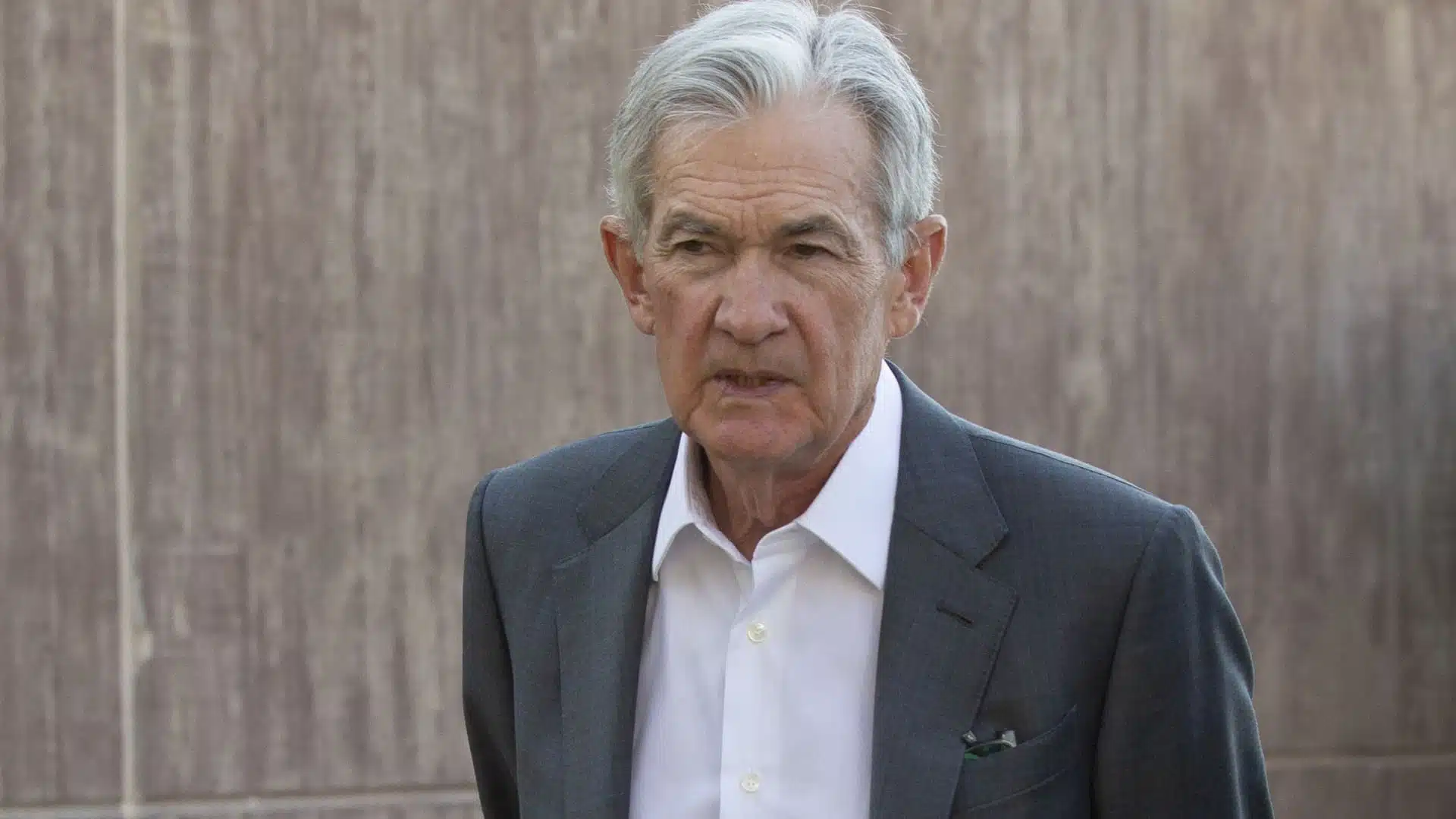

Investors are focusing their attention on a number of significant developments as global markets prepare for a particularly active trading session tomorrow. As a result of the upward trend in U.S. stock futures, the focus shifts to the anticipated remarks of Federal Reserve Chair Jerome Powell, the encouraging financial outlook of Micron Technology, and other significant market influences. This article delves deeper into these aspects, providing a more nuanced understanding of the current state of the financial landscape.

Bullish Movement in Futures

A positive shift in U.S. stock futures is being observed by investors, which indicates that the trading day may come with a positive outlook. During the early morning trading session, the Dow futures showed a rise of 160 points, which corresponds to a 0.4% increase. In the meantime, futures on the S&P 500 increased by 43 points, which is equivalent to a 0.7% increase, and futures on the Nasdaq 100 increased by 274 points, which is comparable to a 1.4% increase. Throughout the previous session, significant indices experienced a slight decline, which was primarily driven by China’s recent economic stimulus measures.

This optimism follows this retreat. In spite of these fluctuations, it is anticipated that the month will end with gains, which will be bolstered by the strategic reduction of the Federal Reserve’s interest rate by fifty basis points, which is intended to maintain economic momentum.

Powell’s Address: A Market Catalyst

At the United States Treasury Market Conference, Federal Reserve Chair Jerome Powell is scheduled to deliver a presentation that will provide critical insights. The Fed has recently reduced interest rates by a significant amount, which Powell describes as being part of a more extensive policy recalibration. His pre-recorded speech comes in the wake of this Federal Reserve action.

The purpose of this adjustment is to strike a balance between the two objectives of preserving employment levels and bringing inflation back to the 2% target that the Federal Reserve has set. Despite this, there is a lack of consensus among Federal Reserve officials, with some government officials expressing concerns regarding the extent of the rate cut. A number of them, including Federal Reserve Governor Michelle Bowman, have expressed their concerns regarding the ongoing pressures of inflation.

Micron’s Upbeat Financial Projections

As a result of an optimistic earnings forecast that exceeded the expectations of Wall Street, the stock of Micron Technology experienced a significant increase in trading after the company’s regular business hours. The giant memory chip company forecasts that its revenue for the first quarter of the fiscal year will be $8.70 billion, which is significantly higher than the $8.35 billion that analysts had predicted. This optimism is a result of the robust demand for high-bandwidth memory chips, which are essential components in technologies that are driven by artificial intelligence.

Micron’s strong market position alongside industry heavyweights such as SK Hynix and Samsung was reinforced by the CEO, Sanjay Mehrotra, who highlighted the sustained strength in customer demand for data center products.

Oil Market Dynamics and Broader Impacts

Oil prices faced downward pressure amid reports that Saudi Arabia may abandon its $100 per barrel price target as it considers ramping up production. The Brent crude contract fell by 2.4%, while U.S. crude futures decreased by 2.8%. These developments come alongside potential increases in Libyan oil supply as political factions move towards resolving key governance disputes. Despite a sharper-than-expected drop in U.S. oil inventories, these supply-side factors have tempered market reactions.

In summary, today’s market movements are shaped by a blend of economic policy signals, corporate earnings expectations, and geopolitical developments. As investors navigate these complexities, the focus remains on Powell’s commentary, Micron’s strategic trajectory, and the evolving energy sector landscape.