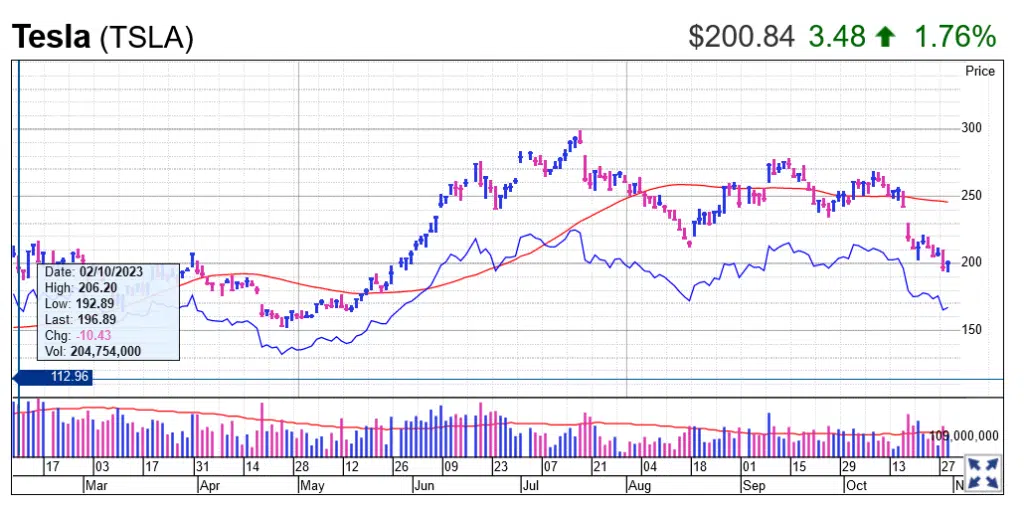

On Tuesday, the Dow Jones Industrial Average experienced a temporary decline of 125 points. This occurrence coincided with the release of housing data that surpassed expectations, as well as the commencement of the Federal Reserve’s two-day meeting. Subsequently, the stock of Tesla (TSLA) exhibited a reversal in its trajectory, following a notable decline during the morning hours of Tuesday, after the electric vehicle industry leader breached the price threshold of 200 on the preceding Monday. The stock of CAT experienced a significant decline after the release of its earnings results.

On Tuesday, the Case-Shiller Home Price Index exceeded expectations by registering a 1% increase in August, surpassing the 0.9% growth observed in July. The projected increase was anticipated to be 0.7%. The Federal Housing Finance Agency House Price Index exhibited a gain of 0.6% during August, surpassing the expected 0.5% increment. The FHFA index experienced a year-on-year growth rate of 5.6%.

The Federal Reserve’s scheduled meeting is set to commence on Tuesday, culminating in an interest rate determination at 2 p.m. Eastern Time on Wednesday. According to market indicators, there is currently a negligible probability of a rate hike and only a marginal likelihood of an increase at the subsequent meeting scheduled for December 13th.

In terms of earnings, notable companies that experienced movement on Tuesday include Amgen (AMGN), Arista Networks (ANET), Caterpillar (CAT), and Lattice Semiconductor (LSCC). Monolithic Power (MPWR), Pinterest (PINS), and Pfizer (PFE) were included in the group.

The shares of Amgen experienced a decline of approximately 3% during the initial trading period, whereas the stock of ANET exhibited a notable surge of 11%. The supply of CAT experienced a significant decline of over 5%, whereas the shares of Lattice witnessed a substantial plunge of an additional 15%. The stock of MPWR experienced an approximate increase of 6%, while the shares of Pinterest exhibited a notable surge of 18%.

Pfizer’s shares experienced a decline of over 1% during the initial trading period.

This Morning on the Dow Jones: Oil Prices and Treasury Yields

Following the commencement of trading on Tuesday, the Dow Jones Industrial Average experienced a decline of 0.2%, while the S&P 500 exhibited a marginal decrease. The Nasdaq composite experienced a drop of 0.3% during morning trading, primarily attributed to its technology-focused constituents.

Within the realm of U.S. exchange-traded funds, it is worth noting that the Invesco QQQ Trust (QQQ), which tracks the Nasdaq 100, experienced a decline of 0.3% during the early hours of Tuesday. Conversely, the SPDR S&P 500 ETF (SPY) exhibited a modest increase of 0.1% during the same period.

The yield on the 10-year U.S. Treasury bond experienced a slight decrease, settling at 4.85% on Tuesday. On Monday, the benchmark reached a settlement level of 4.87%.

