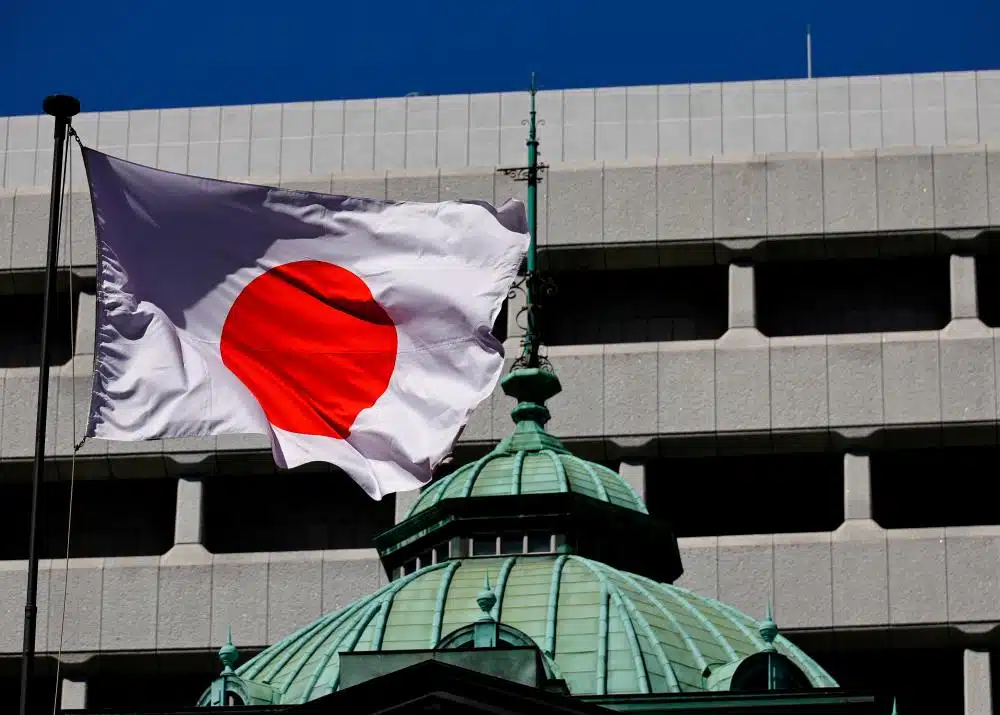

Although inflation is expected to remain stable, Nomura forecasts that the Bank of Japan will raise interest rates once more in December. The central bank, which had previously been a passive actor, is now committed to distancing itself from its accommodating approach.

The Timing of the Next Interest Rate Hike Is Becoming Apparent

In a statement, Nomura expressed their belief that the most likely time for the subsequent increase in interest rates is during the monetary policy meeting that will take place in December. As indicated by the Bank of Japan’s July summary of opinions, which suggests a change in the stance of the central bank’s policymakers, a hike in December, which would be the third one in July, may still occur even if inflation does not accelerate rapidly. This would be the third time that the BoJ has raised interest rates in July.

Nomura reported that policymakers are continuing to evaluate the conditions of monetary policy, even after the 0.25% increase in July. Although they anticipate that core inflation will remain relatively stable at approximately 2% year over year, they are keeping a close eye on the situation.

“This indicates a shift in its policy response function, indicating a potential increase in interest rates even if inflation remains stable,” according to the statement.

In a recent speech that took place on August 7th, the Deputy Governor of the Bank of Japan, Shinichi Uchida, emphasized that inflation and economic data will play a role in determining whether or not interest rates will be raised. The comments made by Uchida, on the other hand, do not entirely rule out the possibility of the Bank of Japan (BOJ) increasing interest rates in the event that stability is restored to the financial markets, according to Nomura.

On the other hand, there are skeptics who are skeptical about policymakers’ enthusiasm for raising interest rates. These individuals would rather wait for additional evidence of price pressures, which are likely to be caused by increases in wages.

The Bank of Japan Will Not Rush into a Final Decision

According to Barclays, the analysis of opinions presented at the monetary policy meeting that took place in July revealed that there was only one viewpoint that could be categorized as hawkish. “On the other hand, there were certain viewpoints that displayed a bias against increasing rates, and even among the statements in favor of rate hikes, there were notable expressions of caution,” according to the report.

Based on Barclays’ findings, it is possible that the Bank of Japan will need to wait until the meeting in December to guarantee that the nationwide CPI data accurately reflects the impending increase in service prices. In spite of this, they now believe that the subsequent rise in the Bank of Japan’s interest rate will take place in January rather than April. This is because they think that wage pressure will have a more significant impact on inflation.

Over the following year, there will be a more defined perspective on the yearly wage increases that are negotiated, which are commonly referred to as “shunt.” According to the information provided by Barclays, this will likely be reflected in the overall wage data.