As per the perspective of T. S. Eliot, the month of April possesses a certain degree of cruelty. The standpoint of shareholders may differ. In the current temporal context, the month in question is September. Historical data suggests that, on average, stock prices have increased during the latter part of the year.

Historical Data of S&P 500 Index Dynamics

Since 1928, it has been observed that the proportion of monthly gains to losses in the S&P 500 index of the United States has consistently averaged around 60% gains and 40% losses, excluding September. However, the onset of autumn exerts a discernible influence on the collective psychology of the market.

Historical data indicates that the index has experienced a decline in approximately 55% of instances in September. Consistent with its historical pattern, the market has exhibited a downward trajectory after a volatile August in recent weeks.

The observed calendar effect contradicts the notion of market efficiency in financial markets. By fundamental principles, it is imperative to acknowledge that asset prices should exclusively undergo fluctuations in direct correlation to the emergence of novel information, such as forthcoming cash flows. The identification, exploitation, and arbitrage of changes, particularly predictable ones, are imperative for traders.

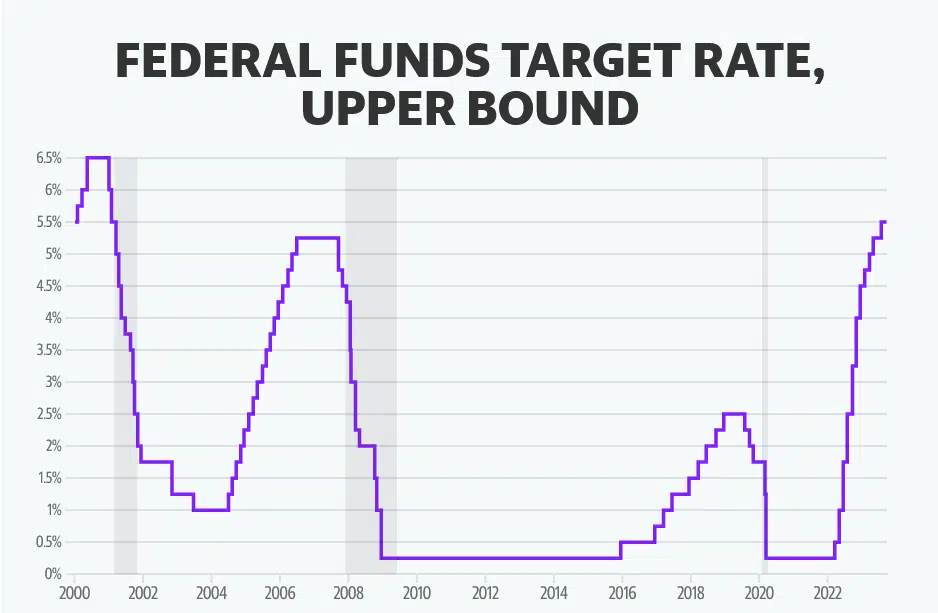

However, in September, there needs to be more clarity regarding the ongoing situation: investors have acquired, or more accurately, embraced a novel understanding. The persistence of high-interest rates, particularly in the United States and other regions, is anticipated to endure for an extended period.

11 Central Banks Have Announced Interest Rate Hikes

The decline in market conditions was instigated by an extensive duration of monetary-policy declarations, commencing with the Federal Reserve of the United States on September 20th, culminating after two days and the involvement of 11 central banks. Except for the Bank of Japan, which maintained a negative short-term interest rate, the remaining prominent entities reiterated a consistent message of prolonging a higher interest rate environment.

In advance, Huw Pill, a representative from the Bank of England, drew a comparison between interest rates and Table Mountain, a prominent geographical feature characterized by its flat summit that overlooks Cape Town. This analogy was juxtaposed with the Matterhorn, a mountain renowned for its triangular peak.

The President of the European Central Bank, Christine Lagarde, implemented a rate increase and articulated her perspective on the enduring nature of the current economic trajectory by referring to it as a “prolonged race.” On average, the Federal Reserve’s governors projected that the prevailing benchmark rate, which currently stands at 5.25-5.50%, would remain above the 5% threshold by the conclusion of 2024.

Regarding the bond market, this development validates the previously established anticipations that had been progressively accumulating throughout the summer period. The yield on two-year Treasuries has exhibited a consistent upward trajectory, experiencing a notable increase from 3.8% in early May to 5.1% at present. This particular duration of Treasuries is exceptionally responsive to near-term projections regarding monetary policy, rendering this upward trend of significant relevance.

Bond Yields Broke All Records

Longer-term interest rates have experienced an upward trajectory, extending beyond the borders of the United States. In the American context, the ten-year Treasury yield has reached a notable milestone, reaching a level not witnessed in the past 16 years, standing at 4.5%. The current work on ten-year German bunds stands at 2.8%, representing the highest level observed since 2011. British gilt yields are currently approaching the level observed during the previous autumn, characterized by significant market turbulence and distressed selling.

Simultaneously, propelled by the robust state of the American economy and the anticipation of its interest rates surpassing those of other nations, the dollar’s value has experienced a notable increase. The DXY, a metric used to assess its relative worth against a basket of six prominent currencies, has experienced a significant growth of 7% after reaching a low point in July.

The Stock Market Did Not React to the Continuation of Higher Interest Rates

In contrast to the bond and foreign exchange markets, the equity market has exhibited a sluggish response in incorporating the potential implications of enduring elevated interest rates. Indeed, borrowing costs do not solely dictate its trajectory. Investor sentiment has been significantly influenced by a prevailing sense of euphoria surrounding the considerable profit-generating capabilities of artificial intelligence (AI), coupled with the seemingly boundless nature of the American economy. The potential for accelerated earnings growth could rationalize a resilient stock market performance despite restrictive monetary measures.

However, investors had adopted an overly optimistic perspective on interest rates, and the recent decline did not solely influence this price sentiment prompted by central bankers’ statements. Given the inherent risk differential between shares and bonds, allocations are expected to yield a commensurately higher return as compensation. Quantifying those above supplementary anticipated gains presents challenges; however, a viable alternative entails juxtaposing the stock market’s earnings yield (i.e., projected earnings per share divided by share price) with the work on more secure government bonds.

When analyzing the S&P 500 index and 10-year Treasuries, it is observed that the “yield gap” between the two has recently decreased to a mere one percentage point. This represents the lowest level observed since the dot-com bubble period.

One plausible scenario entails investors exhibiting a high level of confidence in the underlying earnings of their shares, resulting in a minimal requirement for additional returns to mitigate the potential risk associated with any potential earnings shortfall. However, such a conclusion may appear peculiar when considering the context of economic growth.

Although the growth has been strong, it is reasonable to assume that it has not entirely evaded the cyclical nature of the business cycle, as evidenced by the recent discouraging data on consumer confidence and housing. It would be a more peculiar inference regarding the prospective financial gains from artificial intelligence (AI), a technology still in its nascent stages and whose impact on corporate profitability has yet to be thoroughly examined.

The alternative perspective posits that, hitherto, investors have yet to exhibit a lack of conviction in the sustained longevity of elevated interest rates, as anticipated by the bond market and reiterated by central banking authorities. If such circumstances persist and their resolve falters, the forthcoming months may exhibit heightened severity.