The oil price experienced a slight rebound, with West Texas Intermediate futures increasing by nearly 1%. However, it is essential to note that these futures are still being traded below the threshold of $83 per barrel.

Keep an Eye On These Dow Jones Stocks

According to the chart analysis conducted by IBD MarketSmith, it has been observed that Walmart, a prominent retail entity within the Dow Jones, is currently forming a cup-based pattern. This pattern is being traced with a buy point of 165.85. The shares experienced a cessation of their three-day decline on Monday, exhibiting a rally of 1.2%. The stock of Walmart Inc. (WMT) has shown a notable level of support at its significant 50-day moving average. The supply of Walmart Inc. experienced a decline of 0.1% on Tuesday.

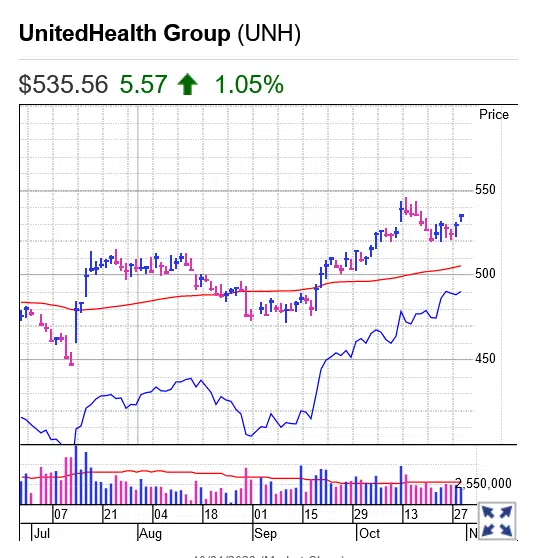

UnitedHealth, a prominent entity in the healthcare industry, is currently engaged in a significant consolidation effort. Notably, it has recently demonstrated a new buy point at 546.78. The stock of UNH experienced a modest increase of 0.9% during the morning session on Tuesday.

Tradeweb Is Now Inside the Buying Range for Most Investors

International Seaways’ attempt to surpass the 48.40 entry point of a cup-with-handle pattern was unsuccessful, as the entry was relinquished amidst a 2.4% decline on Monday. It is imperative to consider the market correction as a deterrent when contemplating the acquisition of breakout stocks. The INSW stock experienced a marginal decline during the morning session on Tuesday.

Lululemon experienced a modest increase of 1.3% on Monday. IBD MarketSmith pattern recognition, however, has determined that it is still below the designated buy point of 406.94 within a flat base. Exercise patience and await a subsequent sustained movement beyond the abovementioned point, which may serve as a potential indication to initiate a purchase. The stock of LULU experienced a modest decline during the morning session on Tuesday.

The individual in question is involved in the creation and development of casino games. The stock of Light & Wonder experienced a modest increase of 0.7% on Monday. Currently, the shares are forming a flat base pattern, with a designated buy point of 79.97. The LNW stock exhibited minimal fluctuations during the early trading session on Tuesday.

The breakout of Tradeweb from a flat base of 87.53 buy points occurred on Thursday after the release of the company’s third-quarter earnings. The stock of TW experienced a 1.2% increase on Monday, displaying noteworthy resilience amidst a challenging market landscape. The supply of TW experienced a modest increase of 0.5% during the morning trading session on Tuesday.

Amazon, Nvidia, and Tesla Are Three of the “Magnificent Seven” Stocks

Within the group of stocks commonly referred to as the “Magnificent Seven,” Tesla experienced a modest increase of 0.5% during the initial trading hours on Tuesday. Conversely, Amazon (AMZN) observed a slight decline, while Nvidia (NVDA) encountered a more substantial decrease of 3.6%. After today’s stock market session, notable constituents of the Dow Jones index, namely Apple (AAPL) and Microsoft (MSFT), declined their respective trading values.

Amazon demonstrated a notable resurgence by surpassing its 50-day line on Monday, exhibiting a substantial 3.9% increase. The shares currently show a potential for an early entry point of 134.48.

The renowned graphics chip manufacturer Nvidia experienced a 1.6% increase in its stock value on Monday, marking a consecutive upward trend for the second day. In the preceding week, the value of shares experienced a decline, breaching the significant threshold of 400 for the first instance since the middle of June.

The Tesla stock experienced a decline of 4.8% on Monday, resulting in its closure below the 200 price level, a milestone not observed since May 26.

The shares experienced a significant decline, falling below their 200-day line after relinquishing this crucial level in recent trading sessions. The current valuation of shares reflects a drop of over 30% from their highest recorded value within the past 52 weeks.